Deloitte Launches Legal Business Practice In US

Deloitte announced the launch of a new Legal Business Services practice on Monday that includes the talents of several former ALSP or legal technology professionals. As the Big Four continues to aggressively pursue new legal expertise, ALSPs could find themselves dealing with a shallower talent pool.

July 13, 2020 at 05:22 PM

3 minute read

The original version of this story was published on Legal Tech News

Deloitte took another giant step into alternative legal service provider country on Monday with the launch of its Legal Business Services practice in the U.S. The new initiative looks to build on the company's existing roster of legal department offerings with the inclusion of such disciplines as contract life cycle management, regulatory consulting, e-discovery and data governance.

To be sure, the Big Four company has been steadily encroaching on the legal world for some time, especially when it comes to technology. Case in point: Deloitte kicked off Legal Ventures, an initiative that traded the organization's expertise in exchange for access to legal tech startups' products and services, last December.

But the launch of the legal business services practice also makes clear that Deloitte is investing just as heavily in the talent or skill sets that have traditionally populated ALSPs and tech companies.

"We anticipate becoming the undisputed market leader in legal business services and to achieve that we're strategically in [search of] leading talent from that world of alternative legal service providers. Chief legal officers, legal operations, legal industry eminence, legal technology," said Mark Ross, a principal with Deloitte Tax LLP.

Ross himself was executive vice president and global head of contracts at Integreon before joining Deloitte in January. Similarly, Deloitte Tax's managing director, Lewis Christian, was the managing director of U.S. contracts consulting at Elevate before crossing over in June. And it's not just the tax business that's seen an influx of ALSP blood. Last May, Deloitte Legal found a new lead partner in former Luminance Technologies CEO Emily Foges.

So why all of the interest in ALSP or legal tech veterans? It could have something to do with Deloitte's ongoing mission to become the "singular destination" in what Ross identified as the multibillion-dollar legal services market. An area such as contract life cycle management benefits from the use of technology solutions, but there's also a fair amount of experience-born strategy involved with knowing how and when to use those resources.

"Contract technology isn't on its own a magic wand that cures all of these ills," Ross said.

Meanwhile, the legal talent pool will likely continue to flow in the direction of the work. Nathan Cemenska, director of legal operations and industry insights at Wolters Kluwer's ELM Solutions, indicated that there's a sense of inevitability among some in the industry that a sizable portion of that business is going to end up with the Big Four, creating a self-fulfilling prophecy among would-be hires.

"I think once somebody goes to the Big Four, it might be hard to get them back," he said.

What this means for the other players in the legal industry remains to be seen. Cemenska doesn't expect to see ALSPs disappear from the landscape entirely. Instead, he postulated that large and financially stable companies will continue to operate despite the growing influence of the Big Four. "I think that there's always going to be room for niche players," he said.

In the meantime, Deloitte remains open to the possibility of continuing to grow its ranks. "We will continue to invest strategically in some of the leading specialists in the market today," Ross at Deloitte Tax said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

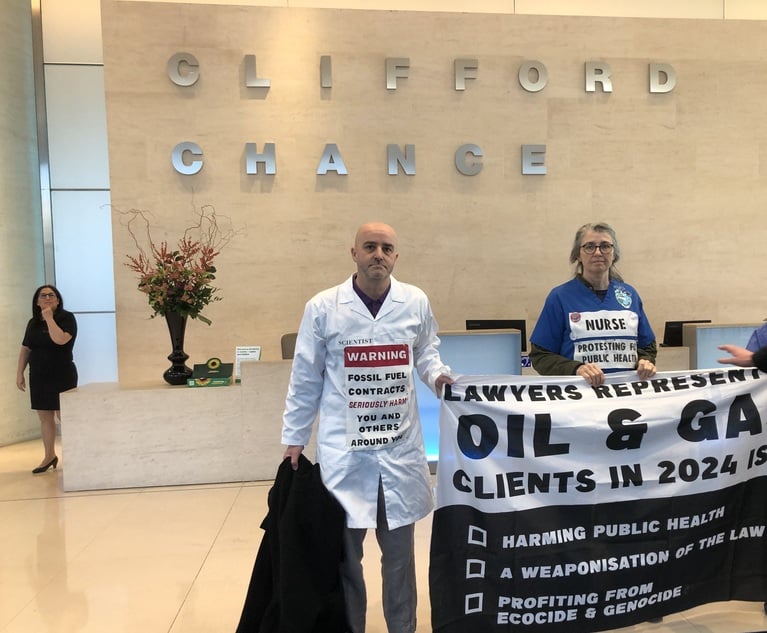

Doctors and Scientists Lead Climate Protests at Each Magic Circle Firm

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250