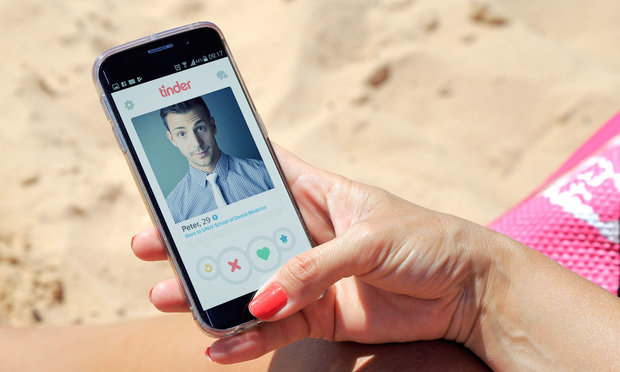

Daily Dicta: Tinder Founders Swipe Right on Gibson Dunn's Orin Snyder in $2B Suit

In a New York State Supreme Court lawsuit, Tinder co-founders and key employees allege that the parent companies manipulated financial information to undercut the value of their stock options.

August 15, 2018 at 11:22 AM

9 minute read

If there's one thing you'd expect from the minds behind Tinder it's this: They know how to pick themselves a lawyer.

If there's one thing you'd expect from the minds behind Tinder it's this: They know how to pick themselves a lawyer.

In their new $2 billion lawsuit against the dating app's parent companies, Tinder's three co-founders plus seven current and former executives swiped right on Gibson, Dunn & Crutcher star litigator Orin Snyder.

In some ways, matching with a lawyer isn't so different than finding a love interest. Is he available? Smart? Does he get me? How have his past relationships worked out? Does he like pina coladas?

Snyder certainly seems to check all the boxes. The Verge once called him “the deadliest trial lawyer in tech,” and he's represented clients including Apple in the e-books trial and Facebook in the ongoing Cambridge Analytica data scandal.

Co-chair of Gibson Dunn's media, entertainment and technology practice, Snyder doesn't just represent companies. According to his law firm bio, his individual clients include Anderson Cooper, Bob Dylan, LeBron James, Lady Gaga, David Letterman, the Rolling Stones and Bruce Springsteen. (This list alone would make me want to hire him.)

Co-chair of Gibson Dunn's media, entertainment and technology practice, Snyder doesn't just represent companies. According to his law firm bio, his individual clients include Anderson Cooper, Bob Dylan, LeBron James, Lady Gaga, David Letterman, the Rolling Stones and Bruce Springsteen. (This list alone would make me want to hire him.)

On behalf of the Tinder execs, Snyder is now taking on Barry Diller's IAC/ InterActiveCorp and its subsidiary, Match Group Inc.

In an email, Snyder said he was hired after he was introduced to Tinder co-founder Sean Rad “by mutual friends in the technology industry.” Rad was CEO, president and chairman of Tinder from February 2012 to September 2017.

On Tuesday, Snyder plus Gibson Dunn partner Matthew Benjamin and associates Laura Raposo, Connor Sullivan and Christine Demana filed a 55-page complaint in New York State Supreme Court, alleging that Tinder's parent companies manipulated financial information to undermine Tinder's valuation. As a result, the Tinder plaintiffs say they were shortchanged on stock options.

It's a complaint that appears to be written for mass consumption, with sentences like “Founders and early employees of startup companies often receive equity in the companies they create, giving them an incentive to build the company's success long into the future,” which is probably not something a judge needs to have explained.

Indeed, the suit (accompanied by a snappy press release about “deception, bullying, and outright lies”) got massive media coverage on Tuesday—featured everywhere from Fox News to The New York Times.

Adding fuel to the fire, the complaint also includes allegations that Match Group's chairman and CEO Greg Blatt groped and sexually harassed Tinder's VP of marketing and communications during and after Tinder's December 2016 holiday party in Los Angeles.

But the crux of the complaint concerns the value of the company. Because Tinder is privately held, the plaintiffs' stock options were scheduled to be independently valued at four specific dates in 2017, 2018, 2020 and 2021.

“[I]f defendants could undermine Tinder's valuation at their first opportunity in 2017 and then eliminate the future Scheduled Puts…they could save themselves billions of dollars,” Snyder wrote. “Because the Scheduled Puts occurred in private—beyond the view of public investors and regulators—defendants could lie about Tinder's financial projections and undermine the value of Tinder without hurting their stock prices or the public perception of Tinder's value.”

According to the Tinder execs, the defendants arrived at a $3 billion valuation “based on their bogus numbers. … They created false financial projections, inflating Tinder's expenses and inventing an alternate universe in which Tinder was stagnating toward freefall.”

The complaint is especially harsh in discussing Blatt (“a longtime lackey” and “notorious bully with a volcanic temper”), who was installed as Tinder's interim CEO during the valuation process. The plaintiffs allege that Blatt's sexual misconduct was “whitewashed” to keep him in place during the valuation and Tinder's subsequent merger into Match—only to announce his retirement two weeks after it was done.

The plaintiffs' Tinder options were then converted in Match options, and the future scheduled valuations were eliminated.

IAC and Match in a statement said they've already paid out more than a billion dollars in equity compensation to Tinder's founders and employees.

