Getting Technology Integration During M&A Done Right

Three steps to ensuring operational efficiencies, customer benefits and enterprise value are achieved on time and in budget.

November 14, 2017 at 08:00 AM

12 minute read

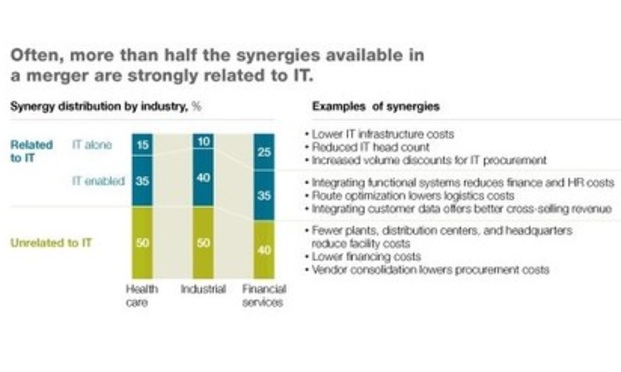

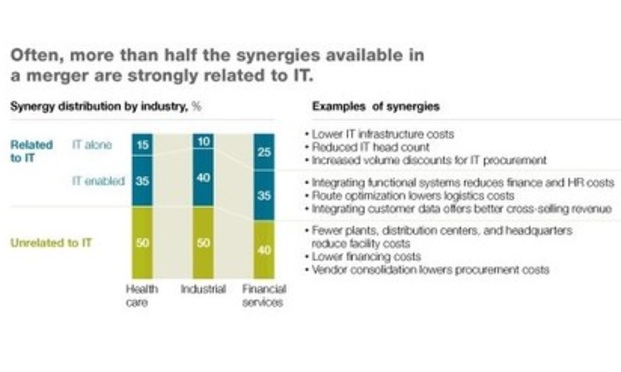

Even with a dip in M&A activity from a robust 2016, there have been over 8,700 M&A deals through September 2017, with an average transaction value of more than $1.2B dollars. According to McKinsey, more than half the financial synergies expected from this type of M&A activity are strongly related to IT integration.

With such a high impact on outcomes, it is critical to get the assumptions, planning and actual integration of combined systems right, right from the beginning. And, getting it right isn't a given: An estimated 70 percent of all M&A activity for tech-enabled companies involved buyers from outside the tech sector.

Three considerations can have an impact in ensuring operational efficiencies, customer benefits and enterprise value are achieved on time and in budget.

1. A Culture of Transparency

There is an innate fear of the unknown that builds exponentially during acquisition processes and integration planning. Top talent flight risk is real and expands with lack of planning, poor execution and a less than transparent process. At the risk of stereotyping, techies like organization—even if that means organized chaos during a post-acquisition process. And they like lots of information and context setting. They want to know the “why” in order to get to the best outcomes.

It is therefore important to understand the company culture and communication styles of each organization, preferably during the due diligence process. Also, identifying early on the official and unofficial leaders and influencers within both organizations makes it more likely the broader team will hit the ground running when they can actually share information.

We know that the foundation of a successful integration is most closely tied with the integration of the teams versus the integration of the systems. Trust, open lines of communication and a comfort level to exchange ideas, recommend approaches and challenge decisions during the integration when things may be behind or going off the rails have all led to better outcomes.

2. A Technology Inventory

Synergy is most commonly associated with increased efficiency and cost savings. For example, if both companies have individual contracts with the same vendor, then combining the two can usually result in a decrease in per user costs, as well as a potential decrease in technology support overhead. Finding synergies during integration is critical, especially given the financial expectations of the board and other stakeholders.

