IRS Power Is Challenged in Marijuana Dispensary's Supreme Court Petition

"The IRS claims it is necessary and within its power to make administrative determinations that a person is criminally culpable under federal drug laws. Such a claim of power by the IRS is unprecedented," Green Solution's lawyers wrote in the U.S. Supreme Court petition.

November 07, 2017 at 03:09 PM

5 minute read

The IRS has no authority to declare that a taxpayer has violated federal anti-drug laws, a Colorado marijuana dispensary tells the U.S. Supreme Court in a new petition that takes the justices into a dispute over state legalization schemes and federal taxation.

The Green Solution Retail Inc., one of the largest retail marijuana chains in Colorado, petitioned the high court this week to overturn a U.S. Court of Appeals for the Tenth Circuit ruling in May that said federal law bars lawsuits challenging tax assessment activities.

Green Solution's 2013 and 2014 tax returns are the centerpiece of the dispute. The IRS audited the filings and determined that the company, though operating legally in Colorado, violated federal drug trafficking laws. The IRS demanded company financial records to determine if Green Solution improperly took credits and deductions that are not available to illegal drug merchants. Green Solution sued to keep the IRS out of its books, arguing the agency has no right to determine whether it broke federal drug laws.

“The IRS claims it is necessary and within its power to make administrative determinations that a person is criminally culpable under federal drug laws. Such a claim of power by the IRS is unprecedented,” Green Solution's lawyers, James Thorburn and Richard Walker of Colorado's Thorburn Walker, wrote in the Supreme Court petition.

The IRS did not immediately respond to a request for comment Tuesday. Thorburn declined to comment about the petition.

The petition comes at a perilous time for the marijuana industry. Twenty-nine states and the District of Columbia permit some form of legal marijuana, but questions persist about whether and how the U.S. Department of Justice under U.S. Attorney General Jeff Sessions might confront state regulatory schemes. Sessions has staked an anti-legalization position at the helm of Main Justice.

Political questions about the legalization of marijuana should not be answered by the IRS, Green Solution's lawyers told the U.S. Supreme Court.

“Answering the question of the extent of the IRS's administrative authority will also answer just how far the IRS can jump into these political questions,” Green Solution's attorneys said in their petition. “To this end, the court should not allow the IRS to administratively determine whether a person is violating federal criminal drug laws.”

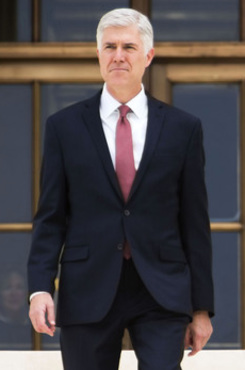

Justice Neil Gorsuch. Credit: Diego M. Radzinschi / ALM

Justice Neil Gorsuch. Credit: Diego M. Radzinschi / ALMThe petition quoted heavily from then-Tenth Circuit Judge Neil Gorsuch's 2015 opinion in Feinberg v. Commissioner of Internal Revenue. Now a Supreme Court justice, Gorsuch noted in that ruling, which upheld an IRS decision to strike business tax deductions taken by a Colorado dispensary, the federal government's “mixed messages” on marijuana enforcement.

The U.S. Justice Department under President Barack Obama had declined to prosecute marijuana retailers operating in accordance with state law, Gorsuch said, while the IRS refused to recognize tax deductions taken by those businesses because of their illegal operation under federal law.

“So it is that today prosecutors will almost always overlook federal marijuana distribution crimes in Colorado but the tax man never will,” Gorsuch wrote.

The IRS is also seeking information from the Colorado Marijuana Enforcement Division about the products Green Solution sells, their weight and the identity of purchasers. A case challenging the IRS request is pending in Colorado federal district court.

Green Solution's petition in the Supreme Court is posted below.

Read more:

Charges Against San Diego Cannabis Attorney Alarm Industry Lawyers

IRS Lawyer Says the Agency Isn't Targeting Cannabis Lawyers

Marijuana's Rapid Growth Could Put New Spotlight on Arbitration

California's Pot Chief Says She's Not Focusing on Feds

Burning Questions for Greenbridge Corporate Counsel's Founder

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Apple Files Appeal to DC Circuit Aiming to Intervene in Google Search Monopoly Case

3 minute read

DC Circuit Revives Firefighters' Religious Freedom Litigation in Facial Hair Policy Row

3 minute read

Judges Split Over Whether Indigent Prisoners Bringing Suit Must Each Pay Filing Fee

4th Circuit Upholds Virginia Law Restricting Online Court Records Access

3 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250