“With respect to the matters alleged in the complaint, the facts are simple: Match Group and the plaintiffs went through a rigorous, contractually-defined valuation process involving two independent global investment banks, and Mr. Rad and his merry band of plaintiffs did not like the outcome,” the statement said.

“Mr. Rad (who was dismissed from the company a year ago) and Mr. Mateen (who has not been with the company in years) may not like the fact that Tinder has experienced enormous success following their respective departures, but sour grapes alone do not a lawsuit make.”

Class Cert Granted—Again—in Goldman Sachs Securities Suit

A federal judge in the Southern District of New York on Tuesday granted class certification in a securities lawsuit against Goldman Sachs, a victory for plaintiffs lawyers from Robbins Geller Rudman & Dowd.

The complaint alleges Goldman Sachs failed to disclose conflicts of interest in connection with certain collateralized debt obligations transactions, including the infamous Abacus transaction that resulted in Goldman paying a $550 million fine to the SEC.

U.S. District Judge Paul Crotty originally certified the class of investors in 2015. But on an interlocutory appeal, the U.S. Court of Appeals for the Second Circuit reversed and remanded the decision, ruling that he may have imposed too high a burden on Goldman.

On remand, Crotty on Tuesday wrote, “The question for the court then is rather simple and straight forward: Have defendants demonstrated, by a preponderance of the evidence, that the alleged misstatements had no price impact?” His conclusion” “Defendants have not rebutted the Basic presumption by a preponderance of evidence.”

Robbins Geller partner Spencer Burkholz said, “The plaintiffs appreciate the time and consideration given by the court to this decision, and look forward to heading towards trial on behalf of all investors.”

The plaintiffs are also represented by Labaton Sucharow.

Goldman Sachs is represented by Sullivan & Cromwell lawyers including Robert Giuffra Jr.

Dow Chemical Wins $1B in Canadian Contract Fight

I don't usually cover litigation outside the United States, but a recent win by Canada's Bennett Jones is too big to ignore.

A team led partner Blair Yorke-Slader won more than $1.06 billion for Dow Chemical in a breach of contract claim against Nova Chemicals, the co-owner and operator of Dow and Nova's ethylene manufacturing plant in Alberta, Canada.

Yorke-Slader, who is vice-chair of the 400-lawyer firm, said in an email that since 2001, Nova “had been running the plant only hard enough to meet its own needs, and had been taking part of Dow's share of product for itself besides.”

Ethylene is an essential element in many plastic and petrochemical products.

After a seven-month trial, trial judge Barbara Romaine earlier this summer issued a 334-page ruling. She found Nova had concocted a scheme “to deceive and mislead Dow…to satisfy its own requirements and a strategic plan to control a competitor.”

The billion-dollar damage award only covers 2001 until the end of 2012. Another $300 to $400 million is likely to be tacked on for 2013-2018, the plaintiffs said.

The judge also dismissed Nova's counterclaims against Dow.

In addition to Bennett Jones, Dow was represented by Burnett Duckworth Palmer and Blake Cassels & Graydon.

Nova, which is appealing the decision, was represented by Miller Thomson; Osler, Hoskin & Harcourt and Norton Rose Canada.

What I'm Reading

Manafort Prosecutors Used the Few Tools Available to Confront Tough Judges

In their dialogue with Judge Ellis, the special counsel prosecutors have picked their battles but defended themselves when they felt it was necessary.

Murder of Mayer Brown Partner Shocks Colleagues, Appellate Bar

The 72-year-old founder of Mayer Brown's U.S. Supreme Court practice was shot on Monday in his suburban Chicago home and died of his wounds.

Weinstein Sex Trafficking Charges Survive Motion to Dismiss

The judge acknowledged that while the allegations against Weinstein weren't the “archetypal sex trafficking action,” they were nonetheless plausibly established.

Former Houston Judge Disciplined for Jailing Mentally Ill Rape Victim Before Trial

The judge ordered the victim jailed in order to secure her testimony at trial—a move which led to the woman being attacked by an inmate while in custody.

Will the Church Sex-Abuse Grand Jury Report Lead to New Civil Suits?

The new grand jury report reveals that thousands of children were sexually assaulted at Catholic dioceses across Pennsylvania by more than 300 predatory priests for decades.

From 'Honest Man' to 'Scared Stiff': All of Trump's Tweets Dishing on Jeff Sessions

Sessions, meanwhile, has nothing but praise for his boss.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Litigators of the (Past) Week: Tackling a $4.7 Billion Verdict Post-Trial for the NFL in 'Sunday Ticket' Antitrust Litigation

Take-Two's Pete Welch on 'Getting the Best Results While Getting in the Way the Least'

Litigators of the Week: Kirkland Beats Videogame Copyright Claim From Lebron James' Tattoo Artist

Trending Stories

- 1Lawyers' Reenactment Footage Leads to $1.5M Settlement

- 2People in the News—Feb. 4, 2025—McGuireWoods, Barley Snyder

- 3Eighth Circuit Determines No Standing for Website User Concerned With Privacy Who Challenged Session-Replay Technology

- 4Superior Court Re-examines Death of a Party Pending a Divorce Action

- 5Chicago Law Requiring Women, Minority Ownership Stake in Casinos Is Unconstitutional, New Suit Claims

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250