Weil's London Office Posts Revenue Drop as Firm's Overall Profits and Revenue Rise

The firm attributed the London drop to fluctuations in the dollar-pound exchange rate.

March 06, 2020 at 05:59 PM

5 minute read

Barry Wolf. (Courtesy photo)

Barry Wolf. (Courtesy photo)

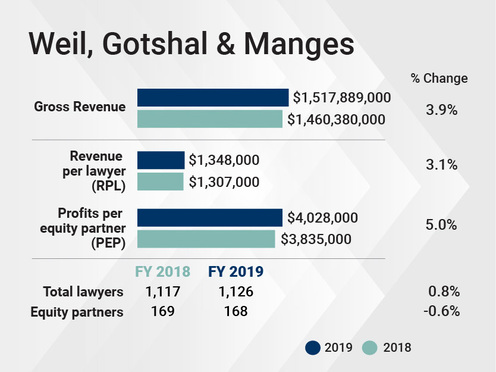

Weil, Gotshal & Manges' revenue saw an increase in revenue in 2019 and even bigger jump in profits per equity partner, but in London, the firm's revenue declined.

While overall revenue increased 3.9% to $1.52 billion and profits per equity partner grew at an even faster clip, crossing the $4 million mark. revenue from the firm's London office dropped about 1.65%, from $188.1 million in 2018 to $185.0 million last year, the firm said.

Barry Wolf, the firm's executive partner, attributed the decline to fluctuations in the dollar-pound exchange rate. Controlling for those, the office's revenue would have been up "about five or six million dollars," he said, to about $193 million.

He also said the firm continued to invest in the London office, making hires like corporate star David Avery-Gee and restructuring partner Neil Devaney in the second half of last year.

Wolf said he was "thrilled" with the firm's overall success, saying 2019 capped a five-year strategic push in which profits per equity growth averaged about 12% per year. He said all parts of the firm helped deliver growth, but its litigators and its restructuring lawyers, with their work on major bankruptcies such as Pacific Gas & Electric, Sears and a raft of others, led the pack.

"Where we have a significant amount of market share is in the restructuring arena, and that clearly had its impact in 2019," said Wolf. "We're not in a recession, but we're clearly in a marketplace where there's disruption in certain industries."

The firm's mergers and acquisitions lawyers still grew their contribution to the firm's top line, Wolf said, but transaction activity was "spotty" owing to uncertainty around U.S.-China trade relations and Brexit. "M&A and private equity were just not up as much as they had been, year-over-year, in years before," he said.

Head count rose by less than 1% from 2018 to 2019 and the equity partner ranks saw a net loss of one, to 168.

Weil closed its Warsaw, Poland office, last year, and the office's lawyers spun off into a new firm. Some firms simply shutter an office and pay out severance, Wolf said, but Weil made sure its Polish lawyers, now operating as Rymarz Zdort, could stand on their own by covering certain expenses for a period of time. The Prague office, spun off in 2018, has a similar arrangement, he said.

"Culturally, we thought it was important that we make sure that all of our people ended up on their feet with jobs," he said. "These were all loyal, successful people."

Total hours billed by lawyers fell about 3.8%. Wolf attributed the drop to the "choppiness" in M&A and explained that rates didn't have to rise that sharply to help the firm grow its revenue as much as it did. The firm's pullback in Central Europe, and its growth in higher-rate markets meant that more revenue could be derived from a similar number of hours, Wolf said.

Some of the firm's biggest accomplishments don't appear on its balance sheet, he said, noting its partner class of 16 was the most diverse in the firm's history, with more than half women and four attorneys of color. He also highlighted the firm's rollout of adoption and fertility benefits and its development of a program with Columbia University to teach junior associates about business.

Culture "is something that I know doesn't necessarily go to the financial results for 2019, but it's something we spend a lot of time and effort on," Wolf said.

Last year was Weil's first year for its new partnership and counsel track. He said the effects of it won't be apparent for several years. The firm's nonequity partner count fell last year from 95 to 92.

In restructuring, Weil represented debtors in several major cases filed last year. Besides PG&E, the California utility wracked with fire-related liabilities that has paid big bucks to several major law firms, Weil also represented home loan company Ditech Holding, which it billed more than $17 million, and oil driller EP Energy Corp., from which it has sought $7.9 million in fees for work done in 2019.

The firm said it represented debtors or creditors in more than half of 2019's 10 biggest bankruptcy cases. There's also a long tail of cases, including creditor representations, that don't make as many headlines but keep the practice going strong, Wolf said.

Weil litigators also had major cases. They helped Morgan Stanley and Brazilian financial giant BTG Pactual through major leveraged buyout and merger-related disputes, beat a $3 billion copyright infringement case targeting Getty Images, and helped HP and its customers win at summary judgment—and attorneys' fees—in a sprawling patent infringement dispute with tens of millions on the line.

Weil's corporate lawyers also went to work for several big clients. The firm said it worked on more than 80 transactions worth over $1 billion, including representing oilfield equipment and technology firm Apergy in a $7.4 billion combination with ChampionX and helping Brookfield Asset Management put together a $20 billion global infrastructure fund. It also helped MGM Resorts team up with Blackstone Real Estate Income Trust to acquire the Bellagio.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Carey Abogados’ Senior Partner Becomes New Head of IBA, First Chilean to Assume Role of President

Goodwin Hires Quinn Emanuel Antitrust Partner to Launch Brussels Office

3 minute read

Claus von Wobeser: Mexico's ‘Godfather of Arbitration’ Becomes Firm’s Honorary Chair

Jenner & Block Expands London Team with Baker McKenzie Hire to Lead New Practice Area

2 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250