D.C. Judge Nixes Kasowitz' $90B Whistleblower Suit Against Chemical Giants

The firm Kasowitz Benson Torres brought the lawsuit under the False Claims Act against various chemical companies, including BASF and Dow Chemical, but a D.C. judge said the firm's legal theory failed.

October 23, 2017 at 02:22 PM

21 minute read

A federal judge Monday dismissed Kasowitz Benson Torres' False Claims Act lawsuit against several major chemical manufacturing companies, ruling the firm's legal theory didn't hold up.

Kasowitz brought the lawsuit against BASF Corp., the Dow Chemical Co., Huntsman International and Covestro last year, after obtaining information about the companies during discovery in other litigation concerning product liability. The firm, acting on behalf of the federal government, alleged the companies failed to report risk information about certain chemicals to the Environmental Protection Agency as required by the Toxic Substances Control Act.

The law firm's so-called “reverse” FCA claim argued the companies cheated the U.S. out of money by not paying fines for their alleged violations, and that they owed the government $90 billion. As the relator of the claim, Kasowitz stood to gain 30 percent of the recovery, or roughly $27 billion.

But in granting the companies' motion to dismiss the case, U.S. District Judge Rosemary Collyer wrote that, because the EPA had yet assessed or levied any fines, the companies did not have an “obligation” to pay the government.

“An unassessed, contingent penalty is not an FCA 'obligation' subject to suit under the reverse false claims provision,” Collyer wrote in the opinion. “TSCA creates a duty to obey the law, but the duty to pay penalties is not established until penalties are assessed and final.”

The firm was represented by partners Daniel Benson, Andrew Davenport and Ann St. Peter-Griffith. Sotiris Planzos of the Potomac Law Group also represented the plaintiffs.

In an emailed statement, a Kasowitz spokeswoman said the firm disagrees with the judge and will appeal the decision.

She said Collyer's ruling “would enable the chemical company defendants here to evade paying billions of dollars in statutory TSCA penalties for their concerted and continuing refusal over many years to disclose the serious health and safety dangers their isocyanate chemicals pose to coal miners, other industrial users, and consumers.”

Dow Chemical was represented by a team from several firms, which included Kirkland and Ellis partner Christopher Landau and Latham & Watkins partner Alice Fisher. Venable's Seth Rosenthal represented BASF and a team from Reed Smith represented Huntsman International. Covestro was represented by a team from Bradley Arant Boult Cummings.

Kasowitz' theory centered on a 2009 amendment to the FCA, via the Fraud Enforcement and Recovery Act, which defined what an “obligation” to pay the government is under the FCA. Kasowitz argued that new definition encompassed duties contingent on future government action.

The companies, however, said Congress did not mean for the provision in FERA to allow individuals to sue companies over fines the government never issued. The Justice Department declined to intervene in the case, but did file a statement of interest backing the defendants' arguments.

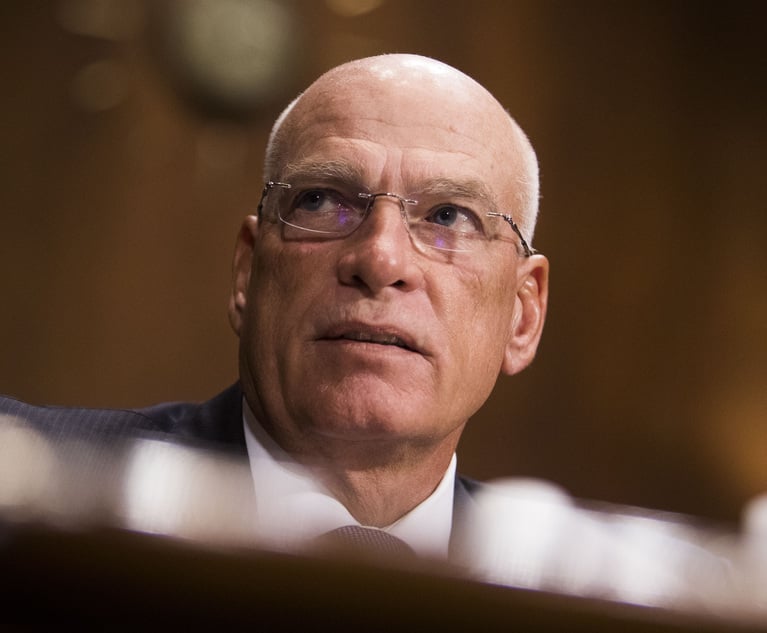

In her opinion, Collyer wrote that Congress' intent with the amendment was clear. For example, she noted that, during the discussions on the amendment, then-Senator John Kyl, now of counsel at Covington & Burling, said that “obviously” lawmakers did not want “the Government or anyone else suing under the False Claims Act to treble and enforce a fine before the duty to pay that fine has been formally established.”