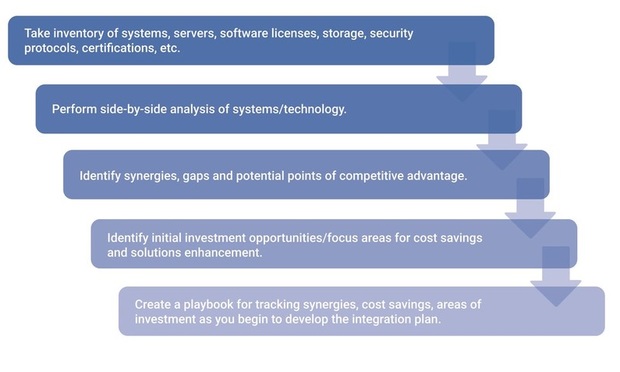

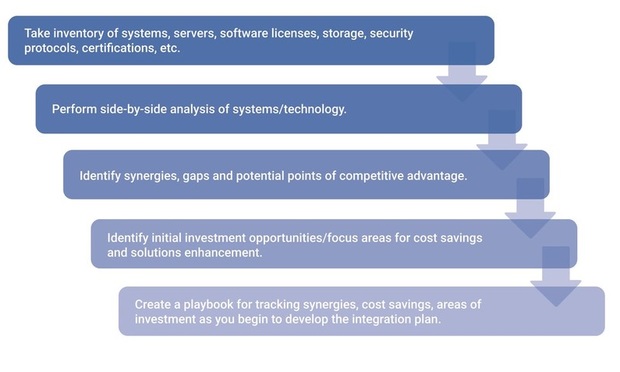

It is therefore vital to have a complete and accurate inventory of all technologies and systems throughout the organizations during, and after, the due diligence process. It is amazing how many “technology” assets are unknown, even by the IT team, including software purchases made by individual team members throughout the organization. Creating a culture of accountability and responsibility is important from the start.

Often overlooked during synergy planning, however, is the identification of unique systems and tools not shared by the combining organizations. Focusing on points of differentiation vs. points of similarity can drive multiples of enterprise value. For example, acquired companies may be “too close” to their development and IT investment outcomes. Experience has shown integration processes have been able to identify unique development, technologies and workflows that had not yet, but should have been patented. Adding to the intellectual property of the larger organization is a high-impact outcome. Also leveraging a larger and more scalable infrastructure can propel unique and undervalued technology into new and highly successful competitive advantages.

3. A Timeline for Success

An integration plan is often driven by an M&A playbook. Organized chaos is good, and using best practices is important. But the playbook must include processes and tools to get people talking, information shared and ideas flowing.

The first step is to establish the integration team. Each company should have equal representation to establish and align on a 30-60-90 day plan. Representation should be broader than the top of the organizational charts; unofficial leaders and influencers should be welcomed and encouraged to participate. Once a decision is made in a meeting, it will take managers and moral suasion to actually get things done. Integration must be an organic exercise and not just imposed from the top.

First meetings of the integration team are most successful when they are in person and free-flowing whiteboarding conversations; this is the start of building a common technology vocabulary and culture. Most importantly, the first 30 days should be 100 percent observation and evaluation to understand how each company operates, including team structures, processes, workflows, reporting metrics and documentation. Decisions made before this step typically result in expensive and time-consuming “do-overs.”

After the first 30 days, the IT team should have a good understanding of the systems, gaps, synergies and investments needed to establish concrete technology integration action plans. The plans should be available and tracked as transparently as possible, using shared system software tools such as Basecamp. It is important to assign owners to tasks and set specific dates for completion to measure progress and success—and highlight red flags.

Once the integration building blocks are identified and underway, the team can then start focusing on potential high-impact action items such as more powerful processes and workflows, better ways to measure performance, advanced automation of basic task, collaborative tools and centralized systems. These should also be worked into the action plans – and tracked appropriately.

After the 60-day mark, all integration action items should be established. The next 30 days are all about execution.

Integration planning and execution do not stop at the 90-day mark. All companies, regardless of sector, are technology dependent. New products enter the market almost daily claiming to increase efficiency, save money and grow revenue. Successful companies continue to challenge their technology teams to identify new synergies, gaps and opportunities regardless of whether or not they are in an M&A process.

Rick Hutchinson is the chief technology officer of Advanced Discovery, a global eDiscovery and risk management company.

Even with a dip in M&A activity from a robust 2016, there have been over 8,700 M&A deals through September 2017, with an average transaction value of more than $1.2B dollars. According to McKinsey, more than half the financial synergies expected from this type of M&A activity are strongly related to IT integration.

