A Pandemic and a Major Partner Exit — Is Freshfields' Stateside Mission Under Threat?

The firm made waves last year with the hire of M&A guru Ethan Klingsberg. But will COVID-19 and a recent heavyweight departure reverse recent gains?

April 28, 2020 at 09:28 AM

11 minute read

Freshfields' US M&A head, Ethan Klingsberg

Freshfields' US M&A head, Ethan Klingsberg

When Freshfields Bruckhaus Deringer hired Ethan Klingsberg in October, it underscored what one partner at a rival firm called "Freshfields' mission to finally conquer the U.S.".

The four-partner, Klingsberg-led team from Cleary Gottlieb Steen & Hamilton was the "rocket fuel" the firm needed to ascend New York's upper echelons, its proclamation that "it isn't going to go the way of other U.K. firms in New York - it's going to be a major success", a Freshfields London partner put it.

With the COVID-19 pandemic decimating the M&A market, however, and the firm's former head of U.S. M&A, Mitchell Presser, exiting this month, there has been a profusion of speculation across the market that Freshfields' progress of the past year is about to come undone.

"This will set them back a few paces at least," a partner at a rival firm said.

'Corporate America's sweetheart'

It had all looked so different when Klingsberg joined in October. According to a New York-based M&A partner, Klingsberg is "a rainmaker whose deal sheet and market credibility takes Freshfields up a notch, maybe two."

Klingsberg led on Google's creation of parent company Alphabet; on the internet behemoth's $12.5 billion acquisition of an arm of Motorola, and in 2012, the $8.5 billion merger of Alpha Energy with Massey Energy.

One recruiter says: "He's corporate America's sweetheart. There's maybe a handful of names you'd put next to him in terms of deal power and deal recognition." A second partner at a top five U.S. law firm in New York adds his was "one of the marquee signings of 2019"; he's a man "connected with the Wall Street illuminati."

Onlookers also pointed to Freshfields' hire of Washington partner Aimen Mir, a former state official deeply rooted in America's investment and national security policymaking, earlier that year, as well as the fact Cleary is also a lockstep firm, which is likely to aid the team's transition.

"If you can't break into the U.S. market with a Wachtell partner, then I don't know what you need."

Presser out

But when former Wachtell Lipton Rosen & Katz partner Presser left the Magic Circle firm's New York office for Morrison & Foerster earlier this month, the mood among rivals changed. Is Freshfields' U.S. operation about to lose its recent gains in this embattled deal market?

"It's an odd one," says a senior London partner of a top five U.S. firm. "If you can't break into the U.S. market with a Wachtell partner, then I don't know what you need."

A second partner at a Big Law U.S. firm said: "It will be a blow to them, losing a big name senior partner after just a few years. How can [Freshfields] justify that? They're some way off the top five [in New York] and this will set them back a few paces at least."

"We are not cutting any corners. We are not settling for being sub-scale. We are not settling for doing commoditised work."

However, one partner with knowledge of the departure suggests that there is more than meets the eye.

Presser's oft-cited deals include Morgan Stanley's acquisition of U.S. oil pipeline and terminal business TransMontaigne in 2006, and the $15 billion leveraged buyout of Kinder Morgan the same year. The partner points to the fact that there have been few headline deals since.

And while acknowledging that Presser is "hugely talented at what he does, and he's done incredibly well to build the deal sheet that he has", the partner also says his book of business is "not the kind of work Freshfields is going for". The partner adds that the firm is aiming instead for "major public M&A".

Although this raises questions about why the firm hired him in the first place, it does ring true for others as well. One New York partner at another Magic Circle firm in the U.S. describes Presser as "a luxury". They add: "But what Freshfields wanted was a major player. Someone who can get in the big money domestic and cross-border deals."

The person with knowledge of Presser's departure says: "He was doing small private equity deals. It was nice steady work, but they were small deals, mostly in the food and [agriculture] markets. And it was purely domestic."

Presser and MoFo declined to comment for this article.

A second person with knowledge of the situation indicates that Presser's exit was "part of [Freshfields'] growing-up process".

"If you want to step up a league, that can often mean losing those who might impede that movement," the person says. "And let's not forget, Presser was making a lot of money [at Freshfields]. A lot. He was a 60-plus pointer, which isn't bad for a three-year stint."

