Daily Dicta: Daughter of Deceased North Face Founder Loses Appeal Seeking Inheritance

"We are hard-pressed to imagine a reason that as a matter of public policy, Chile would be concerned about Summer's inheritance or lack thereof."

October 01, 2018 at 03:44 PM

9 minute read

With a tart rebuke from a California court of appeals, San Francisco socialite Summer Tompkins Walker came up empty-handed again in her bid to inherit money from her billionaire father, who co-founded The North Face and Esprit.

With a tart rebuke from a California court of appeals, San Francisco socialite Summer Tompkins Walker came up empty-handed again in her bid to inherit money from her billionaire father, who co-founded The North Face and Esprit.

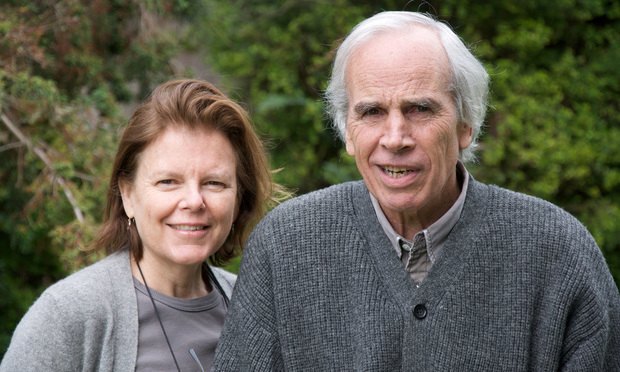

Douglas Tompkins (pictured above with his wife Kristine) died in a kayaking accident in Chile in December 2015, but left no money to his two adult daughters. According to his lawyers, he didn't believe in inherited wealth, and wanted his fortune to fund conservation efforts in South America, where he gifted vast swaths of land to create five national parks in Chile and Argentina.

Although Summer in remarks to the San Francisco Chronicle called her late father “a completely self-absorbed human being, a narcissist,” she still wants his money.

Represented by White & Case, she filed a “forced heirship” suit in Los Angeles Superior Court in 2016 (her sister did not join in the case). She argues Chilean law should apply to her father's estate because he left California in 1994 and never intended to return, adopting Puerto Varas, Chile as his new home. And Chilean law has a forced heirship provision that requires people to dispose of their estates in specific percentages to specific family members.

She struck out last year when Judge Lesley Green in Los Angeles granted summary judgment in favor of Tompkins' widow and trustee, Kristine McDivitt Tompkins, and co-trustee, Debra Ryker, represented jointly by Sheppard, Mullin, Richter & Hampton.

She struck out last year when Judge Lesley Green in Los Angeles granted summary judgment in favor of Tompkins' widow and trustee, Kristine McDivitt Tompkins, and co-trustee, Debra Ryker, represented jointly by Sheppard, Mullin, Richter & Hampton.

On appeal, California's Second Appellate Division was equally unmoved.

In a decision issued on Friday, the panel noted that the trust contained a clear choice-of-law provision selecting California law—and in California, you don't have to leave your kids a nickel if you don't want to. (By the way, it's not as if Summer will live in a cardboard box without the inheritance. The Sheppard Mullin team in court papers said she is independently wealthy from her mother Susie Tompkins Buell's share of Esprit, plus she “married into an enormously wealthy San Francisco family.”)

Summer argued that California's public policy favors comity—a discretionary doctrine that permits a California court to apply the law of a foreign jurisdiction under limited circumstances—and therefore Chilean law should apply.

Or not.

“Tompkins intended California law to apply here and … California law recognizes his right to so choose,” wrote panel members Luis Lavin, Anne Egerton and Halim Dhanidina. “Under Summer's rewritten version of the statute … if a trustor selects California law—the law of the forum—our courts would effectively disregard both the choice-of-law provision in the trust and the general rule that California courts apply California law, and instead conduct a searching factual inquiry in an effort to determine what state's (or in this case, country's) law should be applied.”

As for the notion of comity, the panel wasn't too concerned about offending Chilean diplomats or law enforcement officials by declining to enforce their laws.

“[W]e are hard-pressed to imagine a reason that as a matter of public policy, Chile would be concerned about Summer's inheritance or lack thereof as she is neither a citizen nor a resident of Chile and the record on appeal contains no evidence that she has any connection with Chile.”

If anything, she could theoretically claw back the wilderness preserves to claim her share of her father's estate—not exactly a compelling motive for the Chilean government to take her side.

“This was an extraordinary victory for the planet and a triumph over pure greed,” said Sheppard Mullin's Adam Streisand, who represents the trust. “We saved millions of acres Doug donated to expand Patagonia and national parks and wildlife preserves. At the same time, by elucidating some of the more complex provisions of California's probate code, we have created an open runway for choosing our laws of freedom of testation over forced heirship regimes.”

That Was Quick

Elon Musk reached a speedy settlement with the U.S. Securities and Exchange Commission, which on Saturday announced a deal to end its potentially ruinous securities fraud suit against the Tesla founder.

