Magic Circle Trio Lead on Q1 Asia Pacific M&A as Deal Values Plummet Amid COVID-19 Pandemic

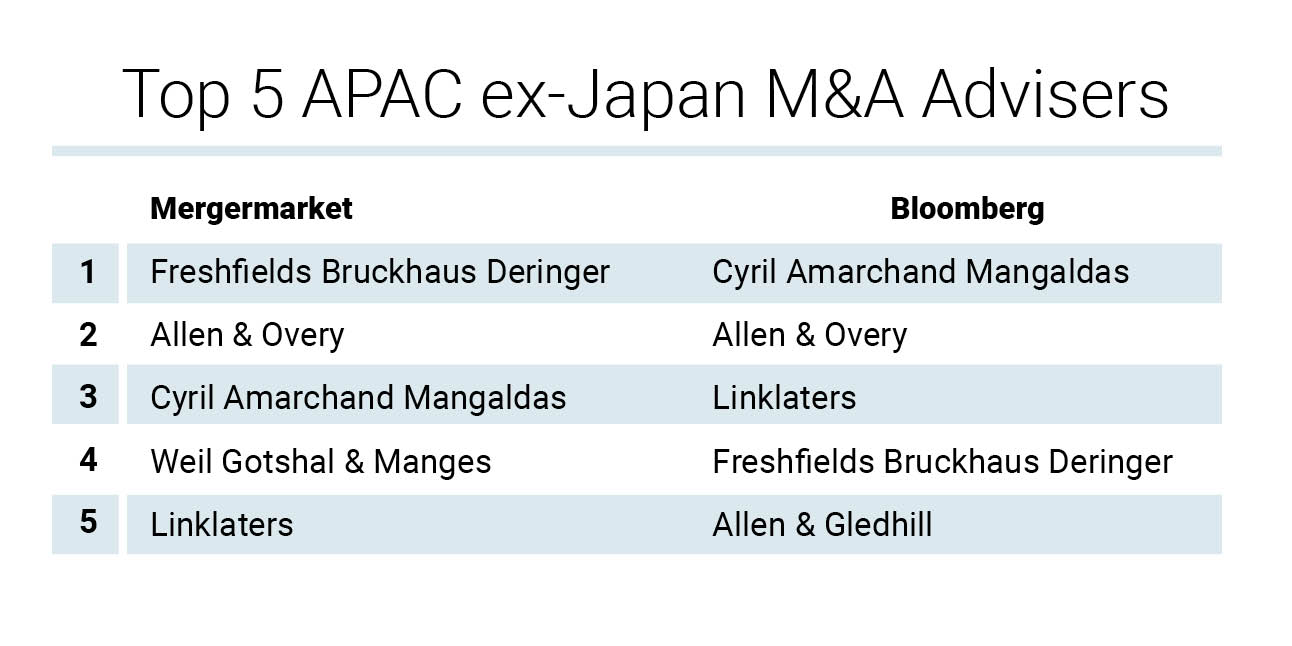

Allen & Overy, Freshfields Bruckhaus Deringer and Linklaters ranked among the region's top M&A advisers during the first three months of 2020.

April 03, 2020 at 12:54 PM

3 minute read

The coronavirus pandemic drove Asia Pacific M&A activity in the first three months of 2020 to its lowest levels since 2013, and Allen & Overy, Freshfields Bruckhaus Deringer and Linklaters led the pack of international legal advisers on those deals.

According to data compiled by Bloomberg, M&A deals with Asia Pacific-based targets in the first quarter of the year totaled $178.2 billion, down 4.2% year-on-year. And deals worth $1 billion or more decreased by 6.1% to 31 deals in the region.

Mergermarket counted 616 M&A deals in the Asia Pacific region, excluding Japan, in the first quarter, generating $103.2 billion in total deal value, a decline of 32% from a year earlier. This also marked the lowest quarter in terms of deal value since the first quarter in 2013.

The coronavirus outbreak that originated in China and later spread across Asia is canceling out the momentum regained late last year when China and the United States agreed to an initial trade agreement, the Mergermarket report said.

"Hopes of a quick recovery in the Asia Pacific seem to fade as the pandemic spread to other major economies across the world," the report stated, adding that China and Hong Kong, the largest contributors to M&A activity in Asia and the first area to be hit by the pandemic, have seen deal value plunge 35.8% to $51.3 billion in the first quarter.

Tesco Plc.'s $10.6 billion sale of its Thailand and Malaysia business was the largest M&A transaction in the Asia Pacific announced so far this year. The deal helped put three Magic Circle firms in the top five Asia Pacific legal advisers, according to rankings by both Bloomberg and Mergermarket. Allen & Overy and Freshfields are representing Tesco as the retail giant sold its Thai and Malaysian divisions to Thailand's Charoen Pokphand Group, which was advised by Linklaters.

