Study Finds Judges Mostly Reject Discovery Requests for Litigation Funding Documents

The conclusion of the study—that judges rarely grant discovery into litigation funding documents—helps explain why opponents of the industry are pushing for legislative and rule changes to require that funding agreements be disclosed.

May 14, 2018 at 12:54 PM

5 minute read

Credit: Alexander Kirch/Shutterstock.com

Credit: Alexander Kirch/Shutterstock.com Amid a push by litigation funding opponents for greater transparency in the industry, a new industry study has found that federal and state court judges have overwhelmingly blocked attempts by litigants to peer into their opponents' legal financing arrangements.

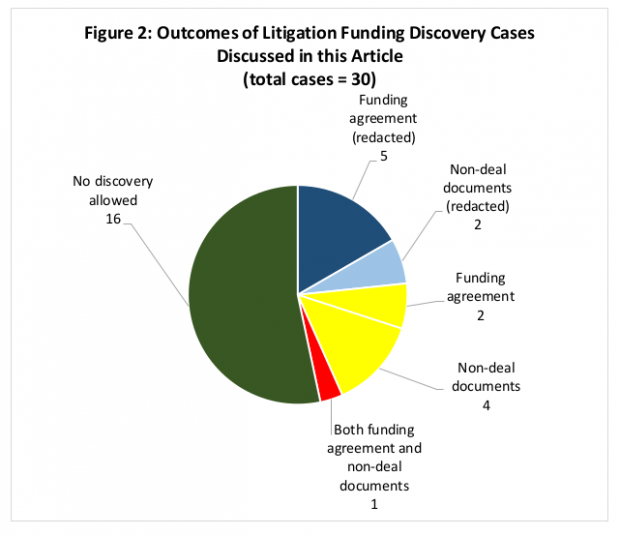

The case law analysis by Tennessee-based litigation funding broker Westfleet Advisors identified 30 cases across the United States in which a party sought to force disclosure of the other sides' litigation financing documents.

In 24 of those cases—or 80 percent—the judge denied the discovery requests altogether or granted limited discovery, according to the study, which was authored by Westfleet CEO Charles Agee, Adams and Reese partner Lucian Pera, and Vanderbilt University law student Steven Vickery.

The study, which is presented as a comprehensive analysis of existing case law, was shared with Law.com on the condition that it not be re-published in its entirely. Certain infographics from the study have been excerpted below.

Source: Westfleet Advisors study. Used with permission.

Source: Westfleet Advisors study. Used with permission. Agee said in an interview that the impetus for doing the study was to be able to inform potential clients—litigants and lawyers seeking funding—what the state of the law is on disclosure of related documents.

“When you read about it in the press, it's always presented as, 'Well, it's a mixed bag, anything can happen,'” Agee said. “That's not consistent with the research that Lucian and I have done over the years.”

Most of the cases that Westfleet analyzed were in federal court, including the recent decision by a federal judge in Ohio requiring plaintiffs in the opioid multidistrict litigation to disclose any third-party funding agreements to the court in camera.

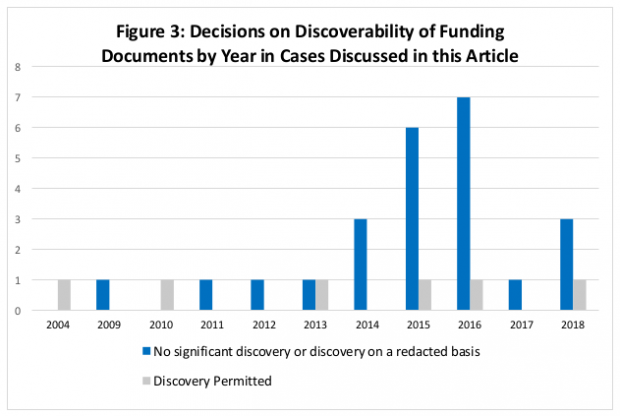

But the company also looked at decisions in state courts. It identified a case as far back as 2004 in Massachusetts called Conlon v. Rosa, for example, in which the judge allowed discovery of the redacted funding agreement and non-deal documents.

