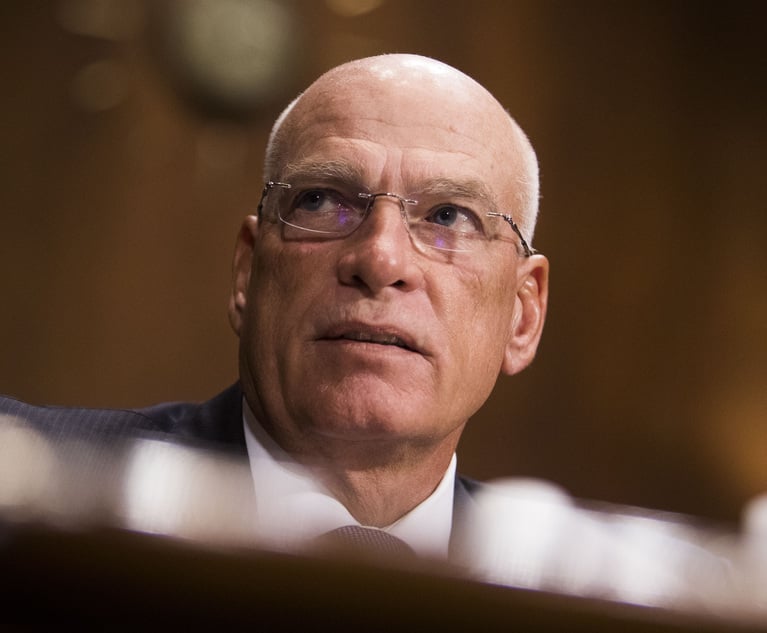

Clayton: SEC Fiduciary Rule on Track Despite DOL Court Defeat

At the SIFMA compliance conference, Jay Clayton told Ken Bentsen that the court ruling on Labor's fiduciary rule “hasn't affected” the SEC's approach to its fiduciary rule-making.

March 22, 2018 at 05:18 PM

4 minute read

The 5th Circuit Court of Appeals ruling issued Thursday torpedoing the Labor Department's fiduciary rule isn't impeding the Securities and Exchange Commission's efforts to write its own fiduciary rule, the agency's chairman, Jay Clayton, said Monday.

“Seventy-two hours later” after the 5th Circuit Court of Appeals struck down Labor's fiduciary rule, “it hasn't affected the way I'm approaching this” fiduciary rulemaking at the SEC, Clayton said during a question-and-answer session at the Securities Industry and Financial Markets Association's annual compliance conference, held in Orlando, Florida.

Ken Bentsen, president and CEO of SIFMA, queried Clayton on how soon the agency would release its own fiduciary proposal, asking if it would be “soon.”

Clayton responded: “Soon is fair. From my perspective, the sooner the better. I'm not sitting on this.”

Bentsen asked, does the 5th Circuit decision “affect [the SEC's] timing” on releasing its own fiduciary rule?

“I think there's a lot going on there [in the ruling] for what it means for the Department of Labor,” Clayton replied. “I haven't had any discussions with the Department of Labor on what it means from a broader perspective of administrative law and the approach to administrative law. We'll see, but as far as I'm concerned, we're moving forward.”

A Labor Department spokesperson said in a statement that with the 5th Circuit vacating the 2016 fiduciary rule in its entirety, “pending further review, the Department will not be enforcing the 2016 fiduciary rule.”

The U.S. Court of Appeals for the 5th Circuit voted 2-1 on Thursday to vacate the Labor Department's fiduciary rule.

The nine plaintiffs in the 5th Circuit case included the U.S. Chamber of Commerce, the Securities Industry and Financial Markets Association and the Financial Services Institute.

The ruling comes one day after Labor won a case in federal court brought against its fiduciary rule by Market Synergy Group, an insurance distributor.

The appeals court struck down the entirety of the fiduciary rule.

Dale Brown, president and CEO of FSI, said that while the court's decision “in our favor is critical because the rule would have pushed the cost of retirement advice and planning services out of the reach of many Main Street investors, our work is far from over.”

FSI, he said, is ”now redoubling our efforts to support the SEC's current push to create a uniform standard that protects investors and their full access to the advice, products and services they depend on to save for a dignified retirement, care for aging parents and educate their children.”

Crafting an SEC Fiduciary Rule

Clayton stated Monday at the SIFMA compliance event that a client's relationship with their financial professional usually includes dealing with ”at least five” regulators.

“I've convinced myself that we need to do something to try and bring that five, six, seven number [of regulators] down, and I would like the SEC's action in this area to be the focal point around which people say, 'Yes, that's how we should look at the relationship. That's the basis on which you should have to demonstrate compliance.' That is the objective. How we get there we've been working very hard on.”

Noting the comments that have been filed regarding an SEC fiduciary rulemaking, Clayton said that “most people believe there should be a clearly articulated standard for broker-dealers and that you can bring some clarity as well to the investment advisor standard, which has been talked about a lot but not in great substance,” Clayton said.

“I see no objection to my view that we should do our best to clarify, in plain language, what that standard means. I think we've demonstrated that you can do that in a fairly short plain English document.”

This article was originally published at ThinkAdvisor.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Paul Weiss’ Shanmugam Joins 11th Circuit Fight Over False Claims Act’s Constitutionality

‘A Force of Nature’: Littler Mendelson Shareholder Michael Lotito Dies At 76

3 minute read

US Reviewer of Foreign Transactions Sees More Political, Policy Influence, Say Observers

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute readTrending Stories

- 1Call for Nominations: Elite Trial Lawyers 2025

- 2Senate Judiciary Dems Release Report on Supreme Court Ethics

- 3Senate Confirms Last 2 of Biden's California Judicial Nominees

- 4Morrison & Foerster Doles Out Year-End and Special Bonuses, Raises Base Compensation for Associates

- 5Tom Girardi to Surrender to Federal Authorities on Jan. 7

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250