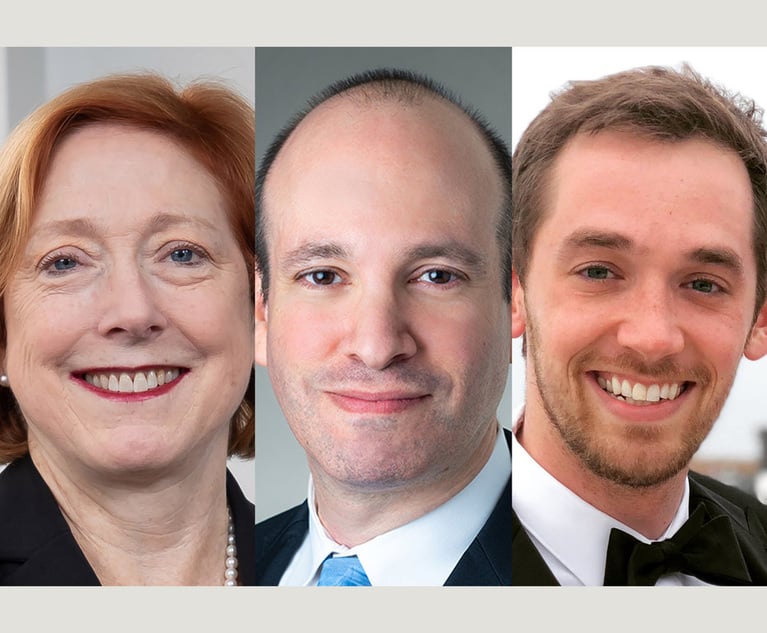

Angela Liu, Dechert partner. Courtesy photo

Angela Liu, Dechert partner. Courtesy photo What Was Up With All the Securities Class Actions Targeting Non-U.S. Issuers Last Year? Dechert's Angela Liu Weighs In

Liu and her colleagues recently released a white paper analyzing why the percentage of securities class actions targeting issuers based outside the U.S. jumped from 15% in 2019 to just over 27% last year even though the total number of securities suits was down.

March 15, 2021 at 07:30 AM

4 minute read

While the total number of federal securities class actions was down year-over-year in 2020, the percentage of total cases targeting issuers based outside the U.S. jumped from 15% in 2019 to just over 27% last year. A group of securities litigators from Dechert recently crunched the numbers of the case filings, did some analysis of the underlying allegations and dug into the dispositive decisions issued involving non-U.S. issuers over the past year. You can download a copy of their report for yourself here.

Late last week we caught up with partner Angela Liu to discuss the Dechert team's findings. She pointed out that companies headquartered in China were the most frequent targets based outside the U.S. The 28 Chinese companies hit with securities class actions in the U.S. was more than double the next highest, with Canadian companies being hit with 12 such suits. Liu also pointed out that the market capitalizations of the target companies were all over the map, with nearly as many small cap non-U.S. companies valued at $250 million or less (14) targeted as those valued in the tens of billions (15).

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Litigators of the Week: Shortly After Name Partner Kathleen Sullivan’s Retirement, Quinn Emanuel Scores Appellate Win for Vimeo

Litigators of the Week: A Knockout Blow to Latest FCC Net Neutrality Rules After ‘Loper Bright’

Litigators of the (Past) Week: Defending Against a $290M Claim and Scoring a $116M Win in Drug Patent Fight

Litigation Leaders: Jason Leckerman of Ballard Spahr on Growing the Department by a Third Via Merger with Lane Powell

Law Firms Mentioned

Trending Stories

- 1Charlie Javice Fraud Trial Delayed as Judge Denies Motion to Sever

- 2Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

- 3With DEI Rollbacks, Employment Attorneys See Potential for Targeting Corporate Commitment to Equality

- 4Trump Signs Executive Order Creating Strategic Digital Asset Reserve

- 5St. Jude Labs Sued for $14.3M for Allegedly Falling Short of Purchase Expectations

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250