Perhaps indicating how the litigation finance industry has grown in recent years, the bulk of the decisions came down between 2014 and 2016, according to the study.

Source: Westfleet Advisors study. Used with permission.

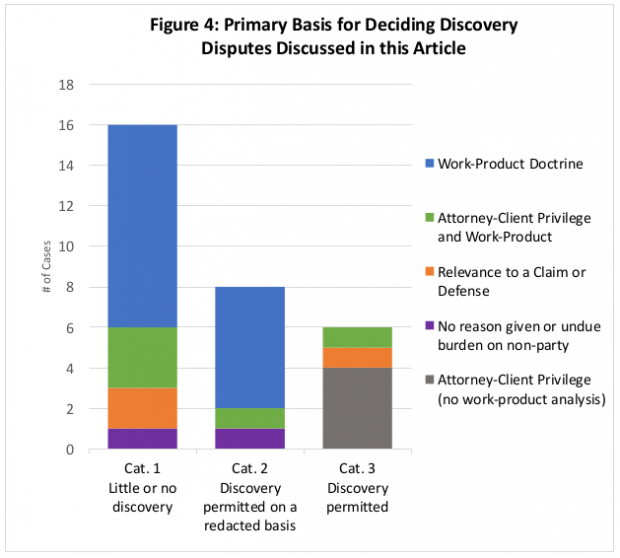

Source: Westfleet Advisors study. Used with permission. By far, the most reliable argument to shield litigation finance-related documents from discovery in the cases analyzed was the “work-product” doctrine. Of the 24 decisions in which discovery was denied or granted in a limited way, 20 of them included the work-product doctrine in their reasoning. Arguments based on relevance, the “common interest” doctrine, and attorney-client privilege did not fare as well.

“Most decisions allowing significant discovery of the funding agreement and non-deal documents in the face of a strong work-product argument by the plaintiff were decided several years ago, before the decision in Miller v. Caterpillar in 2014, the leading decision in this area,” the study said.

The Miller decision, handed down by a federal judge in the U.S. District Court for the Northern District of Illinois, denied discovery requests by lawyers for the construction giant Caterpillar in a trade secrets dispute on relevancy and other grounds. It is often cited by the litigation funding industry in arguing why funding agreements and related documents should not be subject to disclosure in litigation.

Source: Westfleet Advisors study. Used with permission.

Source: Westfleet Advisors study. Used with permission. The conclusion of the study—that judges rarely grant discovery into litigation funding documents—helps explain why opponents of the industry, chiefly the U.S. Chamber of Commerce, are pushing for legislative and rule changes to require that funding agreements be disclosed.

The Chamber has twice pushed for a rule change for all federal courts that would require disclosure of funding agreements in civil disputes, and also helped lobby for pioneering legislation in Wisconsin enacted in April that imposes the same obligation.

Last week, U.S. Senate Judiciary Committee chairman Charles Grassley, R-Iowa, introduced the Litigation Funding Transparency Act. It would require the disclosure of litigation funding agreements in any class action or multidistrict litigation proceeding in federal court.

One of the six cases that Westfleet identified where the funding agreement was required to be disclosed by the court was a class action in the U.S. District Court for the Northern District of California, in which the judge agreed that ascertaining the level of funding and any other obligations was relevant to whether class counsel could pursue the case.

But there wasn't any other consistent factor among those set of cases, the study said, saying that “the unusual circumstances of the cases distinguishes them from the trend of cases upholding objections to such discovery requests.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Bankruptcy Judge Clears Path for Recovery in High-Profile Crypto Failure

3 minute read

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

DC Judge Chutkan Allows Jenner's $8M Unpaid Legal Fees Lawsuit to Proceed Against Sierra Leone

3 minute readTrending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250