Securities Class Actions Hit Record Levels in 2017, Studies Say

Securities class action filings hit record levels in 2017, driven primarily by lawsuits challenging mergers and acquisitions, according to two prominent studies that came out this week.

January 30, 2018 at 06:49 PM

5 minute read

Securities class action filings hit record levels in 2017, driven primarily by lawsuits challenging mergers and acquisitions, according to two prominent studies that came out this week.

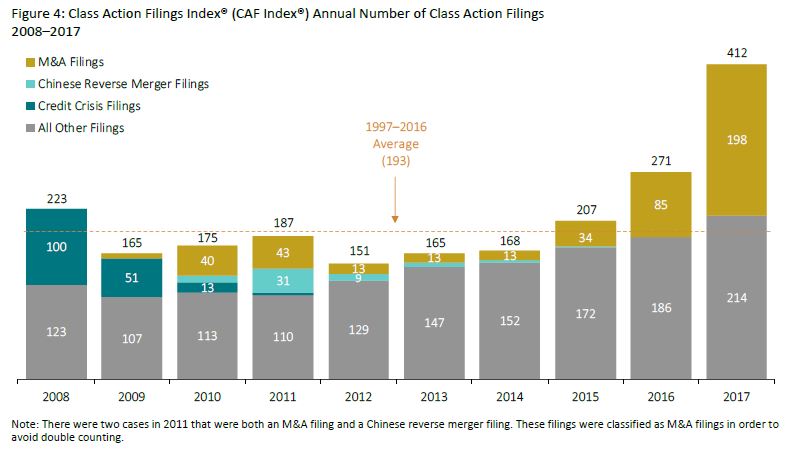

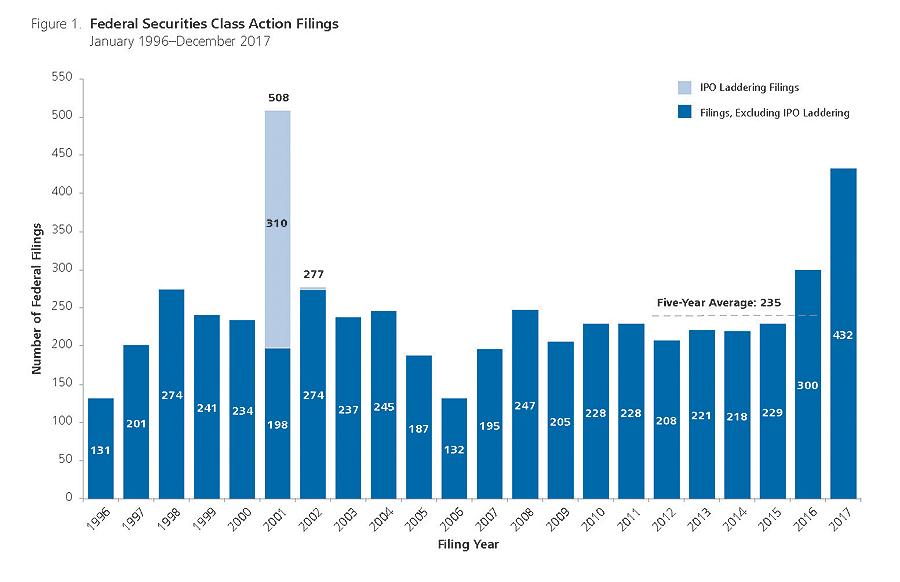

Both Cornerstone Research and NERA Economic Consulting found in annual reports that the number of class action filings brought by shareholders last year was the highest since 2008 and, when excluding the IPO craze of 2001, since the passage of the Private Securities Litigation Reform Act in 1995. Cornerstone Research's report pegged the total at 412, up 52 percent from 2016, and NERA's review found there were 432 filings, up 44 percent.

“The numbers are very high. The numbers are roughly at the same levels as 2008,” said Sasha Aganin, vice president of Cornerstone Research, which partnered with Stanford Law School Securities Class Action Clearinghouse on its study, released on Tuesday. But the stock market was volatile in 2008, when the financial crisis hit. “What's interesting about 2016 and 2017 is the markets have been rising and the volatility of the overall markets was low, but filings are up.”

