The European Parliament in Strasbourg, France. Photo: David Iliff

The European Parliament in Strasbourg, France. Photo: David IliffEurope to Monitor Foreign Investments, but Don't Expect a European CFIUS

The EU oversight mechanism does not exert as much control as the Committee on Foreign Investment in the U.S., lawyers say.

March 28, 2019 at 07:03 PM

4 minute read

The European Union has approved new rules that establish a framework for screening foreign direct investments to protect against security threats, adding to a growing list of governments that have imposed mechanisms to block investments in the name of national security.

In addition to the U.S., Japan, Canada and Australia have taken steps to upgrade their own national security investment review processes.

The new legislation is the EU's response to a rising tide of acquisitions by mainly Chinese companies of European technology, energy and other businesses. It is often compared to CFIUS, the U.S. system for reviewing foreign investments for their impact on national security.

But CFIUS has more teeth, lawyers say.

"At the EU level, it's weaker than CFIUS control. The commission does not have the ability to block or restrict [an investment]," said Felix Helmstaedter, a lawyer at Morrison & Foerster's Berlin office.

CFIUS, which stands for the Committee on Foreign Investment in the United States, has that power. But under the EU legislation, member states remain in charge, Helmstaedter said.

Still, in the current climate of fear and suspicion, directed mostly at China, the EU was able to establish rules after about a year of negotiations.

"Europe must always defend its strategic interests and that is precisely what this new framework will help us to do," European Commission president Jean-Claude Juncker said in November, when the member states finally agreed to an outline of the new system. "We are not naïve free traders. We need scrutiny over purchases by foreign companies that target Europe's strategic assets."

|How the Law Came About

In 2017, the French, German and Italian governments wrote to the European Commission, expressing concern that foreign—specifically Chinese—investors were taking stakes in strategic assets, such as energy grids.

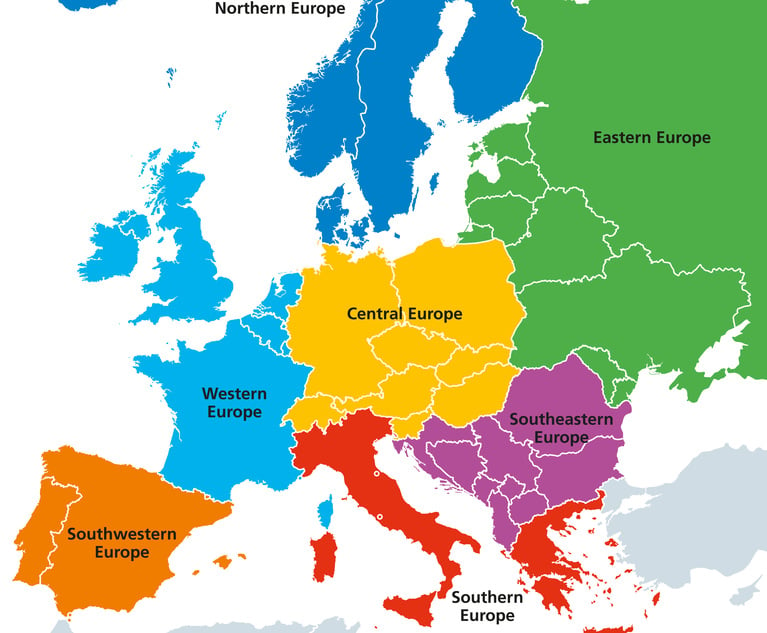

The concern was not so much about the Chinese buying national businesses, as these countries had their own screening rules in place. It was rather about the risks posed if China controlled sensitive businesses in the EU's poorer countries, such as Greece, Portugal and former communist bloc countries. Greece and Portugal, two countries that had been through financial crises, looked to the Chinese for much-needed capital, as they were being shunned by other international investors.

France, Germany and Italy wanted the European Commission to have a degree of central oversight, if not outright control, of investment in other countries.

The ambitions for the EU screening rules had to be scaled back once those drafting the legislation realised that even in the EU's setup, where many powers are centralised, security remained a prerogative of national governments. There was little scope for giving the commission the power to police acquisitions because of security concerns. There was also fierce pushback from countries like Portugal and Hungary, which did not want any interference in their investment plans.

What emerged is a system that allows for sharing information about proposed acquisitions among member states. The commission will be able to give its opinion on whether acquisitions could undermine security in cases involving more than one EU member state or EU projects, such as its Galileo satellite programme. But that's the limit of its powers.

Crucially, member states are not even required to set up national screening schemes. At present, 14 of the 28 member countries have national measures in place. But if a country does not have one, it is not obliged to share information with its EU partners.

Helmstaedter said the rules will have an impact on the length of time it takes to complete a screening process in which the EU gets involved. "It has an impact on the timeline," he said. "Investors will have to be aware [of this] because screening procedures will take longer."

Fredrik Erixon, director at the European Centre for International Political Economy, said there is a fundamental challenge for the regulation that will limit its effect. "There's no commonly agreed-to definition of what we are talking about, whether it's geopolitically controversial or economically controversial," he said.

At present, the EU governments block investments from each other on security grounds. "If you want to have a common screening policy, the first thing would be to have a common approach," he said.

|Related Stories:

EU Disregards US Call for Ban on Huawei Products but Recommends Increased Security Assessment

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of the Game'

7 minute read

GOP's Washington Trifecta Could Put Litigation Finance Industry Under Pressure

Trending Stories

- 1Gibson Dunn Sued By Crypto Client After Lateral Hire Causes Conflict of Interest

- 2Trump's Solicitor General Expected to 'Flip' Prelogar's Positions at Supreme Court

- 3Pharmacy Lawyers See Promise in NY Regulator's Curbs on PBM Industry

- 4Outgoing USPTO Director Kathi Vidal: ‘We All Want the Country to Be in a Better Place’

- 5Supreme Court Will Review Constitutionality Of FCC's Universal Service Fund

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250