Asia Deal Digest: April 2020

Asia's first 50-year bond • large cloud data centers in Japan • Cambodia's largest financial services deal • a rejected application that's now this year's largest IPO in Hong Kong.

April 24, 2020 at 12:40 PM

5 minute read

Asia Deal Digest, published periodically, is a compilation of some of the largest deals carried out in Asia and Australia.

Indonesia

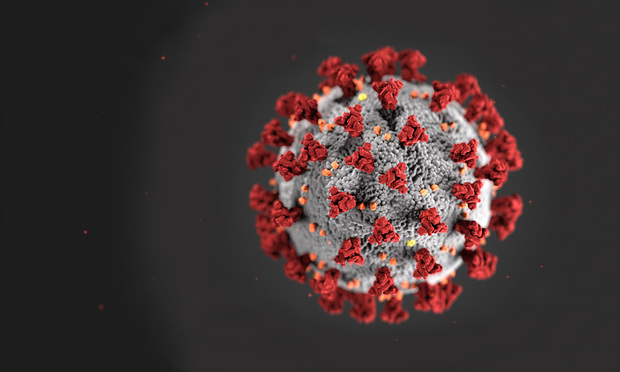

Allen & Overy and Clifford Chance have the lead roles on a $4.3 billion sovereign bond offer by the government of Indonesia to raise funds for COVID-19 relief programs and recovery efforts. The deal was the largest ever dollar-denominated bond ever issued by Indonesia. The offer consisted of three trenches: $1.65 billion in 10.5-year notes with a 3.85% coupon; $1.65 billion in 30.5-year bonds with a 4.20% yield and $1 billion in 50-year securities with a 4.45% return. The 50-year trench is the longest dated sovereign bond ever offered by an Asian issuer.

Allen & Overy Singapore partner Felipe Duque led the team advising the Indonesian government. New York partner Jack Heinberg gave U.S. tax advice. Partner Harun Reksodiputro of Ginting & Reksodiputro, Allen & Overy's Indonesia affiliate firm, served as local counsel.

Clifford Chance Singapore partner Johannes Juette led a team acting for Citigroup, Deutsche Bank, Goldman Sachs, HSBC and Standard Chartered Bank as lead managers of the offer; he was supported by Singapore partner Gareth Deiner.

The proceeds of the bond offer add to a $24.3 billion COVID-19 relief package announced by the Indonesian government. The Southeast Asian nation now has over 7,200 active COVID-19 cases; the virus has killed 689 people in the country.

Japan

Kirkland & Ellis advised Singaporean sovereign wealth GIC Pte. Ltd. on a $1 billion joint investment with U.S. data center operator Equinix Inc. to develop and operate three large data centers in Japan. GIC will hold an 80% interest in the joint venture while Equinix takes the remaining 20%. The joint venture will build two data centers for cloud computing services in Tokyo and an additional one in Osaka. Cloud services and related infrastructure upgrade is in urgent demand as companies globally switched to remote working after the COVID-19 outbreak. Equinix works with some of the world's largest cloud service providers such as Google, Amazon and Alibaba. The deal is expected to close in the second half of this year.

Kirkland Hong Kong partners Daniel Dusek and Mike Rackham and London partners Matthew Elliott and Celyn Evans in London led a team representing GIC with Japan's Mori Hamada & Matsumoto advising on local law. London-based Kirkland mergers and acquisitions partner Annette Baillie, finance partner Kazik Michalski, tax partner Frixos Hatjantonas, technology and intellectual property transactions partner Joanna Thomson, antitrust partner Annie Herdman, and regulatory partner Michael Casey also worked on the deal.

Equinix was advised by Baker McKenzie with London-based corporate partners David Hart, Kirsty Wilson and Charles Whitefoord. Sydney-based IT and telecommunications partner Anne Petterd led a team acting on commercial matters of the transaction. Japanese firm Nagashima Ohno & Tsunematsu real estate partners Makoto Saito and Yoshihisa Watanabe advised on local law.

Cambodia

Korean firm Bae, Kim & Lee advised Seoul-based KB Kookmin Bank on a $603 million acquisition of a 70% stake in Cambodia's Prasac Microfinance Institution Ltd. The Korean bank bought the interest from a consortium of investors that included Hong Kong's Bank of East Asia and Sri Lankan conglomerate LOLC Holdings Plc. KB also plans to acquire the remaining 30% stake and intends to develop Prasac into a full-service commercial bank. Prasac provides financing services to small business and farm owners in Cambodia with over 180 locations, covering over 40% of the country's microlending market.

Clifford Chance Hong Kong M&A partner Neeraj Budhwani led a team advising the selling consortium. Singapore partner Thomas England gave finance advice on the deal.

Hong Kong

O'Melveny & Myers and Davis Polk & Wardwell have the lead roles on the largest Hong Kong initial public offering so far this year. Chinese biotech company Akeso Inc. raised $330 million this week after refiling its listing application in February. The Chinese cancer drugmaker's first application to list in December was returned by the Hong Kong Stock Exchange over a technical error in the company's listing documents. The application, sponsored by Morgan Stanley and J.P.Morgan, was only the second sponsored by a major Western investment bank rejected by the exchange.

Akeso Inc. was advised by O'Melveny on Hong Kong and U.S. law and by Commerce & Finance on Chinese law. The O'Melveny team was led by Beijing partner Ke Geng and Hong Kong partners Ke Zhu and Edwin Kwok. Beijing partner Wang Bo led the team at Tongshang.

Davis Polk Hong Kong partners Li He and Yang Chu represented Morgan Stanley and J.P.Morgan on U.S. and Hong Kong law. Former partner Bonnie Chan also worked on the deal. Chan became head of listing at the Hong Kong stock exchange in January. The banks were advised by Tian Yuan Law Firm on Chinese law with a team led by Beijing partner Fu Siqi.

Akeso is also the most popular pre-revenue biotech companies listed in Hong Kong, having been oversubscribed 639 times. Hong Kong changed laws to allow biotech companies that have not generated any sales to list in 2018; so far 16 biotech companies are listed under that rule change.

Related stories:

O'Melveny & Myers, Davis Polk Advised on Returned Hong Kong IPO Application

Lawyers Expect Deal Uptick as Hong Kong Changes Listing Rules

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

X Ordered to Release Data by German Court Amid Election Interference Concerns

Compliance With the EU's AI Act Lags Behind as First Provisions Take Effect

Quinn Emanuel's Hamburg Managing Partner and Four-Lawyer Team Jump to Willkie Farr

Trump ICC Sanctions Condemned as ‘Brazen Attack’ on International Law

Law Firms Mentioned

Trending Stories

- 1Parties’ Reservation of Rights Defeats Attempt to Enforce Settlement in Principle

- 2ACC CLO Survey Waves Warning Flags for Boards

- 3States Accuse Trump of Thwarting Court's Funding Restoration Order

- 4Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 5Coral Gables Attorney Busted for Stalking Lawyer

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250