5th Circuit Denies AARP, States' Request to Intervene in DOL Fiduciary Ruling

Drinker Biddle's Fred Reish speculates on Labor's next move.

May 03, 2018 at 12:18 PM

4 minute read

The U.S. Court of Appeals for the 5th Circuit denied Wednesday the request by AARP and state attorney's general from California, New York and Oregon to intervene after the court ruled to vacate the Labor Department fiduciary rule.

The court did not explain its order, stating that the motions were denied.

AARP told the court Tuesday that the Labor Department's failure to appeal the court's ruling vacating the rule opened the door for intervention by the retiree advocacy group.

“Although the government once 'vigorously defended' the rule, … it no longer does so here now that the rehearing deadline has passed,” AARP said, referring to Labor being required to file an appeal by April 30.

“Under standard intervention principles, that turn of events warrants granting AARP's motion to intervene,” AARP attorneys Mary Ellen Signorille and Deepak Gupta wrote.

AARP along with state attorneys general from California, Oregon and New York filed motions on April 28 to intervene in the case.

AARP said in a Wednesday statement that the group is “disappointed in today's court decision denying AARP the right to intervene in the Fifth Circuit case to protect the retirement advice provided to our members and other Americans saving for retirement,” adding that AARP “will continue its efforts to fight on behalf of consumers who want financial advice in their best interest.”

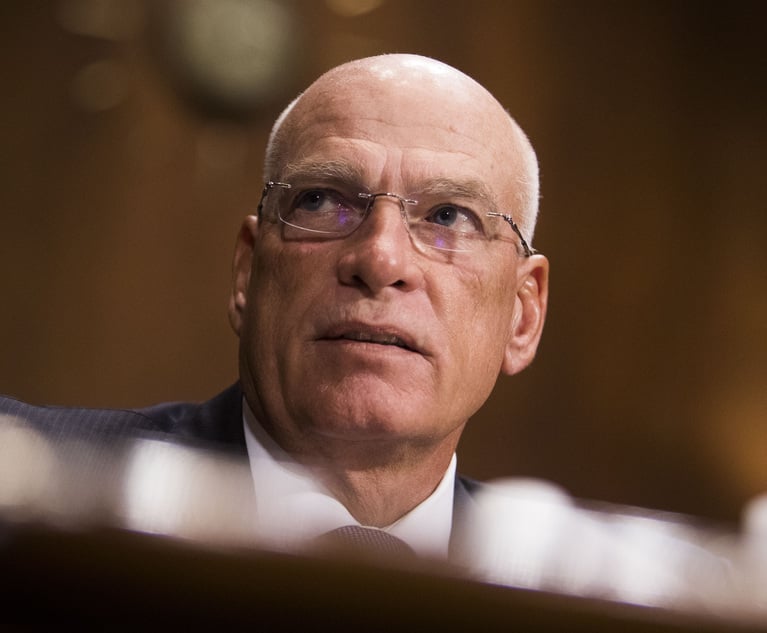

Eugene Scalia, the lead Gibson, Dunn & Crutcher attorney who argued against Labor's rule before the 5th Circuit and represents the plaintiffs — including the U.S. Chamber of Commerce, the Securities Industry and Financial Markets Association and the Financial Services Institute — argued in an April 30 filing with the court that AARP and the state attorneys general “have delayed until the last moment to file intervention motions to seek rehearing en banc,” adding that their delay “is unjustifiable” and should be denied.

Scalia also argued that the AARP and state AGs' requests failed to satisfy the standard for emergency relief.

Chamber, FSI, Financial Services Roundtable, Insured Retirement Institute and SIFMA released a statement after the 5th Circuit ruling that the groups “are pleased the Fifth Circuit denied the motions to intervene, and that the Department of Labor's unlawful 2016 fiduciary rule is at an end.” The SEC, not the DOL, the groups said, “is the appropriate regulator in this area, and we look forward to working with the SEC on the current proposed rulemaking to establish a best interest standard across all accounts, and not just retirement accounts.”

The attorneys for AARP countered in their Tuesday filing that “none of the plaintiffs' efforts to avoid this [rehearing] conclusion is persuasive.”

Plaintiffs' view that the AARP motion “should be summarily denied for failing to comply with this Court's local rule covering 'Emergency Motions' trips at the threshold: By its terms, that rule does not apply. And the plaintiffs' attack on AARP's standing fares no better,” the AARP attorneys wrote.

“The motion should be granted,” the attorneys added, stating that it does not “seek emergency relief.”

AARP had 'no strong incentive to seek intervention in [this case] at an earlier stage,'” the attorneys wrote, citing the plaintiffs' complaint, “because, until the government's about-face following the panel decision, it had vigorously defended its own regulation. That is no longer the case.”

Labor's Next Move?

Fred Reish, partner in Drinker Biddle & Reath's employee benefits and executive compensation practice group in Los Angeles, told ThinkAdvisor on Wednesday that Labor can still ask the Supreme Court to review the ruling, and that Labor has 90 days from the 5th Circuit decision, which took place on March 15, to make that request.

“The prevailing thinking is that the Department will not do that,” Reish said.

On the regulatory front, Labor needs to make two decisions: first, whether to re-amend the old five-part test for fiduciary status under the Employee Retirement Income Security Act. “There is a good chance that the DOL will do that, perhaps proposing something by the end of this year.”

For example, Reish explained that it makes sense for Labor “to try to classify advice on rollovers as fiduciary actions. Also, it appears that, while not entirely clear, the SEC did not include advice to plans within the scope of Regulation Best Interest.”

Another reason that could justify an amended regulation, Reish added, “is that the SEC's Reg BI only covers securities transactions. As a result, recommendations by an insurance-only agent or broker is not included under that proposed rule.”

This story originally appeared at ThinkAdvisor.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Paul Weiss’ Shanmugam Joins 11th Circuit Fight Over False Claims Act’s Constitutionality

‘A Force of Nature’: Littler Mendelson Shareholder Michael Lotito Dies At 76

3 minute read

US Reviewer of Foreign Transactions Sees More Political, Policy Influence, Say Observers

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute readTrending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250