Pinsents Strikes £25M Referral Deal With Litigation Funder

The agreement will allow Pinsents' litigation clients to access a £25 million facility.

July 04, 2019 at 12:13 PM

2 minute read

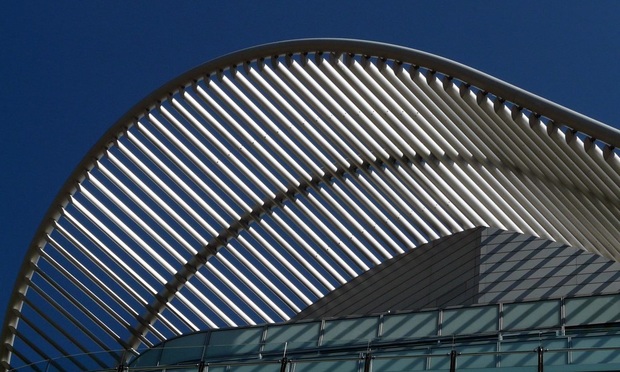

The Peak – Augusta's London HQ, Credit: Flickr/pippigar

The Peak – Augusta's London HQ, Credit: Flickr/pippigar

Pinsent Masons has formalised its relationship with litigation funder Augusta Ventures by way of a new £25 million funding facility.

Under the arrangement, Pinsents clients will receive "preferred rates", including a fast-tracked due diligence process and transparent commercial terms, the firm said in a statement.

To fund the arrangement, Augusta's managing director Louis Young said Augusta has agreed to lay out a £25 million initial facility, with the sum "likely to expand".

Under the terms of the agreement, Augusta will fund the entire cost of pursuing a claim on a "non-recourse" basis – meaning the client pays nothing if the claim fails.

Cases referred by Pinsents need to meet certain funding requirements. Young said the client must be expected to win at least 50% of the damages, and that the anticipated payout should be more than six times the sum of the costs.

Mark Roe, partner and head of international arbitration at Pinsents, said in the firm's statement that the terms provided would be considerably better than clients would typically receive from funders if they were to make an individual approach to the market.

"Often, even if clients have funds available, they prefer to invest them in their business rather than in pursuing claims," Roe said. "We wanted to address that problem."

The move by Pinsents follows Fieldfisher's announcement in May that it has devised its own litigation funding model using a combination of bank debt, firm and partner money to cover litigation costs.

Similarly, Mishcon de Reya set up its 'Protect' service 10 years ago, while Addleshaw Goddard also debuted 'Control' back in 2008, which it relaunched last year on the back of renewed interest in the market. Both services rely on third-party providers.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Malaysia’s Shearn Delamore Set To Expand Local Footprint With New Office Launch

CMA Uses New Competition Powers to Investigate Google Over Search Advertising

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250