Apple Has Its Days in EU Court

The company is appealing a finding issued by the European Commission that Apple owes $14 billion in back taxes.

September 17, 2019 at 05:12 PM

4 minute read

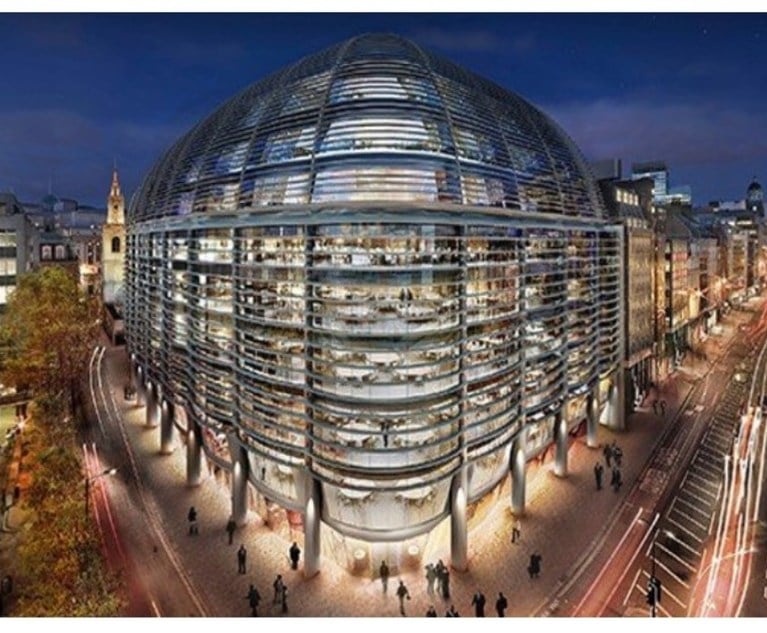

Apple. Photo: Songquan Deng/Shutterstock.com

Apple. Photo: Songquan Deng/Shutterstock.com

In what is being billed as the world's largest tax case, Apple Inc. appeared before the European Union's General Court in Luxembourg on Tuesday to appeal a 2016 finding by the European Commission that the company owes €13 billion ($14.4 billion) in taxes.

During the first day of the two-day hearing, Apple lawyer Daniel Beard dismissed the Commission's arguments that the company's branches in Ireland should be liable for taxes on all sales outside the U.S., telling the court the claim "defies reality and common sense", according to a report by Reuters.

The dispute over whether Apple has paid its fair share in taxes has taken on broader importance, as it is seen as a test of EU competition czar Margrethe Vestager's efforts to end what the Commission views as sweetheart tax deals for multinationals. Vestager, who has been nominated for a second term as competition chief, has also ruled against Starbucks, Amazon and Fiat, ordering them to pay back billions in taxes.

In the case currently on appeal, the Commission contends that all of Apple's profits from its sales outside the U.S. should have been attributed to the company's two branches in Ireland, where the company is based. Ireland, which has benefited from investment by multinational companies attracted by low tax rates, is also challenging the Commission's decision.

According to news reports, Apple argued on day one of the hearing, which is expected to continue on Wednesday, that key intellectual property rights for Apple's products were developed in the U.S. – not in Ireland – so the company's branches in Ireland could not be responsible for generating almost all of Apple's profits outside the U.S.

The Commission argues that the low tax rate Apple pays on its activities in Ireland, which was estimated at 0.005% in 2014, is illegal government aid to the company.

The 28-member European Union has strict rules on the amount of "state" or government aid that can be used to attract investment or convince companies to maintain operations in a particular country. These rules are designed to prevent richer EU countries from using their public budgets to gain unfair advantages in the EU's single market.

The Commission is arguing that Apple's tax treatment in Ireland was a sweetheart deal with Irish tax authorities, reached to convince the company to base its operations there.

The European Commission is responsible for policing state aid across all of the bloc's 28 members, so it issued the order to the Irish government to collect the €13 billion – even though Dublin is defending its treatment of Apple.

The decision against Apple was one of a series in which Vestager ruled against multinationals, saying they had received sweetheart tax deals that distort competition and let companies play one EU country against another to get the most favourable tax treatment.

Vestager faces a series of legal challenges of her decisions in the coming months, as the EU's courts will rule on appeals against several orders. A judgment in the Apple tax case is expected in the next few months, while appeals by Fiat and Starbucks are due next month.

The court's ruling in the Apple case will not be the final word, however. Whoever wins, the case is likely to be appealed to the EU's highest court, the European Court of Justice. A decision there would not be handed down for several years.

Related Reads:

The EU's Antitrust Czar Just Got More Powerful

EU Tax Ruling on Amazon Profits Increases Tensions With US

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

A&O Shearman, Cleary Gottlieb Act on $700M Dunlop Tire Brand Sale to Japan's Sumitomo

Stewarts and DAC Beachcroft Lead on £2B Leicester City Helicopter Crash Litigation

Israel's Rushed Corporate Tax May Spark Law Firm Mergers, Boost Large Firms Including Gornitzky

4 minute readTrending Stories

- 1On the Move and After Hours: Meyner and Landis; Cooper Levenson; Ogletree Deakins; Saiber

- 2State Budget Proposal Includes More Money for Courts—for Now

- 3$5 Million Settlement Reached With Stone Academy

- 4$15K Family Vacation Turned 'Colossal Nightmare': Lawsuit Filed Against Vail Ski Resorts

- 5Prepare Your Entries! The California Legal Awards Have a New, February Deadline

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250