Closing the Gap: Second Tier UK Firms Post Strong PEP Rises

Firms in the second 50 saw higher profits per equity partner rises than the biggest firms did.

September 16, 2019 at 10:28 AM

3 minute read

The second 50 saw strong PEP increases, closing the gap between the group and the U.K. Top 50.

The second 50 saw strong PEP increases, closing the gap between the group and the U.K. Top 50.

The second tier of the U.K.'s top law firms are growing their equity partner profits at a faster rate than their larger rivals, according to Legal Week's latest table of financial results.

The U.K. second 50 – the firms that rank 51-100 based on their revenues – saw their overall average profits per equity partner rise to £504,000 in the last financial year, up 19% from £424,000 the previous year. In comparison, the top 50′s average PEP figure grew by 4% to hit £750,000, amid greater competition with U.S. rival firms.

The average change in PEP among the second 50 was a 6.3% rise, compared with a 4.3% rise at the largest 50 firms. And 14 firms in the second 50 achieved double-digit PEP growth, compared with eight in the top 50.

Several firms saw steep rises. Bristol-based firm Thrings more than doubled its PEP to £212,000, despite the departure of just one equity partner. Intellectual property boutique EIP also nearly doubled its PEP to £400,000, amid a 22% rise in revenues. Meanwhile, PEP at Leeds-headquarted firm Walker Morris rose by 38.8% to reach £583,000.

Combined turnover at the second 50 firms rose 8% for the second year running, to reach £2.15 billion. The U.K. top 50 posted total turnover growth of 9.6% during the same period.

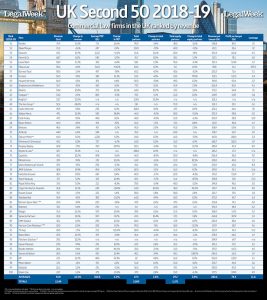

Click on table for an expanded version

Click on table for an expanded versionSix firms grew their turnover by more than 20%, including three listed firms – Knights (51%), Ince (68.6%) and Keystone Law (35.1%) – as well as media and technology firm Wiggin (21.2%), City firm Bates Wells (22.5%) and EIP, which entered the second 50 for the first time with revenues of £27.5 million.

Just one firm – Blake Morgan – saw turnover dip, and then only by less than 3%.

But the strong figures could be threatened by continued economic uncertainty, according to some law firm leaders.

Making her predictions for the market during the next few months, Kingsley Napley managing partner Linda Woolley expects a slowdown in the medium term. She added this was likely "as slower global growth kicks in due to a reversal of the global economic cycle into recession, and as tailwinds caused by matters such as a reversal of the trend towards globalisation, trade wars, Brexit, China and so on, take effect".

However, Peter Lawson, chairman at Scottish firm Burness Paull, was bullish, saying: "The transactional market continues to be strong and activity in the oil and gas sector in the northeast is coming back – not in a big uptick way, but in a more steady fashion. As a sector it's very boom/bust, but I think it's rightsizing itself at the moment."

Click here for a PDF of the full U.K. second 50 table.

For a detailed breakdown of PEP figures across the UK's top 100 firms, as well as revenue, headcount and leverage figures, see the full rankings available through ALM Intelligence's Legal Compass.

With reporting by James Willer.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Some Elite Law Firms Are Growing Equity Partner Ranks Faster Than Others

4 minute read

KPMG's Bid To Practice Law in US On Hold As Arizona Court Exercises Caution

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250