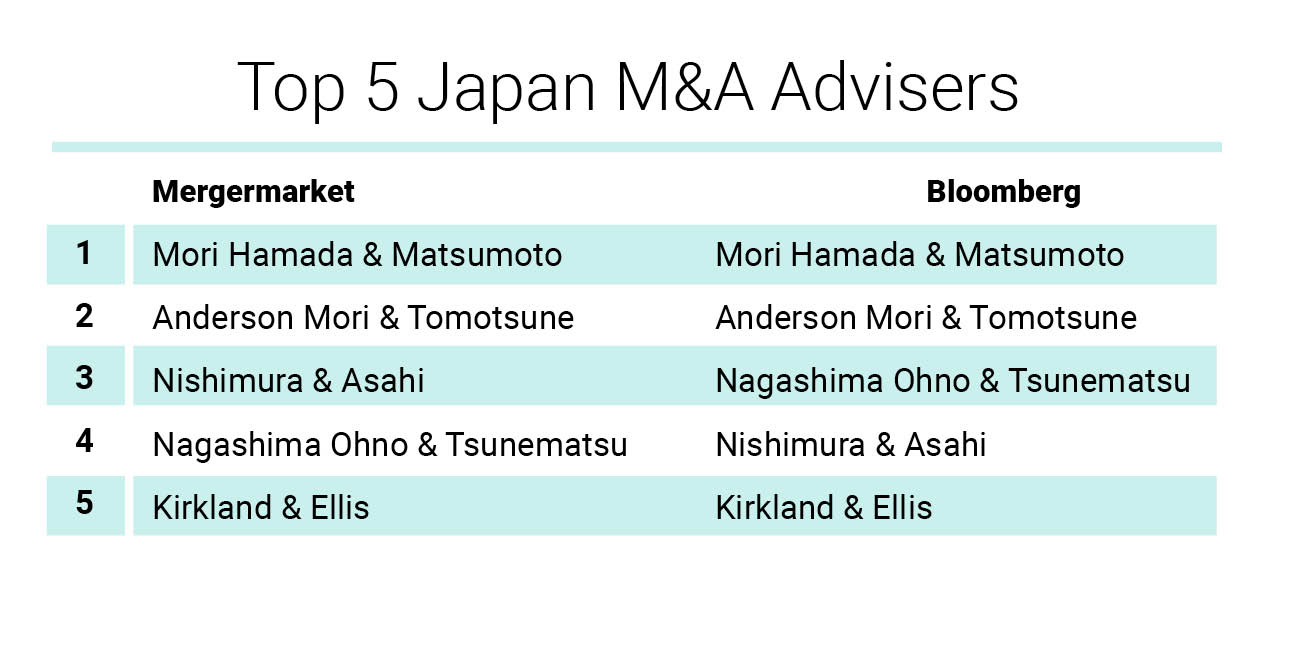

Japan is the only market in Asia that has seen year-on-year growth in first-quarter M&A activity. The country saw $13 billion worth of deals in the first three months of this year, up 62.7% from a year earlier and the highest first quarter since 2016, according to Mergermarket data. The largest deal announced was Hitachi Ltd.'s $4.9 billion offer to buy the remaining 48% of its semiconductor manufacturing equipment maker arm, Hitachi High-Tech Corp.

The coronavirus will likely have more of an impact on the Japanese market. Last week, Japan and the International Olympic Committee agreed to postpone this summer's Tokyo Olympics to 2021. "[The postponement] is likely to cast a shadow on the country's economic forecast since billions of yen have already been spent by the government and sponsors," the Mergermarket report said.

Related Stories:

As COVID-19 Spreads, Deal Lawyers Await Its Impact on China's Markets

Asia Pacific 2019 League Tables: China Deals Plunge Further; Japan, Singapore on the Rise

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Ashurst Strengthens Tokyo Office With Partner Hire From Big Four Japanese Firm AMT

K&L Gates Duo Leaves to Reunite with Former Leader at Sreenivasan Chambers

Deacons Hires Reed Smith’s Banking Partner in Hong Kong

Law Firms Mentioned

Trending Stories

- 1‘The Decision Will Help Others’: NJ Supreme Court Reverses Appellate Div. in OPRA Claim Over Body-Worn Camera Footage

- 2MoFo Associate Sees a Familiar Face During Her First Appellate Argument: Justice Breyer

- 3Antitrust in Trump 2.0: Expect Gap Filling from State Attorneys General

- 4People in the News—Jan. 22, 2025—Knox McLaughlin, Saxton & Stump

- 5How I Made Office Managing Partner: 'Be Open to Opportunities, Ready to Seize Them When They Arise,' Says Lara Shortz of Michelman & Robinson

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250