Busy Litigation Docket, Big Deals Drive Gains at O'Melveny & Myers

In a year that saw long-running merger talks with Allen & Overy finally end up nowhere, the firm grew revenue by 4.3% and boosted profits per equity partner by 2.4%.

February 25, 2020 at 02:42 PM

5 minute read

The original version of this story was published on The American Lawyer

Bradley J. Butwin of O'Melveny & Myers. (Courtesy photo)

Bradley J. Butwin of O'Melveny & Myers. (Courtesy photo)

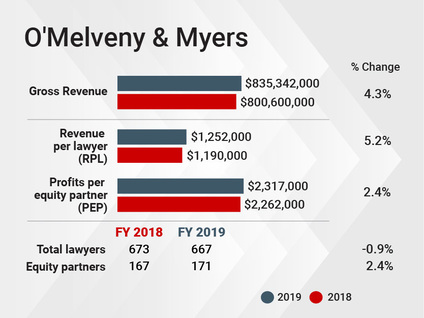

O'Melveny & Myers posted its fifth straight year of revenue increases in 2019, growing its top line by 4.3% to $835.3 million.

The firm's net income rose 4.9% to $396.1 million, a 47% hike over the last five years. Profits per equity partner climbed 2.4% to $2.32 million, while revenue per lawyer expanded by 5.2% to $1.25 million.

"There was just a broad amount of above-the-fold work," said New York-based chairman Bradley Butwin. He noted that O'Melveny's share value, a crucial internal metric that determines how individual partners are compensated, also increased for the fifth straight year, growing by 48% over that interval.

Butwin added that rising demand was the biggest driver for the firm's growth, while rate increases were "relatively modest" compared to the rest of the market.

"With the upticks in net income and gross revenue, a good chunk of that is simply based on the fact that people are busier," he said.

The firm's litigation work was buoyed by two significant trial efforts. In February, a federal appeals court affirmed its victory on behalf of AT&T and Time Warner, which sought to preserve their $100 billion merger against opposition from the U.S. Department of Justice. Then, in May, serving as J&J's national litigation counsel, the firm took the country's first opioid case to trial, where it limited Oklahoma to 2.6% of the $17.7 billion it had sought.

The firm's litigators have another 38 cases slated to go to trial in 2020, including a bellwether opioids trial in New York in March and a California trial in June. "Those are massive cases," said Butwin, "and they're among the most important and highly publicized litigation in the nation."

The firm's litigators have another 38 cases slated to go to trial in 2020, including a bellwether opioids trial in New York in March and a California trial in June. "Those are massive cases," said Butwin, "and they're among the most important and highly publicized litigation in the nation."

On the corporate side, Butwin emphasized that the firm's dealmakers had closed a total of over 300 deals in 2019 with a combined value of over $150 billion, with over 20 exceeding $1 billion. Standouts included advising ViacomCBS in its acquisition of a 49% stake in Miramax and guiding longtime technology client Finisar Corp. in its $3.2 billion sale to II-VI Inc.

Bankruptcy lawyers are guiding the government of Puerto Rico through its restructuring of more than $70 billion in public-sector debt and $50 billion of pension obligations and they've been retained by the governor of California in utility Pacific Gas and Electric's Chapter 11 proceedings.

Butwin said that O'Melveny's strengths in both restructuring work and litigation place it in a safe position in the event of a potential recession in the coming years. The firm also enters 2020 with a higher level of inventory than its start of 2019, which in turn exceeded the previous year, along with a number of new matters.

"I'm pleased that we have the wind at our sails kicking off the new year," he said.

The firm's head count in 2019 was largely stable, as the number of total partners stayed fixed at 178, while the total number of lawyers dropped about 1% to 667. Key lateral hires included former U.S. Deputy Solicitor General Michael Dreeben, who joined the firm with 106 Supreme Court oral arguments under his belt; Lisa Monaco, a former Homeland Security and counterterrorism adviser to President Barack Obama; Jeff Norton, a senior corporate finance partner who returned to the firm after serving as U.S. co-managing partner and head of banking at Linklaters; and Anna Pletcher, former assistant chief of the U.S. Department of Justice's Antitrust Division in San Francisco.

Moving Forward Alone

Any reckoning of O'Melveny & Myers' 2019 must take into account a deal that wasn't completed: the firm's proposed merger with Magic Circle firm Allen & Overy. The firms said they would be halting discussions in September, 18 months after talks became public.

Nearly six months later, Butwin repeated that ending the conversations was a "mutual" decision. But he said the process was not without benefits.

"We're working together on the service of our shared clients," he said, noting that by learning more about each other's capabilities, the firms have more to offer these entities.

One benefit of the merger to O'Melveny would have been a substantially enhanced presence in London. Several partners and lawyers left that office since merger talks began, and the firm's website now lists just four partners, four counsel and one associate there.

Butwin said O'Melveny is looking to add London attorneys in areas that complement the rest of the firm's platform: restructuring, disputes, investigations and M&A. Members of the firm's senior management team are heading across the Atlantic next week to talk to prospects in the lateral market.

Growth in New York is also a priority; Butwin said he expects to be able to announce several corporate partners joining there in the coming weeks. And the firm could also stand to be bigger in Northern California.

And even without a blockbuster merger, Butwin is heartened by another year of record financial performance.

"The focus continues to be executing on our strategic plan," he said.

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

O'Melveny Posts Record Income, Profit Growth in 2018

After Failed Merger Talks, What's Next for O'Melveny?

O'Melveny, California's Top Litigation Department, on AT&T-Time Warner and Collegiality

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Malaysia’s Shearn Delamore Set To Expand Local Footprint With New Office Launch

CMA Uses New Competition Powers to Investigate Google Over Search Advertising

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Law Firms Mentioned

Trending Stories

- 1Supreme Court Appears Sympathetic to Law Requiring Porn Sites to Verify Users' Age

- 2Cybersecurity Breaches, Cyberbullying, and Ways to Help Protect Clients From Both

- 3AI in 2025: Five Key Predictions on How It Will Reshape International Law Firms

- 4Justice Known for Asking 'Tough Questions' Resolves to Improve Civility

- 5Robinson & Cole Elects New Partners and Counsel

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250