Georgia Judge OKs Equifax Lawsuits Over Massive Data Breach

U.S. District Chief Judge Thomas Thrash Jr.'s ruling called the 2017 data breach "unprecedented."

January 28, 2019 at 03:54 PM

5 minute read

The original version of this story was published on Daily Report

Equifax headquarters, Atlanta (Photo: John Disney/ALM)

Equifax headquarters, Atlanta (Photo: John Disney/ALM)

A string of consolidated lawsuits against Atlanta-based Equifax stemming from a 2017 data breach that affected more than 146 million consumers may go forward, the chief judge of the U.S. District Court for the Northern District of Georgia ruled Monday.

Calling the data breach that affected nearly half the U.S. population “unprecedented,” Chief Judge Thomas Thrash Jr. largely rejected arguments by Equifax lawyers that he dismiss pending lawsuits filed on behalf of consumers whose personal and financial information was exposed, and financial institutions that issued debit or credit cards to affected customers and were then faced with helping customers clean up the resulting mess.

Thrash dismissed from the litigation any financial institutions that didn't issue credit or debit cards to affected consumers. But financial card issuers remain plaintiffs because they contend they incurred concrete costs associated with investigating and refunding fraudulent charges, canceling and reissuing potentially compromised cards, and heightened customer fraud monitoring, the judge ruled.

Although Equifax lawyers have argued there are no allegations pending that the financial institutions continue to be harmed by the 2017 data breach, Thrash noted that counsel for the banks contend “that Equifax's cybersecurity systems remain inadequate, and another breach is imminent.”

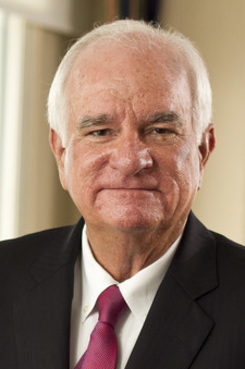

Chief Judge Thomas Thrash Jr. (Photo: John Disney/ALM)

Chief Judge Thomas Thrash Jr. (Photo: John Disney/ALM)Thrash also dismissed separate suits filed by 10 small businesses that were not folded into the consumers' multidistrict litigation. Attorneys representing the businesses didn't contend that confidential business information was compromised. Instead, they advanced “a new legal theory that has never been advanced—much less accepted—in data breach litigation,” Thrash said. “The business plaintiffs assert claims based on the theft of their owners' personally identifying information,” contending the businesses could be harmed because “they rely on the creditworthiness of their owners to obtain business credit.”

King & Spalding partners David Balser and Phyllis Sumner, who are leading a team of lawyers defending Equifax couldn't be reached for comment.

The consumer plaintiffs' lead counsel—Ken Canfield of Atlanta's Doffermyre Shields Canfield & Knowles; Norman Siegel of Kansas City's Stueve Siegel and Amy Keller of Chicago's DiCello Levitt—also couldn't be reached.

The breach, which extended over nearly three months in 2017, “was also severe in terms of the type of information that the hackers were able to obtain,” Thrash wrote. “The hackers stole at least 146.6 million names, 146.6 million dates of birth, 145.5 million Social Security numbers, 99 million addresses, 17.6 million driver's license numbers, 209,000 credit card numbers, and 97,500 tax identification numbers.”

In an 80-page order addressing claims by 96 people on behalf of a proposed class of all consumers whose data was exposed, Thrash concluded that, based on facts alleged in the complaints, “Equifax owed the plaintiffs a duty of care to safeguard the personal information in its custody.” That duty “arises from the allegations that the defendants knew of a foreseeable risk to its data security systems but failed to implement reasonable security measures.”

Chief among arguments offered by Equifax counsel at King & Spalding in Atlanta was Equifax's contention that the exposure of consumers' personal identifying information is not an injury. Equifax also contended that either no harm had resulted from the data breach, or that it was only “speculative future harm.”

Thrash disagreed. “The plaintiffs here have alleged that they have been harmed by having to take measures to combat the risk of identity theft, by identity theft that has already occurred to some members of the class, by expending time and effort to monitor their credit and identity, and that they all face a serious and imminent risk of fraud and identity theft due to the data breach,” Thrash said.

Thrash also was unimpressed by defense arguments that the plaintiffs could not demonstrate that allegations of identity theft or credit or debit card fraud could be traced back to Equifax, which was one of more than 1,500 data breaches the company's attorneys said occurred in 2017 alone.

“The plaintiffs plausibly allege that Equifax had custody of their personally identifiable information, that Equifax's systems were hacked, that these hackers obtained this personal information, and that as a result of this breach, they have become the victims of identity theft and other fraudulent activity,” the judge determined.

Thrash was equally unmoved by Equifax arguments that the credit bureau should not be held responsible for “unforseeable criminal acts of third parties.”

The judge said the question of whether a criminal attack is foreseeable is a jury question. But, he added, “It may not be in this case because of the many public statements by Equifax that it knew how valuable its information was to cyber criminals and its susceptibility to hacking attempts.”

“Equifax itself even experienced prior data breaches,” the judge said. “Furthermore, Equifax ignored warnings from cybersecurity experts that its data systems were dangerously deficient and that there was a substantial risk of an imminent breach.These allegations are sufficient to establish that the acts of the third party cyber-hackers were reasonably foreseeable.”

Read more:

Lawyers in Equifax Data Breach Case Want Material Surrendered to Congress

Massive Equifax Data Breach Was Preventable: Congressional Report

A Bevy of Cybersecurity Pitfalls Marred Equifax's Handling of Insider Threat

Consumer Lawyers Take Aim at Equifax Motion to Dismiss Data Breach Cases

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

An Eye on ‘De-Risking’: Chewing on Hot Topics in Litigation Funding With Jeffery Lula of GLS Capital

Litigators of the Week: The Eighth Circuit Knocks Out a $564M Verdict Against BMO in Ponzi Case

Litigators of the Week: Second Circuit Tells Argentina to Turn Over More Than $300M to Bondholders

How One of the World's Largest Institutional Investors Approaches Litigation

Trending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250