$38M Fee Request in Anthem Data Breach Settlement Under Scrutiny

An objection says the fee request, which is 33 percent of the $115 million settlement, was “outrageous on its face” and should be closer to $13.8 million.

January 03, 2018 at 06:33 PM

6 minute read

A prospective class member has objected to the Anthem data breach settlement, specifically criticizing a fee request of nearly $38 million, and planning to ask that a special master investigate the case for potential over-billing.

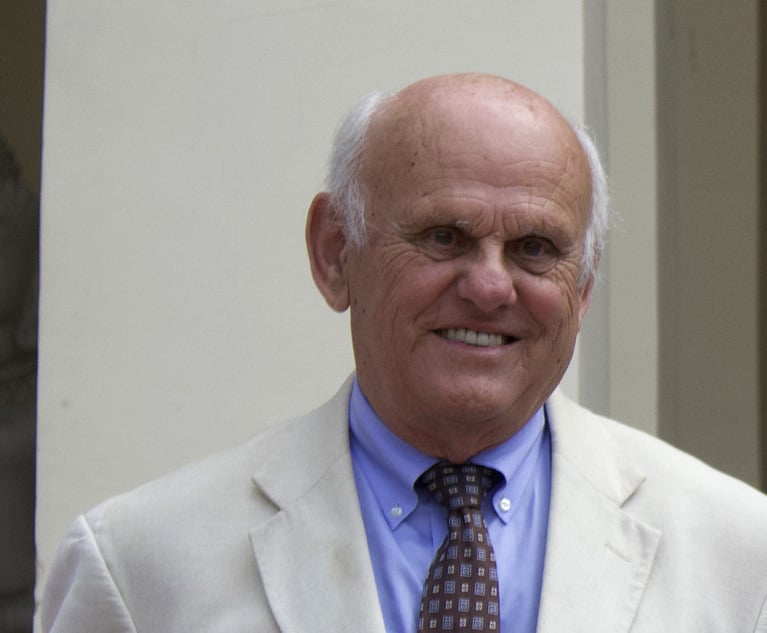

Class action critic Ted Frank, of the Competitive Enterprise Institute's Center for Class Action Fairness, filed the objection on Dec. 29 on behalf of Adam Schulman, who is an attorney at his Washington D.C. organization. The objection said the fee request, which is 33 percent of the $115 million settlement, was “outrageous on its face” and should be closer to $13.8 million. He particularly targeted the average $360 per hour rate for contract attorneys submitted by four lead plaintiffs firms, one of which is San Francisco's Lieff Cabraser Heimann & Bernstein. A special master in Boston is investigating Lieff Cabraser, along with two other law firms, for potential over-billing for staff attorneys in a $74.5 million fee request over securities class action settlements with State Street. The special master's report is due in March.

Frank said he planned to file a motion on Thursday asking that a special master be appointed in the Anthem case.

He wants a special master to look into “the same thing they're investigating in State Street, which is why this billing happened and whether it's appropriate and whether there was an attempt to mislead the court.” He also questioned why 49 other firms not appointed by the court stood to earn a total of $13.6 million in fees and “whether there were side agreements to back scratch or trade favors in other MDLs to get work in this MDL.”

➤➤ Get class action news and commentary straight to your in-box with Amanda Bronstad's email briefing—Critical Mass. Learn more and sign up here.

U.S. District Judge Lucy Koh, who trimmed the number of plaintiffs firms appointed to lead the Anthem case, has scheduled a Feb. 1 hearing for final approval of the settlement in San Jose, California. Two other objections were filed on Dec. 29 that also challenged the fee request, among other things.

Class counsel is expected to respond to the objections by Jan. 25.

Eve Cervantez, of San Francisco's Altshuler Berzon, who is co-lead counsel in the case along with Andrew Friedman of Cohen Milstein Sellers & Toll in Washington D.C., wrote in an email: “The three professional objectors made the same typical, boilerplate objections we often see in consumer class actions, and neglected the true value of the settlement to the class—protection of their personal data both by mandated improvements to Anthem's cybersecurity to prevent future hacks, and by credit monitoring to prevent misuse of their personal data by the hackers that stole it.”

The two lawyers on the plaintiffs steering committee—Michael Sobol of Lieff Cabraser and Eric Gibbs of San Francisco's Girard Gibbs—did not respond to calls or requests for comment.

In the Anthem case, Koh preliminarily approved the settlement in August. The deal provides two years of credit monitoring and identity protection services to more than 78 million people whose personal information was compromised in 2015. It also provides a $15 million fund to pay costs that class members were forced to pay due to the breach, such as credit monitoring services and falsified tax returns.

In motions filed last month, the four lead plaintiffs firms defended their fee request as adequate compensation for obtaining the largest data breach settlement in history. The case involved “massive discovery” and “complicated factual and legal research,” they wrote. It also was “extraordinarily risky,” given that many data breach cases have been dismissed. The fees also were reasonable given the total lodestar—or the amount billed multiplied by the hourly rate—was $37.8 million. The hourly billing rates of partners were between $400 to $970—rates that Koh has approved in prior cases.

“There is no true comparator to this groundbreaking settlement,” Cervantez wrote. “Other data breach cases have not resulted in common funds that come close to $115 million, nor have they included the comprehensive cybersecurity improvements mandated by this settlement, coupled with a major, quantifiable investment in cybersecurity.”

But more than a dozen pro se letters were filed with the court by class members criticizing the deal, mostly because of the fee request and limited cash payouts. Frank's objection cited empirical research finding that judges tended to have lower fee percentages in megafund settlements so as to avoid a windfall to the plaintiffs firms. He also noted that the settlement value on which the fee request was based included $23 million in notice and administration costs. If those costs were excluded, a fee request of 15 percent would amount to $13.8 million.

“Hardly an 'exceptional result' as plaintiffs claim, the settlement is the largest data breach settlement only by the happenstance that the class size is the largest to settle so far,” Frank wrote. “The case is instead a classic instance of leveraging of a large class size rather than achieving a good value.”

The other two objections, one filed by solo practitioners John Pentz in Massachusetts and Benjamin Nutley in California, and the other by a trio of law firms from Missouri and Colorado, raise additional concerns over the cash value of the settlement, a proposed $597,500 in incentive payments to 29 lead plaintiffs and a request on both sides to seal portions of the deal—in particular, the amount of money Anthem has agreed to spend on cybersecurity in the future.

Koh has slashed fee requests in past cases, some involving the same plaintiffs firms. Last year, she cut fees in a $150 million settlement involving the poaching of animators at DreamWorks and The Walt Disney Co. to $13.8 million after finding the original $31.5 million request to be “unreasonably high.” In that case, Koh relied on the billing records, concluding that the U.S. Court of Appeals for the Ninth Circuit's 25 percent benchmark in class action settlements would result in a windfall to the three plaintiffs firms, which included Cohen Milstein.

In related settlements involving high-tech workers in 2015, she halved an $81 million fee request made by two firms, including Lieff Cabraser.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

Netflix Music Guru Becomes First GC of Startup Helping Independent Artists Monetize Catalogs

2 minute read

K&L Gates Files String of Suits Against Electronics Manufacturer's Competitors, Brightness Misrepresentations

3 minute read

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute readTrending Stories

- 1Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

- 2Disney Legal Chief Sees Pay Surge 36%

- 3Legaltech Rundown: Consilio Launches Legal Privilege Review Tool, Luminance Opens North American Offices, and More

- 4Buchalter Hires Longtime Sheppard Mullin Real Estate Partner as Practice Chair

- 5A.I. Depositions: Court Reporters Are Watching Texas Case

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250