According to court papers, Musk turned to Williams & Connolly's Steven Farina to lead his defense.

Farina co-chairs the firm's accounting malpractice and securities litigation and enforcement practice groups. His other clients have included Richard Grasso in his successful fight with the New York Attorney General over his compensation from the New York Stock Exchange.

Tesla was represented by Bradley Bondi of Cahill Gordon & Reindel. Bondi formerly served as counsel to SEC Commissioner Paul Atkins, and then to Commissioner Troy Paredes. He was also a member of the Trump administration's transition team, advising on financial services matters.

The SEC settlement calls for Musk to step down as chairman for at least three years and to pay a $20 million fine. However, he will remain Tesla's CEO.

Tesla will also pay $20 million, will appoint two new independent directors to its board and “establish a new committee of independent directors and put in place additional controls and procedures to oversee Musk's communications.”

The deal is subject to approval by U.S. District Judge Alison J. Nathan in the Southern District of New York.

When Less is More, Appellate Edition

All you appellate lawyers out there sweating and slaving over briefs—you could always try this.

Here's the sum total of the filing to the Supreme Court of Texas by the lawyer for “digital vigilante” James McGibney, who owns the website BullyVille.com.

“By this waiver letter, the respondent respectfully waives the filing of a response to the petition for review. We feel that Chief Justice Sudderth has already covered every issue in this case so comprehensively and soundly that we do not even feel the need to read the petition filed today,” wrote Evan Stone of Stone & Vaughan in Denton, Texas.

That was it.

Guess what else?

It worked.

On Friday, the state Supreme Court sided with McGibney, denying a petition for review and letting stand the decision by the Texas Court of Appeals for the Second District.

I wrote about the case in April. McGibney's site, BullyVille, focuses on exposing revenge pornographers, pedophiles and other online bullies.

In 2014, he filed suit in Texas state court, going after defendants that he said made threats and hateful comments such as “I would like to bury a hatchet right in [McGibney's] f_cking damn face,” and “It will be really funny seeing someone post pics of your wife Christina when she is shopping at Smith's with ur two kids.”

He soon withdrew the case, but one defendant (who counters that McGibney himself is a revenge pornographer) hit him with an anti-SLAPP suit.

The trial court judge was fully sympathetic. Without holding a hearing, he socked McGibney with a $1 million penalty plus $300,000 in attorneys' fees. He subsequently lowered the penalty to $150,000, but kept the legal fees intact.

He also ruled that McGibney had to give the man who filed the anti-SLAPP suit six domain names and publish for 365 consecutive days a “written apology on the first page of all websites” for making the allegations.

The appeals court in a decision that's now final nixed most of that, ruling that the trial court judge abused his discretion in imposing non-monetary sanctions. The panel also held that the $150,000 penalty was excessive, and that the award for attorneys' fees was not reasonable.

What I'm Reading

From 'She Was Authentic' to 'He Is Innocent,' Kavanaugh Hearings Divide Attorneys

How seasoned litigators reacted to the hearings.

Congressional Democrats' Emoluments Suit Against Trump Clears Standing Hurdle

The 201 Democratic members of Congress argue that Trump, who continues to hold interests in and profit from his vast business empire, has accepted foreign emoluments but failed to get the necessary congressional consent before accepting such gifts.

Apple, Wilmer Knock Out $506 Million Patent Judgment

A huge win for Wilmer's Bill Lee over Irell & Manella partner Morgan Chu.

Wachtell Defeats Malpractice Claims, but Icahn's CVR Vows Appeal

A New York federal judge on Friday dismissed a long-running legal malpractice suit brought by Carl Icahn-controlled CVR Energy against Wachtell, Lipton, Rosen & Katz.

Read the Complaint: Facebook Sued Over Newly Disclosed Breach

That was fast—lawyers at Morgan & Morgan and Clayeo C. Arnold filed suit the same day the breach was announced.

Attempt to Recover Attorney Fees for Loss of Dogs Rebuffed by Appeals Court

Because dogs are not livestock.

In case you missed it

Litigator of the Week: Sending a Message to 'The Most Hated Company in Tech'

“When someone is seeking hundreds of millions of dollars from you for worthless intellectual property—you do not settle,” said Paul Hastings partner Yar Chaikovsky.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

2024 Marked Growth On Top of Growth for Law Firm Litigation Practices. Is a Cooldown in the Offing for 2025?

Big Company Insiders See Technology-Related Disputes Teed Up for 2025

Litigation Leaders: Jason Leckerman of Ballard Spahr on Growing the Department by a Third Via Merger with Lane Powell

Trending Stories

- 1Lawyers: Meet Your New Partner

- 2What Will It Mean in California if New Federal Anti-SLAPP Legislation Passes?

- 3Longtime AOC Director Glenn Grant to Step Down, Assignment Judge to Take Over

- 4Elon Musk’s Tesla Pay Case Stokes Chatter Between Lawyers and Clients

- 5Courts Demonstrate Growing Willingness to Sanction Courtroom Misuse of AI

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250