US firms plummet down UK M&A deal rankings

Magic circle dominates 2018 M&A league tables for first time in years

January 08, 2019 at 04:45 AM

3 minute read

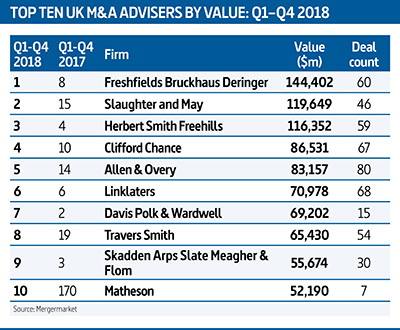

US firms have slipped down the league tables for UK M&A activity, with magic circle and UK firms dominating all of the top six slots in 2018 for the first time since 2014.

Kirkland & Ellis, Davis Polk & Wardwell and Skadden Arps Slate Meagher & Flom, which took the top three spots in 2017, all fell in the last 12 months. Kirkland plummeted to 12th, Davis Polk to fourth and Skadden to 9th, according to the data compiled by Mergermarket for Legal Week.

Freshfields Bruckhaus Deringer topped the table for 2018 after advising on 60 deals worth a total of $144.4bn. It was followed by Slaughter and May ($119.6bn), Herbert Smith Freehills ($116.3bn), Clifford Chance ($86.5bn) and Allen & Overy ($83.1bn). Linklaters ($70.9bn) came sixth.

It marks a significant change on the previous three years, in which at least two US-based firms have taken top five rankings.

Freshfields M&A partner Bruce Embley said the activity of particular sectors could influence which firms rank highly.

Freshfields M&A partner Bruce Embley said the activity of particular sectors could influence which firms rank highly.

He added: "Clients might look at using a different firm for big public deals than they would for private equity deals. Within different sectors, you see different firms having particular strengths. Big M&A continues to face more and more hurdles, including protectionist trends.

"Clients are incredibly sophisticated and want to choose firms that they believe are best placed to navigate these challenges; it may well be that circumstance fed more into the UK-headquartered skillset."

UK M&A deal volume in the last quarter fell to its lowest point since Q1 of 2014, with the sector racking up 333 deals worth $34bn (£26.6bn).

However, the rest of 2018 was busier. Law firms worked on 1,519 deals across the full year worth $245.8bn (£192.6bn) in the UK.

Deal highlights for Freshfields included the second largest M&A deal of the year in Europe – Comcast's purchase of Sky, a deal that also handed roles Davis Polk & Wardwell, A&O, Skadden Arps Slate Meagher & Flom, Simpson Thacher & Bartlett, HSF and Slaughters.

Deal highlights for Freshfields included the second largest M&A deal of the year in Europe – Comcast's purchase of Sky, a deal that also handed roles Davis Polk & Wardwell, A&O, Skadden Arps Slate Meagher & Flom, Simpson Thacher & Bartlett, HSF and Slaughters.

Freshfields also advised opposite Linklaters and A&O on the third-biggest deal of the year, in which energy company E.ON €43bn (£38bn) acquired a controlling stake in renewable energy business Innogy from German rival RWE.

DLA Piper did the most deals in the UK with 128 mandates, with CMS in second place on 125.

Nigel Wellings, co-head of London corporate at CC, said: "We saw a very busy summer. Our cycle is a bell curve where we usually expect to ramp up from September. That whole curve came forward and didn't really stop."

Gavin Davies, global M&A head at HSF, said key drivers of activity were corporates with cash seeking rationalisation and growth, private equity with dry powder needing to invest, and cheap debt.

"These drivers prevailed over the headwinds of political and economic uncertainty, populist protectionist trends creating greater political interest in deals, and high value expectations," he said.

For activity across the whole of Europe, Freshfields topped the M&A tables for the third year in a row with deals worth $343.5bn (£269.2bn). Linklaters came second with $288.3bn (£225.9bn) and A&O jumped from 13th place to third place at $241.1bn (£188.9bn).

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Partners from Baker McKenzie, DLA Piper and PwC Join New Firms in Australia

4 minute read

India Firm Engaged as Volkswagen Sues Local Authorities Over $1.4B Tax Bill

De Brauw Partner Departs for In-House Role with Swiss Family Enterprise

Reed Smith Joins Saudi Legal Boom as UK and US Firms Race for Market Share

5 minute readTrending Stories

- 1Conversation Catalyst: Transforming Professional Advancement Through Strategic Dialogue

- 2Trump Taps McKinsey CLO Pierre Gentin for Commerce Department GC

- 3Critical Mass With Law.com's Amanda Bronstad: 700+ Residents Near Ohio Derailment File New Suit, Is the FAA to Blame For Last Month's Air Disasters?

- 4Law Journal Column on Marital Residence Sales in Pending Divorces Puts 'Misplaced' Reliance on Two Cases

- 5A Message to the Community: Meeting the Moment in 2025

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250