Report: Consumer Class Actions Nearly Tripled in the Past Decade

Data privacy and unwanted text messages were among the claims in a rising number of consumer class actions, according to an inaugural report released Wednesday by Lex Machina.

October 23, 2019 at 07:39 PM

5 minute read

The original version of this story was published on National Law Journal

Volkswagen cars and SUV dealership. Photo: Shutterstock

Volkswagen cars and SUV dealership. Photo: Shutterstock

The number of consumer protection class actions has nearly tripled in the past decade, with cases over data privacy and unwanted text messages behind the increase, according to a report compiled by Lex Machina.

The "Consumer Protection Litigation Report," released Wednesday, is the first of its kind by Lex Machina, a unit of LexisNexis, that tracks consumer protection lawsuits filed in federal courts.

Overall, the number of consumer protection lawsuits rose by less than 20% from 2009 through 2018, with a collective 132,000 awarding $34 billion in damages over the past decade. In a webinar Wednesday, Laura Hopkins, a legal data expert at Lex Machina, said she predicted that 2019 would see similar numbers.

Class actions, however, rose much higher, from 1,223 to 3,382 filings, in the same timeframe. Hopkins attributed much of that increase to a rise in data breach cases.

"You could classify that as more catastrophic events are happening to a large group of people," she said. "There's more liability in data breach cases, and higher expectations for data security. Also, plaintiffs are seeing that if they come together, they have a little more traction or leverage and media exposure from class actions."

The most popular places to file consumer lawsuits was the Eastern District of New York, which had 3,558 filings from 2016 to 2018, of which 2,102 were class actions. Other top venues were the Middle District of Florida, ranked at No. 3, which had the most Telephone Consumer Protection Act cases, and the Northern District of Georgia, at No. 5, which had the highest number of Fair Credit Reporting Act cases. Other top districts were in California and New Jersey.

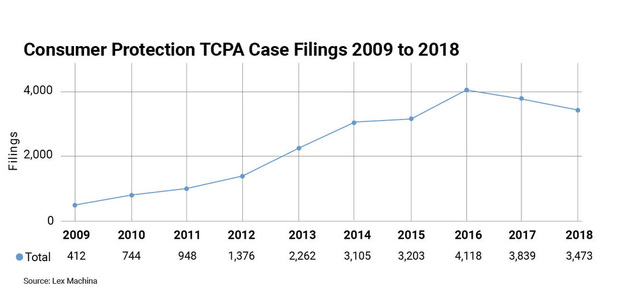

The report looked at cases based on specific federal statutes. Those alleging violations of the Telephone Consumer Protection Act, for instance, rose 740%, and those asserting Fair Credit Reporting Act claims increased by more than 150%, according to a report.

Hopkins said newer TCPA lawsuits focus on text messages sent to cellphones. As to the FCRA claims, she said, consumers have a higher expectation of keeping their data private.

"People are accessing their credit reports more and taking more ownership of that data," she said.

The report also looked at cases brought under the Fair Debt Collection Practices Act, the Truth in Lending Act or other federal consumer protection statutes, such as the Federal Trade Commission Act or Consumer Financial Protection Act.

According to the report, Truth in Lending Act cases fell more than 800% since 2009, which was the height of the mortgage crisis. Fair Debt Collection Practices Act lawsuits also fell but still made up 72% of consumer protection claims filed in the past decade.

The report also ranked the top law firms handling consumer protection cases on both sides. Atlas Consumer Law, based in Lombard, Illinois, filed the largest number: 1,593 cases from 2016 to 2018.

In an emailed statement, firm partner James Vlahakis said, "As reflected by the data compiled by Lex Machina, there is a correlation between an increase in consumer protection litigation filings and diminished governmental enforcement actions. Further, increased collection and credit reporting activities have resulted in more consumers turning to private attorneys to enforce their statutory rights. After bringing certain cases to trial and focusing our efforts on the discovery process, we reaffirmed our belief that the federal judicial system is the best venue to balance the scales of justice."

No. 2 in number of filings was Lemberg Law, based in Wilton, Connecticut, and Garden City, New York's Sanders Barshay Grossman landed at No. 3. Morgan & Morgan, ranked No. 4 overall, filed the most TCPA cases, while the Law Offices of Todd D. Friedman, based in Beverly Hills, California, filed the most class actions.

On the defense side, Jones Day topped the list, defending 2,229 filings from 2016 to 2018 and handling the most FCRA cases. Jones Day represents Experian Information Solutions Inc., which faced 3,115 consumer cases from 2010 to 2018. Atlanta's King & Spalding, which ranked No. 5 with 1,217 filings, represents Equifax Information Services LLC, the No. 1 defendant in consumer protection lawsuits, with more than 4,000 cases filed under the FCRA from 2016 to 2018. Sessions, Fishman, Nathan & Israel, based in New Orleans, defended the most class actions and TCPA cases.

The damages figures in the report distinguished between those in judgments, often reached by the Federal Trade Commission, and those from class action settlements. In 2016 and 2017, the $14.7 billion that Volkswagen paid to settle lawsuits and government actions over its "clean diesel" vehicles influenced much of the damages totals from judgments.

The largest class action settlement from 2016 to 2018 was a $142 million deal that Wells Fargo & Co. paid to resolve claims that it opened bank accounts without the consent of nearly 3 million of its customers.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

While Antitrust Enforcement Might Have Been Hot in 2024, Cartel Fines Were Not

2024 Marked Growth On Top of Growth for Law Firm Litigation Practices. Is a Cooldown in the Offing for 2025?

Litigators of the Week: A Knockout Blow to Latest FCC Net Neutrality Rules After ‘Loper Bright’

Trending Stories

- 1Court Rejects San Francisco's Challenge to Robotaxi Licenses

- 2'Be Prepared and Practice': Paul Hastings' Michelle Reed Breaks Down Firm's First SEC Cybersecurity Incident Disclosure Report

- 3Lina Khan Gives Up the Gavel After Contentious 4 Years as FTC Chair

- 4Allstate Is Using Cell Phone Data to Raise Prices, Attorney General Claims

- 5Epiq Announces AI Discovery Assistant, Initially Developed by Laer AI, With Help From Sullivan & Cromwell

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250