According to two people familiar with Freshfields' pay structure, Presser was a "superpointer", meaning he earned above the 60 points accorded by the firm's modified lockstep, in which a point accounts for £60,000, sources close to the matter have said (though a third person close to the firm indicated this figure was "a little bit" too high).

'Broadly European'

Even if the loss of Presser was not as dramatic for the firm's U.S. practice as some people make out, various questions of old remain.

"If [Freshfields] is trying to do the U.S. end of broadly European deals, then they'll do well," says one of the Big Law partners. "But going head to head with Wachtell and Cravath Swaine & Moore on the biggest U.S. deals, they're going to struggle. And obviously this is the market you need to capture if you're going to compete on that Wall Street level."

The partner adds: "Freshfields doesn't have the same penetration in the U.S. as in the U.K. and Germany. They will try and target particular relationships and sectors. My guess is [Klingsberg] will go to previous clients for work, and will tap into Freshfields' international client base to do inbound work for them."

To this Klingsberg responds that "the firm is 100% committed to the U.S.".

"We're not here just to serve the U.S. component [of cross-border deals]. I do big domestic and cross-border deals. Band one work, band one quality. While others are picking a jurisdiction, we're upscaling in the U.S., Asia and Europe – no one else can say that and be built to take care of the high end, most complex work. It's pretty amazing."

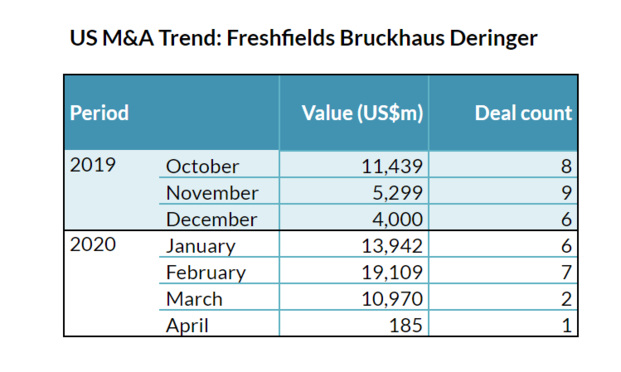

Klingsberg claims that Freshfields' U.S. practice is "finishing one of its best quarters ever" and that its client base is growing.

Deals and data

A look at the U.S. office's top deals for Q4 2019 and Q1 2020 reveals a mix of European-rooted and U.S.-based deals, including:

- Advising London Stock Exchange on its acquisition of U.S. target Refinitiv for $27 billion

- Advising Goldman Sachs as financial adviser on Hexcel Corporation's $13.7 billion combination with Woodward.

- Advising Royal Caribbean Cruises on its $1.3 billion venture into the luxury and expedition cruise market.

- Advising on an upcoming $5 billion investment for a U.S. client

Data from Refinitiv shows that, at the beginning of April, Freshfields took the top spot for announced global deal value for the first quarter of 2020, announcing $99.6 billion worth of deals in Q1 2020, compared to $35.1 billion in Q1 of 2019, when the firm ranked 37.

In an internal document about the U.S. office this month, seen by Law.com, Freshfields' strategy appears to be to transplant what goodwill it has generated in its regions to the less developed U.S. office. It says: "Freshfields is the only major firm in the U.S. with "band one" capabilities globally across seven major practice areas [according to Chambers Global]."

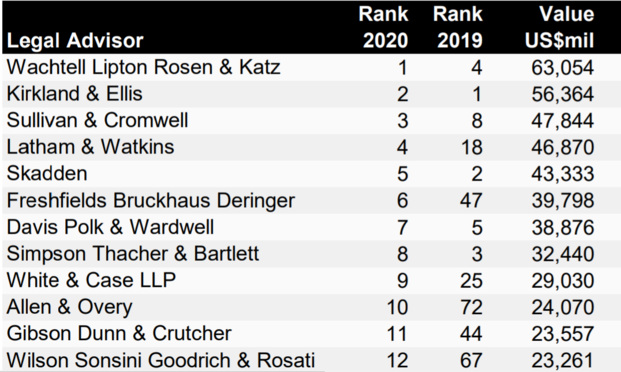

In U.S. M&A, the firm ranked sixth in the first quarter league table, 41 places higher than in the same period last year, according to data from Refinitiv. This was comfortably ahead of 10th-placed Magic Circle rival Allen & Overy.

