Litigator of the Week: A Slap on the Wrist? More like the Tap of a Feather

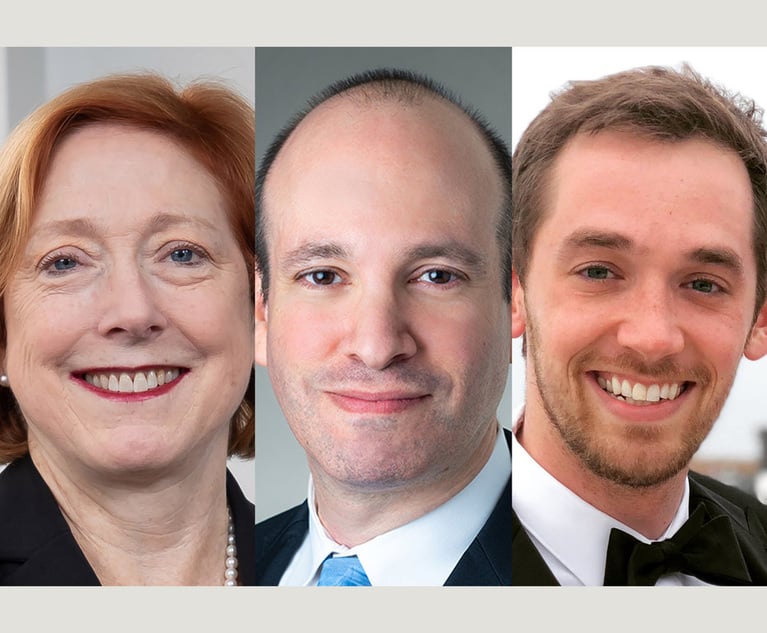

It was an offer his client couldn't refuse.That's how Fried, Frank, Harris, Shriver & Jacobson partner Steven Witzel described the deal offered by the U.S. Securities and Exchange Commission to William Tirrell, a former top executive at Bank of America and its wholly owned broker-dealer Merrill Lynch.

September 09, 2017 at 12:22 AM

22 minute read

It was an offer his client couldn't refuse.

That's how Fried, Frank, Harris, Shriver & Jacobson partner Steven Witzel described the deal offered by the U.S. Securities and Exchange Commission to William Tirrell, a former top executive at Bank of America and its wholly owned broker-dealer Merrill Lynch.

The government accused Tirrell of being directly involved in a massive securities fraud. The bank itself had previously agreed to a $415 million settlement—the second largest penalty in SEC history—for allegedly misusing customers' funds to help it get around a requirement to keep substantial cash on the sideline in the event that it became insolvent.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

MoFo Associate Sees a Familiar Face During Her First Appellate Argument: Justice Breyer

Amid the Tragedy of the L.A. Fires, a Lesson on the Value of Good Neighbors

Litigators of the Week: Shortly After Name Partner Kathleen Sullivan’s Retirement, Quinn Emanuel Scores Appellate Win for Vimeo

Trending Stories

- 1The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 2Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 3As Litigation Finance Industry Matures, Links With Insurance Tighten

- 4The Gold Standard: Remembering Judge Jeffrey Alker Meyer

- 5NJ Supreme Court Clarifies Affidavit of Merit Requirement for Doctor With Dual Specialties

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250