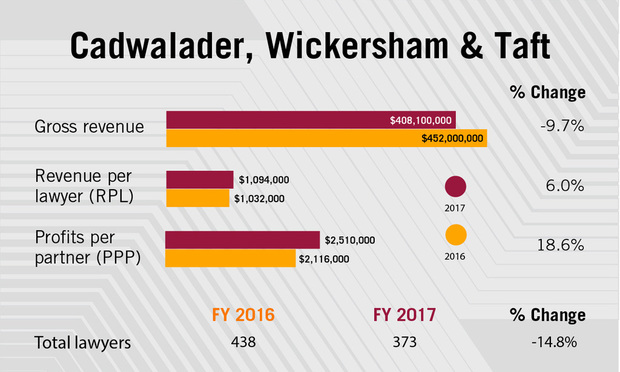

Cadwalader sees profits soar amid revenue and headcount decline; reaffirms London ambitions

PEP jumps nearly 20% to $2.5m against 10% revenue dip and 15% reduction in lawyer numbers

February 13, 2018 at 05:10 PM

6 minute read

The original version of this story was published on New York Law Journal

Photo: Diego M. Radzinschi/ALM

Photo: Diego M. Radzinschi/ALM

Cadwalader, Wickersham & Taft grew its equity partner profits nearly 19% last year, in what the firm called a "validation" of its refocused strategy on a core client base of Wall Street banks, funds and corporations.

Profits per partner shot up by 18.6% to $2.51m in 2017 as the equity partnership contracted by five partners to 40 partners, according to preliminary ALM reporting. Meanwhile, the firm's revenue dropped 9.7% to $408.1m, and overall lawyer head count dipped by about 15%, after the closure of three offices. Revenue per lawyer increased 6% to $1.09m.

The firm's success has attracted talented alumni back to the firm, said managing partner Patrick Quinn. In the last week, he said, M&A dealmaker Christopher Cox and real estate finance expert Alan Lawrence have rejoined the firm's equity partnership.

"Profits per partner being up 19% is some validation that we're doing the right things," Quinn said in an interview.

"Profits per partner being up 19% is some validation that we're doing the right things," Quinn said in an interview.

"It's gratifying to see that the firm's performance is reflecting the benefits of that more focused strategy," he said, adding: "This is not a strategy about managing to the bottom line. It's much more about making sure we're the best law firm we can be to service our natural clients."

Increased profitability is an "end product of good strategy", Quinn said. "We're just very, enthusiastic to continue the momentum."

Cadwalader adopted its new strategic plan in late 2016, focusing its services on its core client base of financial institutions, large companies and funds, and leading to office closings in Hong Kong, Beijing and Houston, as well as a series of partner exits.

Quinn has previously said the firm had sought years ago to diversify too broadly, entering areas that were "not the practices that best served our natural client base".

The firm's headcount, at 373 lawyers in 2017, is nearly half the size it was in 2006, when it counted about 721 lawyers, according to ALM data. Quinn said the firm's 15% lower headcount last year was "part of the strategy" and, "in refocusing the firm's resources, we became temporarily smaller, but the strategy is very much about growth and we do expect 2018 to be a year of healthy growth for us".

He added: "It's really about redeploying resources into practices that are better suited to who our firm is and who our clients are."

Still, Quinn won't give any future headcount goals. "Numbers drive you to do things that are not consistent with your strategy," he said.

Quinn cited the firm's smaller size as leading to its 10% revenue drop in 2017, its third year in a row of declining revenue. "We're a smaller firm now than we were last year," Quinn said, adding that the firm "outperformed our own projections by a pretty significant margin".

Familiar faces, partner moves

Quinn also pointed to the return of Cox and Lawrence as a marker of the firm's recent success.

Cox initially came to Cadwalader from Cahill Gordon & Reindel in 2012, becoming chairman of its corporate practice. In early 2016, he moved to New Jersey-based pharmaceutical product development company The Medicines Co. He remained a senior counsel at the firm until rejoining the partnership this month.

Lawrence practised at Cadwalader for 16 years until leaving in 2009 for Arnold & Porter. Lawrence, whose important client relationships include Freddie Mac, represents institutional lenders and funds in real estate financings and restructurings and investors in the acquisition, development, and operation of commercial properties.

In new hires last year, Cadwalader brought on litigators Kyle DeYoung, Todd Blanche and Ellen Holloman; as well as Kurt Oosterhouse in finance; Peter Morreale in capital markets; and David Teigman in executive compensation.

But Cadwalader saw more than a dozen partners leave in 2017, including Kenneth Wainstein, formerly co-chairman of the firm's litigation department and chairman of the white-collar group who left for Davis Polk & Wardwell. Other departures included Bruce Bloomingdale, who left for Dechert; Johnny Chiu, now at Perkins Coie; Gregory Mocek, now at Allen & Overy; Richard Nugent, now at Jones Day; and Adam Summers, who joined Fried, Frank, Harris, Shriver & Jacobson.

Quinn said the firm had anticipated some departures in 2017. "We understood when we embarked on this new strategy that there were going to be some people who may not see themselves as essential to that strategy," he said.

London ambitions

Just this year, Cadwalader saw a four-partner team going to Milbank, Tweed, Hadley & McCloy in London. "We're in a very, very active lateral market," Quinn said, but added: "We are extremely committed to London."

In London, where Quinn said the firm just expanded its office space, revenue increased in 2017 to $49.6m, about a 10% rise from 2016. Quinn said the firm's London office is now interested in hiring in litigation, restructuring, finance, corporate and regulatory.

"We're very bullish on growth for London," he said.

Speaking on practice area strengths in 2017, Quinn said the firm saw success across the board, including in corporate, capital markets, finance, real estate and litigation. In particular, Quinn said the firm's well-known structured products and securitisation practice "had an extremely strong year". The firm said it closed 189 CLO transactions in 2017, valued at more than $86bn. Cadwalader said it also dominated the field of firms that advised issuers and underwriters of commercial mortgage-backed securities offerings.

In its corporate department last year, Cadwalader represented Marcato Capital Management LP, a San Francisco-based investment manager, on multiple matters, including in a proxy contest with Buffalo Wild Wings and in connection with its investment in the company that makes Uggs boots. With Cox's ties to the company, Cadwalader represented The Medicines Co. in its agreement to sell its infectious disease business unit to Melinta Therapeutics Inc for $270m.

And starting in 2017, Quinn said, the firm began partnering with in-house lawyers from clients such as Goldman Sachs, JPMorgan Chase, Morgan Stanley and other banks in staffing work on pro bono matters. "It's about building a deeper and stronger relationship with the clients and that really seems to resonate with the clients, It's great for us too," Quinn said.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Jones Day, BCLP & Other Major Firms Boost European Teams with Key Partner Hires

4 minute read

$13.8 Billion Magomedov Claim Thrown Out by UK High Court

Trending Stories

- 1'A Death Sentence for TikTok'?: Litigators and Experts Weigh Impact of Potential Ban on Creators and Data Privacy

- 2Bribery Case Against Former Lt. Gov. Brian Benjamin Is Dropped

- 3‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

- 4State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

- 5Invoking Trump, AG Bonta Reminds Lawyers of Duties to Noncitizens in Plea Dealing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250