With such a high impact on outcomes, it is critical to get the assumptions, planning and actual integration of combined systems right, right from the beginning. And, getting it right isn't a given: An estimated 70 percent of all M&A activity for tech-enabled companies involved buyers from outside the tech sector.

Three considerations can have an impact in ensuring operational efficiencies, customer benefits and enterprise value are achieved on time and in budget.

1. A Culture of Transparency

There is an innate fear of the unknown that builds exponentially during acquisition processes and integration planning. Top talent flight risk is real and expands with lack of planning, poor execution and a less than transparent process. At the risk of stereotyping, techies like organization—even if that means organized chaos during a post-acquisition process. And they like lots of information and context setting. They want to know the “why” in order to get to the best outcomes.

It is therefore important to understand the company culture and communication styles of each organization, preferably during the due diligence process. Also, identifying early on the official and unofficial leaders and influencers within both organizations makes it more likely the broader team will hit the ground running when they can actually share information.

We know that the foundation of a successful integration is most closely tied with the integration of the teams versus the integration of the systems. Trust, open lines of communication and a comfort level to exchange ideas, recommend approaches and challenge decisions during the integration when things may be behind or going off the rails have all led to better outcomes.

2. A Technology Inventory

Synergy is most commonly associated with increased efficiency and cost savings. For example, if both companies have individual contracts with the same vendor, then combining the two can usually result in a decrease in per user costs, as well as a potential decrease in technology support overhead. Finding synergies during integration is critical, especially given the financial expectations of the board and other stakeholders.

It is therefore vital to have a complete and accurate inventory of all technologies and systems throughout the organizations during, and after, the due diligence process. It is amazing how many “technology” assets are unknown, even by the IT team, including software purchases made by individual team members throughout the organization. Creating a culture of accountability and responsibility is important from the start.

Often overlooked during synergy planning, however, is the identification of unique systems and tools not shared by the combining organizations. Focusing on points of differentiation vs. points of similarity can drive multiples of enterprise value. For example, acquired companies may be “too close” to their development and IT investment outcomes. Experience has shown integration processes have been able to identify unique development, technologies and workflows that had not yet, but should have been patented. Adding to the intellectual property of the larger organization is a high-impact outcome. Also leveraging a larger and more scalable infrastructure can propel unique and undervalued technology into new and highly successful competitive advantages.

3. A Timeline for Success

An integration plan is often driven by an M&A playbook. Organized chaos is good, and using best practices is important. But the playbook must include processes and tools to get people talking, information shared and ideas flowing.

The first step is to establish the integration team. Each company should have equal representation to establish and align on a 30-60-90 day plan. Representation should be broader than the top of the organizational charts; unofficial leaders and influencers should be welcomed and encouraged to participate. Once a decision is made in a meeting, it will take managers and moral suasion to actually get things done. Integration must be an organic exercise and not just imposed from the top.

First meetings of the integration team are most successful when they are in person and free-flowing whiteboarding conversations; this is the start of building a common technology vocabulary and culture. Most importantly, the first 30 days should be 100 percent observation and evaluation to understand how each company operates, including team structures, processes, workflows, reporting metrics and documentation. Decisions made before this step typically result in expensive and time-consuming “do-overs.”

After the first 30 days, the IT team should have a good understanding of the systems, gaps, synergies and investments needed to establish concrete technology integration action plans. The plans should be available and tracked as transparently as possible, using shared system software tools such as Basecamp. It is important to assign owners to tasks and set specific dates for completion to measure progress and success—and highlight red flags.

Once the integration building blocks are identified and underway, the team can then start focusing on potential high-impact action items such as more powerful processes and workflows, better ways to measure performance, advanced automation of basic task, collaborative tools and centralized systems. These should also be worked into the action plans – and tracked appropriately.

After the 60-day mark, all integration action items should be established. The next 30 days are all about execution.

Integration planning and execution do not stop at the 90-day mark. All companies, regardless of sector, are technology dependent. New products enter the market almost daily claiming to increase efficiency, save money and grow revenue. Successful companies continue to challenge their technology teams to identify new synergies, gaps and opportunities regardless of whether or not they are in an M&A process.

Rick Hutchinson is the chief technology officer of Advanced Discovery, a global eDiscovery and risk management company.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View AllTrending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250