China Outbound Investment Decline Continues, Inbound Rises Amid COVID and Regulatory Challenges

Chinese investments into Europe suffered the biggest drop, but deals into North America and into the rest of Asia were also down from last year.

June 22, 2020 at 11:28 AM

4 minute read

China's outbound investment tanked in the first five months of 2020 due to the COVID-19 pandemic and an across-the-board regulatory shift in most developed markets, according to findings in a recent report by Baker McKenzie and research firm Rhodium Group.

Between January and May, outbound investments from China dropped both in deal count and in value, the report found. Compared with the same period in 2019, new outbound deals announced by Chinese companies were down 88% in total value, at $6.4 billion. Until the end of May, Chinese investors announced an average of 30 outbound deals each month so far this year, just one-third of the average 90 deals every month during 2016-18, the period when China's overseas investment peaked.

Chinese investments into Europe suffered the biggest fall with only $1.4 billion worth of deals announced in the first five months of this year, down a sharp 93% from $19.5 billion last year. Deals into North America were down to $700 million from $6 billion. Chinese outbound investment into the rest of Asia totaled $4.3 billion, a 65% drop from last year.

"In comparison to the boom years, China's outbound investors are simply not in the same position to ramp up overseas buying at the moment," said Frankfurt partner Thomas Gilles, who chairs the firm's Europe, Middle East and Africa-China group.

Gilles said Chinese companies with global ambitions now face a very different environment, largely because of recent changes in foreign investment regimes in several industrial countries.

The Committee on Foreign Investment in the United States, or CFIUS, continues to lead the charge in scrutinizing Chinese investment. A recent example of CFIUS's broad reach under expanded jurisdiction granted by the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA) came last month when the committee ordered California-based Ekso Bionics Inc., a robotics medical devices manufacturer, to unwind a joint venture in China. The deal, which occurred outside of the U.S., did not have an impact on Ekso's U.S.-based assets.

Paul Marquardt, a Washington, D.C., partner with Cleary Gottlieb Steen & Hamilton, wrote on the firm's international trade and sanctions watch blog that given the existing military application of Ekso's technology, a CFIUS ban would not have been surprising had the deal been a Chinese acquisition of Ekso. "But … the transaction appears to have been far from that and its review potentially signals a significant expansion of CFIUS's asserted jurisdiction," he wrote.

And COVID-19 has not slowed the committee down. "The pandemic may prompt CFIUS to examine health care sector transactions more closely than before," said Rod Hunter, a Washington, D.C., partner at Baker McKenzie and a former CFIUS official.

More are following in CFIUS's footsteps. The pandemic has prompted governments in Europe and elsewhere to tighten foreign investment regulations in an effort to protect strategic industries such as health care from being bought out by foreign interests. In March, Australia announced temporary measures to require all foreign transactions into the country to be subject to government review. France and Spain both lowered thresholds for transactions to be screened, according to the Baker McKenzie report, while others, including the U.K., Sweden, New Zealand and Poland, are currently planning foreign investment review legislation.

As Chinese outbound deals plunged, inbound foreign investment into China came into focus. In the first five months of 2020, newly announced foreign M&As into China totaled $9 billion, surpassing Chinese outbound M&A activity in both deal count and value for the first time in a decade, according to the report.

The report identified technology and financial services as the areas where Chinese assets are attracting foreign interests. German carmaker Volkswagen, for example, recently announced two billion-dollar investments: It spent $1.1 billion to take over control of a joint venture with China's Anhui Jianghuai Automotive Group and is buying a 26% stake in Chinese battery maker Guoxuan High-Tech for $1.2 billion.

|

Related Stories:

Freshfields and Allbright Lead On China's Biggest Ever Electric Car Deal

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

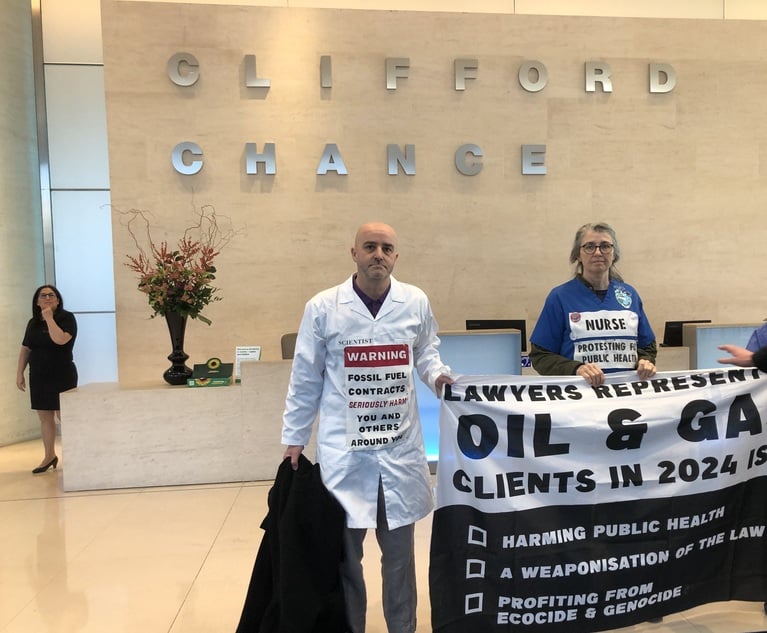

Doctors and Scientists Lead Climate Protests at Each Magic Circle Firm

Law Firms Mentioned

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250