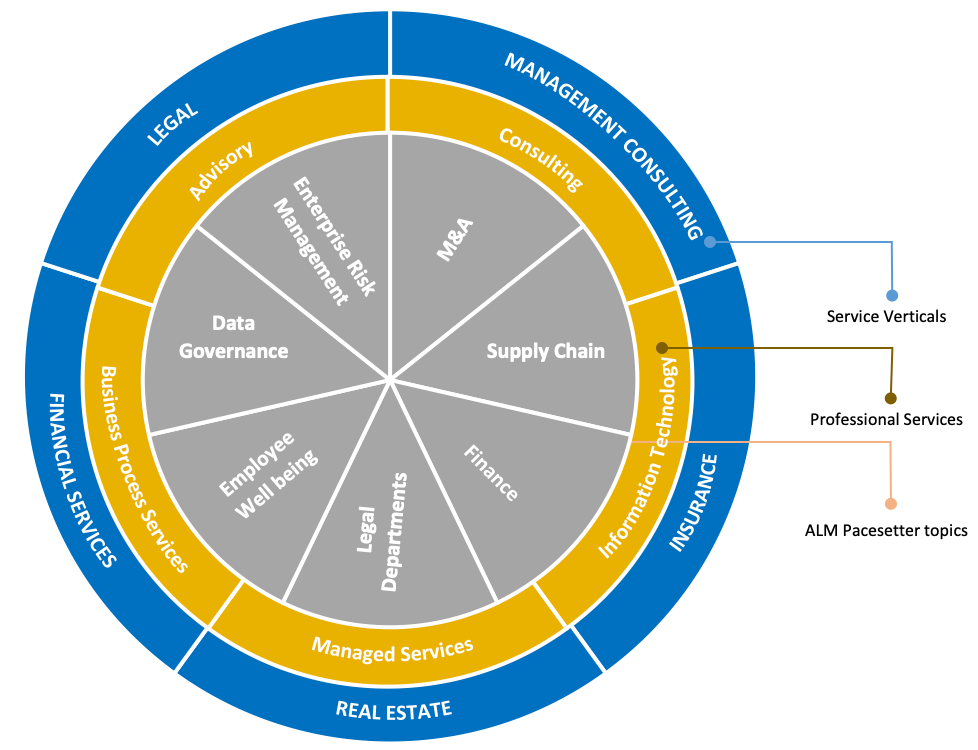

ALM is setting a new direction for research with the release of its newest product, ALM Intelligence Pacesetter Research. Pacesetter Research takes a platform view of the two-sided market for professional services, providing objective assessments of service providers and insightful viewpoints on demand trends that help buyers evaluate their options and providers identify business opportunities and threats. The research reports feature insightful analysis on each of the segment leaders, which are nominated by the Pacesetter Advisory Council, which is composed of buy-side professionals and experts from throughout each industry.