Daily Dicta: ‘Work it Out’ Judge Tells SEC and VW

“I'm not going to invite any comment. I don't even want to hear any comment,” U.S. District Judge Charles Breyer said.

August 19, 2019 at 06:42 PM

5 minute read

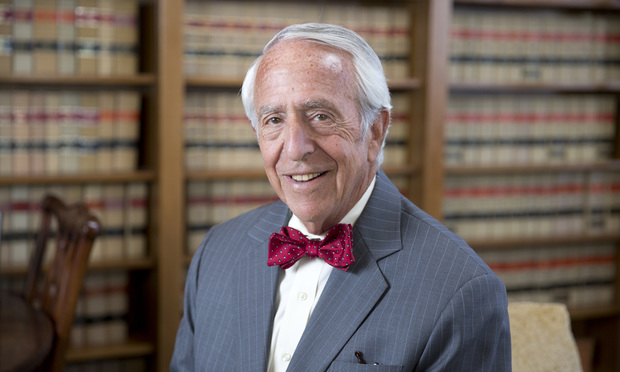

U.S. District Judge Charles Breyer, Northern District of California

U.S. District Judge Charles Breyer, Northern District of California

Enough already.

That was the message from U.S. District Judge Charles Breyer on Friday during a status conference for the U.S. Securities & Exchange Commission’s suit against Volkswagen in connection with the diesel emissions cheating scandal.

The San Francisco-based judge took it upon himself to stay all discovery and directed to the parties “to sit down and see if you can work it out because whatever you work out today will be less expensive to everybody than what you would work out in the future.”

Breyer declined to let lawyers from either side speak much beyond introducing themselves—Dan Hayes and Jake Schmidt on behalf of the SEC, and Robert Giuffra and Suhana Han of Sullivan & Cromwell on behalf of the VW defendants.

“I’m not going to invite any comment. I don’t even want to hear any comment,” Breyer said, according to a transcript of the proceedings.

The SEC sued VW earlier this year, alleging that the company (which is primarily listed on the Frankfurt Stock Exchange) sold “billions of dollars of corporate bonds and other securities in the United States … without disclosing that its ‘clean diesel’ cars used defeat devices to conceal substantial emissions problems.”

VW counters that the bonds were bought exclusively by giant, sophisticated investors, and that all payments of interest and principal were made in full and on time. But the SEC says that the bonds were riskier than the investors were led to believe, so they should have gotten a higher interest rate.

VW counters that the bonds were bought exclusively by giant, sophisticated investors, and that all payments of interest and principal were made in full and on time. But the SEC says that the bonds were riskier than the investors were led to believe, so they should have gotten a higher interest rate.

It’s heartbreaking, I know. Try not to cry yourself to sleep tonight.

The timing of the suit earned Breyer’s ire because VW already settled with everybody and their mother in 2016. At a status conference in May, the judge compared the SEC to a “carrion hawk that simply descends when everything is all over and sees what it can get from the defendant.”

On Friday, he broadly hinted that even if the SEC were to win, it wouldn’t be worth its while.

“We are talking about the allocation of significant resources in order to litigate an issue of liability which under these—this set of laws, Volkswagen says they have not run afoul of, okay,” Breyer said, noting that there would likely be extensive discovery, including witnesses in Germany, where VW is based.

And for what?

“[I]f the court were to conclude that there is some liability here—after an extensive motion practice and discovery practice—the court then would be obligated to assess penalties, I assume. That is what follows after liability, penalties and a lot of things go into it,” he said.

To assess a fine, he reminded the lawyers, the court considers a number of factors, including “Whether the penalty should be reduced to account for other sanctions that the defendant faces or has paid whether criminal or civil. So if that’s a correct statement of the law—and I have no reason to believe it is not a correct statement of the law …”

Giuffra chimed in. “Your honor, we think it definitely is.”

Breyer continued, “Volkswagen has paid approximately $22 billion or some sum around that.”

“I think it is actually over 25 at this point,” Giuffra told the court.

“Okay, 25. I’m not going to quibble over 3 billion,” Breyer said.

The point is, he continued, “whatever penalty—Tier One, Tier Two, Tier Three or Tier Twenty—whatever it is, on the one side of the ledger will be fact that they have paid 23, 24, $25 billion. … So that’s where I see the case evolving if the SEC is correct in their allegations that there is liability.”

In other words, don’t expect much in the way of recovery.

Still, the two sides may have a hard time finding middle ground. The SEC wants disgorgement, prejudgment interest, civil penalties, permanent injunctions and an officer and director bar.

But VW in court papers frames the suit as “a case of a government agency belatedly piling on.” It says the complaint lacks merit, denies making any misstatements or omissions in connection with the bond offerings, and points out that the company has already surrendered any alleged ill-gotten gains many times over—paying an average of $40,000 per offending vehicle, “dwarfing any conceivable profit.”

Still, Giuffra in an interview said his client is ready to talk. “As we’ve shown in the past four years, VW is always open to settling cases on fair terms.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Shareholder Democracy? The Chatter Elon Musk’s Tesla Pay Case Is Spurring Between Lawyers and Clients

6 minute read

Litigation Leaders: Mark Jones of Nelson Mullins on Helping Clients Assemble ‘Dream Teams’

Litigators of the Week: Rolling Back Elon Musk's $56B Tesla Compensation Package

Litigators of the Week: Quinn Emanuel Slashes $137M Racial Discrimination Verdict Against Tesla by Nearly 98%

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250