PE star Higgins' $10m Kirkland switch leaves 'bad taste' after Freshfields lockstep reform

Buyout star's big-money move highlights scale of lockstep challenge for UK firms

December 19, 2017 at 10:23 AM

5 minute read

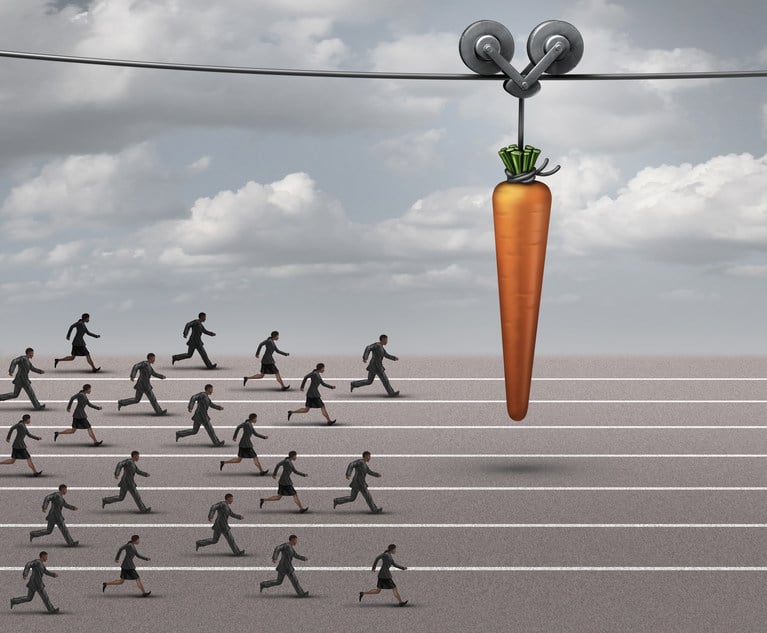

No lockstep reform was ever going to let Freshfields Bruckhaus Deringer match Kirkland's $10m (£7.5m) a year offer for City buyout star David Higgins.

Even so, confirmation of his exit to the US firm is a blow to Freshfields, coming so soon after it revamped its remuneration model to enable it to better reward top performers.

While a handful of Freshfields' stars – and Higgins would have been among them – will now be able to make six times more than those at the bottom, this will put them on around £3m.

It's a figure which, while good even by the standards of most City law firms, is a long way off the guaranteed package on offer at Kirkland – particularly when considering Higgins is not joining as the US firm's highest earner, and that sources suggest Kirkland's profit per equity partner is likely to increase significantly next year.

Though the magic circle firm did not change its lockstep simply to keep Higgins, it's fair to say he was a driving force in the overhaul, pushing for change that would effectively bump up pay for a small number of stars, while lowering pay for others.

"Freshfields will be very disappointed because he drove a huge amount of change and division internally," says one City private equity partner of the timing of Higgins' move. "The firm has flexed its lockstep massively more than any other magic circle firm, and he has turned around and said it is not enough.

"I think it leaves a bad taste after all the tension and pushiness. Junior partners have seen a senior partner go round and tell them that the firm needs fixing and needs to change its lockstep. He's been incredibly vocal about it and now he is leaving."

A former Freshfields partner adds: "He was on the more aggressive end of the spectrum of lockstep change. It is not the first time we thought he might go, but Freshfields is never going to give anyone a deal that is $10m guaranteed. If you're going to lose someone like that anyway, maybe you shouldn't compromise the system for it."

The money may well have been the biggest attraction of Kirkland, but sources both inside and outside the firm suggest Higgins was also frustrated because he wanted a management position that was not on offer at present at Freshfields, and, according to some, would have been unlikely to happen.

"He always had management aspirations, but was a bit like Marmite at Freshfields," says one buyout partner. "He's a divisive character," says another source.

On top of the shadow Higgins' exit casts over Freshfields' lockstep reform, it also raises questions about the firm's private equity practice, which will be left in the hands of co-head Adrian Maguire.

Higgins has at least two key PE clients in common with Kirkland – Cinven and Blackstone – as well as a wider client list that includes Canada Pension Plan Investment Board, Hellman & Friedman, The Carlyle Group and GIC.

Many of these relationships are more closely aligned with the firm than Higgins, however, prompting some to predict that while some work may move with Higgins, the bulk will not.

As one partner comments: "Freshfields is good at sharing clients around so I don't think they will lose anyone overnight. They have some really good people other than David, so I suspect they won't lose too many clients. I don't think Kirkland is hiring him for his book of business – he has a stellar personal reputation, but medium to low portable clients."

However, given Higgins is the first really big-name partner to be prised out of the team for a rival firm, Freshfields' ability to retain these clients in the longer term will depend on its ability to prevent others – such as Maguire – from heading towards the door now the seal has been broken.

While few firms could match the package on offer at Kirkland beating Freshfields' £3m figure would be less challenging, particularly after a bruising period both financially and culturally at the UK firm.

Despite Higgins' departure, Freshfields' private equity practice still has a lot going for it. For Kirkland, however, he offers the top name UK partner the PE practice it lacked in London.

One buyout partner says: "It's a good move for Kirkland and signals a change in pace for the firm, which will gain a more English-facing PE practice. It will reawaken the market."

Another adds: "It's a great move. For Higgins to bring in the $30m needed to justify a $10m package is more than possible at Kirkland."

One Kirkland partner agrees, describing the hire as "a monumental coup". He adds: "Higgins was Freshfields' main private equity guy. He was very senior – one of the key people at the senior end of private equity in Europe."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Will a Market Dominated by Small- to Mid-Cap Deals Give Rise to This Dark Horse US Firm in China?

Big Law Sidelined as Asian IPOs in New York Dominated by Small Cap Listings

Trending Stories

- 1In Novel Oil and Gas Feud, 5th Circuit Gives Choice of Arbitration Venue

- 2Jury Seated in Glynn County Trial of Ex-Prosecutor Accused of Shielding Ahmaud Arbery's Killers

- 3Ex-Archegos CFO Gets 8-Year Prison Sentence for Fraud Scheme

- 4Judges Split Over Whether Indigent Prisoners Bringing Suit Must Each Pay Filing Fee

- 5Law Firms Report Wide Growth, Successful Billing Rate Increases and Less Merger Interest

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250