UK Top 50 Full Results: Growth Slows But Optimism Remains

Our comprehensive table shows slow but steady is the story of the year for the top law firms, which are still failing to keep pace with their US rivals on profits.

September 03, 2019 at 04:35 AM

5 minute read

London Highlights: Top 50 UK revenues have now topped £24 billion. Credit: Shutterstock.com

London Highlights: Top 50 UK revenues have now topped £24 billion. Credit: Shutterstock.com

Growth at the U.K.'s largest law firms slowed in the 2018-19 financial year, as market uncertainty affected firms' ability to improve on the previous year's bumper results.

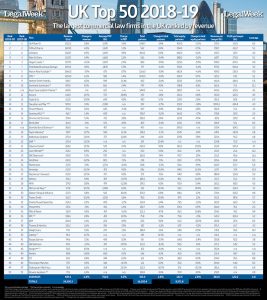

Click on table to view large version

Click on table to view large versionCombined revenues across the U.K.'s top 50 firms grew by 9.6% to £24.2 billion. The increase, though achieved against a backdrop of economic uncertainty amid ongoing Brexit discussions, is a clear slowdown compared with 2017-18, when the total combined revenue number grew by 15.4%. It is also the lowest rise since 2015-16.

The average profit per equity partner (PEP) for a top 50 firm reached £750,000, a 4% rise on the previous year, when the figure grew at the same rate.

The slow PEP growth means that U.K. firms are still struggling to keep pace with their American rivals. Collectively, average profit per equity partner among the top 100 U.S. firms grew by 6.5% to reach $1.8 million (£1.5 million) in 2018, while the group measured an 8% uptick in revenue.

The U.K. top 50′s increase in revenues was largely offset by rising headcount numbers, which rose 8.5% to a combined total of 55,615 across the 50 firms. That meant average revenue per lawyer remained almost flat, rising just 1% to reach £384,000.

But the U.K. growth was at least consistent. Just three U.K. firms – Hogan Lovells, Norton Rose Fulbright and Hill Dickinson – saw revenues drop year on year.

The fastest-growing firms for revenue were Keoghs, Fieldfisher, DWF, Freeths, Ashurst and Addleshaw Goddard, all of which saw at least 13% rises.

"Even if there is a slowdown, it does not feel like a repeat of 2008″

Commenting on activity levels through the year, Sebastian Pritchard-Jones, senior partner-elect at Macfarlanes, said: "The main challenges in the market came from the political uncertainty which peaked in the run-up to the end of March. That certainly affected decision-making on the part of some clients. We sense however that if/when we have finality to the political process, there is quite a bit of pent-up demand that could be unleashed on the transactional side."

He added: "Even if there is a slowdown, it does not feel like a repeat of 2008."

At the top end of the table, Linklaters leapfrogged its Magic Circle rival Allen & Overy and transatlantic firms Hogan Lovells and Norton Rose Fulbright, to take the third spot behind DLA Piper and Clifford Chance.

Its growth means the financials of most of the Magic Circle are now very closely matched. Linklaters and Allen & Overy's revenues are £1.6 billion, while Clifford Chance is on £1.7 billion and Freshfields Bruckhaus Deringer is on £1.5 billion. PEP at the firms is also similar, with all four firms having PEP of between £1.6 million and £1.8 million.

"We're certainly not predicting a cliff-edge and our view is that London will remain one of the world's most important financial centres"

Linklaters' managing partner Gideon Moore said: "The uncertainty that Brexit creates is clearly unsettling but it is in moments like these that our teams can be of most value to our clients.

"We're certainly not predicting a cliff-edge and our view is that London will remain one of the world's most important financial centres, and elsewhere we see significant scope and opportunity for dealmaking. PE firms and funds, for example, are sitting on record amounts of dry powder, fuelling record levels of take-private and carve-out business."

Freshfields senior partner Edward Braham added: "I expect continuing demand from clients who are dealing with change and complexity across their business. At a time when the world is stepping back from globalisation, it has never been more important to have lawyers who bring global experience."

Eleven firms reported double-digit PEP increases, including Ashurst, which increased its PEP by 30%, and Hill Dickinson, where it rose 25.9%.

However, PEP dropped at Bryan Cave Leighton Paisner, Pinsent Masons, Macfarlanes, HFW, Charles Russell Speechlys, Mills & Reeve and Pennington Manches.

Herbert Smith Freehills senior partner James Palmer said: "What we're seeing is more complexity in transactions and more complexity involved in getting them through. That complexity is a key factor in the uptick in our workload. If transaction volumes fall still further, you reach a point where it has an impact on performance, but our goal is to get a share of that complicated work which justifies clients using us."

Hogan Lovells U.K. and Africa head Susan Bright added: "There was a resurgence in demand for Brexit-related advice – most recently in relation to the impact of a potential no-deal exit on October 31. Despite the ongoing uncertainty surrounding Brexit, we saw a healthy level of dealflow and overseas-led investment, with many high-value transactions taking place in the technology, life sciences and financial services sectors."

Click here to see the full table of results

With reporting by James Willer.

Closing the Gap: Second Tier UK Firms Post Strong PEP Rises

For a detailed breakdown of profit per equity partner (PEP) figures across the UK's Top 50 firms, as well as revenue, headcount and leverage figures see the full rankings available through ALM Intelligence's Legal Compass.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KMPG Moves to Provide Legal Services in the US—Now All Eyes Are on Its Big Four Peers

International Arbitration: Key Developments of 2024 and Emerging Trends for 2025

4 minute read

The Quiet Revolution: Private Equity’s Calculated Push Into Law Firms

5 minute read

'Almost Impossible'?: Squire Challenge to Sanctions Spotlights Difficulty of Getting Off Administration's List

4 minute readTrending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250