The law firms set to benefit from private equity spending this year

Large funds raised by largest buyout houses mean some law firms could be in line for bumper year

January 04, 2019 at 02:00 AM

5 minute read

Freshfields Bruckhaus Deringer and Clifford Chance are in pole position to benefit from a glut of private equity spending this year, according to Legal Week analysis of bespoke industry research.

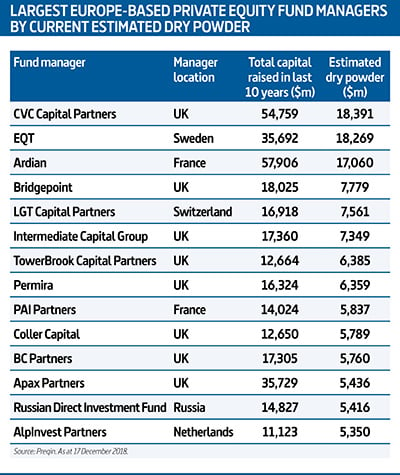

The European buyout firms with the most uninvested capital ready to spend are CVC Capital Partners, EQT, Ardian and Bridgepoint, according to rankings produced by data provider Preqin for this publication. Together, the four firms have more than $60bn ready to spend, making them some of the most coveted clients in the market.

Freshfields and CC both act for two of the firms with the most capital at their disposal. In the last 18 months, the two magic circle firms have picked up mandates for both CVC, which logged estimated 'dry powder' of $18.4bn at the end of 2018, and EQT, which had $18.2bn.

Kirkland & Ellis private equity partner David Higgins said: "Given the amount of dry powder that's been raised, we're seeing a continuing number of large consortium deals and carve-outs as clients search for value and less competitive situations.

Kirkland & Ellis private equity partner David Higgins said: "Given the amount of dry powder that's been raised, we're seeing a continuing number of large consortium deals and carve-outs as clients search for value and less competitive situations.

"There's also an expectation that there will be more take-private deals as [private equity firms] look for value on public markets. Technology continues to be an interesting sector – we've seen that in a lot of recent deals."

- CVC: estimated dry powder – $18.4bn. Lead advisers include: CC, Freshfields, White & Case, Latham & Watkins, Weil Gotshal & Manges

Freshfields took centre stage for long-term client CVC Capital Partners in April 2018 when the UK-based fund sold its majority stake in Sky Bet to Canadian betting company Stars Group. London corporate partners Tim Wilmot and Christopher Mort, antitrust partner Alastair Chapman and US based co-head of global financial institutions Valerie Jacob led for Freshfields.

The firm also advised last month on CVC's acquisition of a minority shareholding in Premier Rugby Limited, and in July took a role for a consortium including CVC on its purchase of industrial gas giant Linde's US assets ahead of its planned mega-merger with rival Praxair. Latham & Watkins Germany managing partner Oliver Felsenstein and Frankfurt-based corporate partner Leif Schrader also advised CVC as part of the transaction.

Freshfields' private equity team suffered a blow last year when rainmaker Higgins moved to the London office of US firm Kirkland & Ellis. But CVC remains an established client, partly thanks to the fact that Freshfields partner Chris Bown joined CVC as a legal adviser in 2013.

CC also has strong ties to the private equity giant and last summer, London funds partner Andrew Husdan picked up a role for CVC on a $600m secured term and revolving loan facility.

CC has maintained the relationship despite several partner departures from the magic circle firm's private equity practice to Latham, though the US firm has in turn tightened its hold on the fund. Ex-CC partner Kem Ihenacho took a role for Latham in November as it sought to become a joint majority shareholder in software security company Omada.

White & Case, meanwhile, has kept up a steady flow of work for CVC in the US.

- EQT: estimated dry powder – $18.2bn. Lead advisers include: Kirkland; Freshfields, Simpson Thacher & Bartlett, CC; Weil

EQT instructed a Munich-based Freshfields team on the merger of one of its hearing-aid manufacturing assets, Sivantos, with rival Widex in May, with the magic circle team headed up by global insurance head Wessel Heukamp.

In June, the Swedish private equity firm jointly purchased chemicals distribution company Azelis from Apax Partners, a deal that reportedly valued the company at about $2bn (£1.5m). Leading on the transaction for EQT were CC private equity partner Spencer Baylin and then-CC private equity partner Amy Mahon, who recently sealed a move to Simpson Thacher & Bartlett.

Kirkland and Simpson Thacher have still maintained a firm hold over EQT's mandates this year, while other firms to have advised the group in the past include Allen & Overy.

- Ardian: estimated dry powder – $17bn. Lead advisers include: Willkie Farr & Gallagher, Latham, Weil, BonelliErede, Giovannelli & Associati

French buyout firm Ardian was third in the Preqin rankings, with estimated uninvested capital of $17bn. The private equity firm is known to use a variety of legal advisers.

In 2018, Willkie Farr Munich partner Maximilian Schwab advised the client on two mandates – the sale of its portfolio company ESIM Chemicals to Sun European Partners and the sale of hotel cosmetics manufacturer ADA International to Austria-based investment firm Moonlake Capital.

Latham has picked up roles for the firm this year, particularly in France. Ardian has also turned to local law firms for continental Europe deals, including BonelliErede and Giovannelli.

- Bridgepoint: estimated dry powder – $7.7bn. Lead advisers include: Travers Smith, Ropes & Gray, A&O

UK buyout firm Bridgepoint, which has estimated uninvested capital of $7.7bn, is a major client of Travers.

In May, Travers advised Bridgepoint its sale of sandwich chain Pret a Manger to German investment group JAB Holdings for a reported £1.5bn, with head of private equity Paul Dolman and private equity partner Ian Shawyer leading the team.

However, Ropes has also picked up some mandates from Bridgepoint after ex-Travers partners Phil Sanderson and Helen Croke moved to the US firm in 2016. Croke advised Bridgepoint last year on legal software and Bridgepoint portfolio company BigHand's acquisition of legal pricing tool DW Reporting.

In October, Bridgepoint also added A&O to its roster of advisers.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

X Ordered to Release Data by German Court Amid Election Interference Concerns

Compliance With the EU's AI Act Lags Behind as First Provisions Take Effect

Quinn Emanuel's Hamburg Managing Partner and Four-Lawyer Team Jump to Willkie Farr

Trump ICC Sanctions Condemned as ‘Brazen Attack’ on International Law

Trending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250