Collyer also cited a remarkably similar case in the Fifth Circuit last year, in which a whistleblower claimed his former employer failed to report information to the EPA under the TSCA and was therefore liable for the penalties. But the Fifth Circuit also held that unassessed regulatory penalties are not “obligations” under the FCA.

“In light of the above legislative history and case law, the Court agrees with Defendants that an 'obligation' under [the amendment] refers to an established duty to pay that exists at the time of the fraudulent conduct, the amount of which may or may not be specifically known at that time,” Collyer wrote.

A federal judge Monday dismissed

Kasowitz brought the lawsuit against

The law firm's so-called “reverse” FCA claim argued the companies cheated the U.S. out of money by not paying fines for their alleged violations, and that they owed the government $90 billion. As the relator of the claim, Kasowitz stood to gain 30 percent of the recovery, or roughly $27 billion.

But in granting the companies' motion to dismiss the case, U.S. District Judge Rosemary Collyer wrote that, because the EPA had yet assessed or levied any fines, the companies did not have an “obligation” to pay the government.

“An unassessed, contingent penalty is not an FCA 'obligation' subject to suit under the reverse false claims provision,” Collyer wrote in the opinion. “TSCA creates a duty to obey the law, but the duty to pay penalties is not established until penalties are assessed and final.”

The firm was represented by partners Daniel Benson, Andrew Davenport and Ann St. Peter-Griffith. Sotiris Planzos of the Potomac Law Group also represented the plaintiffs.

In an emailed statement, a Kasowitz spokeswoman said the firm disagrees with the judge and will appeal the decision.

She said Collyer's ruling “would enable the chemical company defendants here to evade paying billions of dollars in statutory TSCA penalties for their concerted and continuing refusal over many years to disclose the serious health and safety dangers their isocyanate chemicals pose to coal miners, other industrial users, and consumers.”

Kasowitz' theory centered on a 2009 amendment to the FCA, via the Fraud Enforcement and Recovery Act, which defined what an “obligation” to pay the government is under the FCA. Kasowitz argued that new definition encompassed duties contingent on future government action.

The companies, however, said Congress did not mean for the provision in FERA to allow individuals to sue companies over fines the government never issued. The Justice Department declined to intervene in the case, but did file a statement of interest backing the defendants' arguments.

In her opinion, Collyer wrote that Congress' intent with the amendment was clear. For example, she noted that, during the discussions on the amendment, then-Senator John Kyl, now of counsel at

Collyer also cited a remarkably similar case in the Fifth Circuit last year, in which a whistleblower claimed his former employer failed to report information to the EPA under the TSCA and was therefore liable for the penalties. But the Fifth Circuit also held that unassessed regulatory penalties are not “obligations” under the FCA.

“In light of the above legislative history and case law, the Court agrees with Defendants that an 'obligation' under [the amendment] refers to an established duty to pay that exists at the time of the fraudulent conduct, the amount of which may or may not be specifically known at that time,” Collyer wrote.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute read

Federal Judge Grants FTC Motion Blocking Proposed Kroger-Albertsons Merger

3 minute read

Frozen-Potato Producers Face Profiteering Allegations in Surge of Antitrust Class Actions

3 minute read

Trending Stories

- 1Life, Liberty, and the Pursuit of Customers: Developments on ‘Conquesting’ from the Ninth Circuit

- 2Biden commutes sentences for 37 of 40 federal death row inmates, including two convicted of California murders

- 3Avoiding Franchisor Failures: Be Cautious and Do Your Research

- 4De-Mystifying the Ethics of the Attorney Transition Process, Part 1

- 5Alex Spiro Accuses Prosecutors of 'Unethical' Comments in Adams' Bribery Case

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250