Source: Refinitiv—April Q1 2020 data for deals with any U.S. involvement.

Source: Refinitiv—April Q1 2020 data for deals with any U.S. involvement.Further to this, based on Mergermarket data, in the six months since Klingsberg joined, the firm has brought in 39 U.S.-based deals worth $64.9 billion.

Source: Mergermarket. Based on announced deals where Freshfields has advised either target/seller or the bidder; based on dominant geography of target, bidder or seller company being the U.S.

Source: Mergermarket. Based on announced deals where Freshfields has advised either target/seller or the bidder; based on dominant geography of target, bidder or seller company being the U.S.But in the wider context of 2019, according to data from Mergermarket which ranks firms according to deal values in the U.S. over the year, the firm sits well outside the top five in 17th place. This is behind even 14th placed U.K.-focused rival Slaughter and May. Table-topping Wachtell brought in deals worth more than three times Freshfields' total, at $590 billion.

And such rankings are likely to matter little in the coming months given the steep fall in M&A work. M&A lawyers are having to shift their focus to compliance work, advising on consolidations, equity infusions and acquisitions by opportunistic private equity houses.

But Klingsberg is stoic, upbeat even: "Dozens of transactions were dried up that were in the middle of being negotiated. The tipping point was at the end of March. Then the pivot was to a lot of strategic and corporate governance advice. We always say we're not here to do just M&A, but are part of a broader strategic relationship with clients."

He adds: "I can tell you now, even with the pandemic, we are currently working on a multi-billion dollar all-cash transaction, representing the special committee of a U.S. public company exploring a major strategic transaction, representing a U.S. public company negotiating a merger of equals, representing a private equity firm buying a U.S. target, and representing a company in a strategic transaction with a financial sponsor.

"That's the pipeline that's reemerged after everything stopped during March."

'A long road'

Despite his optimism, Klingsberg will also be aware of the historic failings of the top U.K. firms in New York.

It's been an unequal transatlantic tale in which the large U.S. firms somehow found their footing in the U.K. market long ago, but in which, conversely, none of Freshfields, Linklaters, Allen & Overy or Clifford Chance have quite "cracked the U.S. code", according to one of the London partners at one of the world's largest U.S. law firms.

But the partner suggests that onlookers have perhaps been unfair in their appraisals of the Magic Circle in the U.S. given how long it takes for a firm to establish itself. The storied Wall Street firms like Wachtell, Cravath and Simpson Thacher & Bartlett have established "deep relationships over 100 years with thousands of people, rather than over 20 years with 100".

"It's a long road if you're trying to crack the U.S," they add. "[Klingsberg] was a scalp, for sure. But if you want to see progress, you have to keep investing. Pandemic or not, they have to continue building, and be relentless about it. For now, [the U.S. office] seems more like a work in progress."

For Klingsberg, 'building' means "dedicating resources to be both of scale and top tier across the board in Europe, Asia and the U.S.".

He believes that, while other firms are "comfortable aiming to be top tier in only one region and are either sacrificing scale and/or the level, complexity or profile of work they are focused on doing in other regions", Freshfields is "unique in committing the resources and investment to both scale and high end client service in Europe, Asia and the U.S.", highlighting, among other areas, corporate transactions, regulatory, investigations, litigation, and restructuring.

He adds: "We are not cutting any corners. We are not settling for being sub-scale. We are not settling for doing commoditised work."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Big Law Sidelined as Asian IPOs in New York Dominated by Small Cap Listings

X-odus: Why Germany’s Federal Court of Justice and Others Are Leaving X

Mexican Lawyers On Speed-Dial as Trump Floats ‘Day One’ Tariffs

Threat of Trump Tariffs Is Sign Canada Needs to Wean Off Reliance on Trade with U.S., Trade Lawyers Say

5 minute readLaw Firms Mentioned

Trending Stories

- 1Who Are the Judges Assigned to Challenges to Trump’s Birthright Citizenship Order?

- 2Litigators of the Week: A Directed Verdict Win for Cisco in a West Texas Patent Case

- 3Litigator of the Week Runners-Up and Shout-Outs

- 4Womble Bond Becomes First Firm in UK to Roll Out AI Tool Firmwide

- 5Will a Market Dominated by Small- to Mid-Cap Deals Give Rise to a Dark Horse US Firm in China?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250