Both studies found that so-called merger objection lawsuits were driving the filings but that a large portion of them were getting dismissed. Cornerstone found there were 198 M&A filings in 2017, the largest number since 2009 and nearly half the total number of cases. Authors of both studies predicted more to come in 2018.

“I anticipate that merger objection filings will persist,” said Stefan Boettrich, co-author of NERA's study, which came out on Monday. “It may not be another record number like this year, but the level they're at is probably going to be maintained.”

Here's some key trends coming out of the studies:

- Three law firms are driving growth. Cornerstone Research found that three law firms—The Rosen Law Firm and Pomerantz, both in New York, and Los Angeles-based Glancy Prongay & Murray—were driving the increase in filings. “It's interesting that these firms decided that's worth their time and effort to file lawsuits when the dollar values of the drops are relatively smaller,” Aganin said. Pomerantz's Jeremy Lieberman countered in an email that his firm served as lead counsel in the $2.95 billion partial settlement with Petrobras this year—the largest securities class action settlement in a decade. Also, decisions on class certification in the case “have created very favorable precedent for investors, and will form the bedrock of securities class action jurisprudence for decades to come.”

- The Trulia decision is driving merger objection filings. The Delaware Court of Chancery's 2016 decision in In re Trulia Stockholder Litigation, which rejected disclosure-only settlements, is driving much of the increase in merger objections in federal court. “We're seeing those types of cases migrate out of Delaware and into federal jurisdictions,” NERA's Boettrich said. Cornerstone Research reported that the number of merger objection filings in the U.S. Court of Appeals for the Third Circuit tripled from 2016.

- Dismissals are high. “Merger objection cases tend to be dismissed faster than other cases,” NERA's Boettrich said. But it's not just merger objection cases getting dismissed. Voluntary dismissals went from two in 2016 to 32 in 2017. “There's a real spike in them,” he said.

- Settlement values are down. NERA found that the average settlement value in 2017 was $25 million, a drop of more than 40 percent from 2016 and the lowest since 2001. “One trend that's behind that is the fact there not only are settlements down overall in terms of the counts but the number of large settlements or moderately large settlements are virtually nonexistent,” Boettrich said. Boettrich expected that trend to turn around in 2018 with “a substantial number of large cases in the pipeline.”

- SCOTUS already has impacted California. Filings brought in California's state courts under Section 11 of the Securities Act of 1933 have dropped. In 2017, unlike previous years, lawyers filed identical suits in federal courts. Both are likely due to the U.S. Supreme Court's anticipated decision in Cyan v. Beaver County Employees Retirement Fund, which could nix California state court jurisdiction over Section 11 claims, according to both studies. Boris Feldman, a partner at Wilson Sonsini Goodrich & Rosati in Palo Alto, California, said many cases have been stayed or lawyers have refused to settle until the Supreme Court makes its decision. If the Supreme Court comes down for defendants, that could end a trend that began in about 2015. “They're going to plummet,” Feldman said of securities cases in California state court. And not just Section 11 cases—merger objection cases, too. “They scurried into federal court, but I don't know if it was a well-thought-out strategy that will result in money,” he said.

- More cases were filed against European defendants. NERA's report said 22 filings were against European defendants, up from 17 in 2016, and Cornerstone Research's study found those filings reached record levels against companies in Greece and the United Kingdom. Previous filings against foreign defendants have focused on China and Hong Kong.

- New cases involve “initial coin offerings.” There were five class actions filed over so-called “initial coin offerings” in 2017, according to Cornerstone Research. Those involve bitcoin and other cryptocurrencies. “There were several offerings of those financial instruments that came under scrutiny by various regulators,” Aganin said. “Now, there are lawsuits related to that.”

Another key trend, ALM's Kristen Rasmussen wrote, was the continuing emergence of Big Pharma and health care companies as lawsuit magnets in 2017.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

4th Circuit Upholds Virginia Law Restricting Online Court Records Access

3 minute read

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute readTrending Stories

- 1Evidence Explained: Prevailing Attorney Outlines Successful Defense in Inmate Death Case

- 2The Week in Data Jan. 24: A Look at Legal Industry Trends by the Numbers

- 3The Use of Psychologists as Coaches/Trial Consultants

- 4Could This Be the Era of Client-Centricity?

- 5New York Mayor Adams Attacks Fed Prosecutor's Independence, Appeals to Trump

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250