Report: Shareholder Lawsuits Being Filed at Record Pace, and They're Getting Bigger

A record pace of shareholder class action filings continued during the first half of 2018—and the cases are getting much bigger, according to a midyear report released today.

July 25, 2018 at 04:31 PM

4 minute read

A record pace of shareholder class action filings continued during the first half of 2018—and the cases are getting much bigger, according to a midyear report released today.

The report, by Cornerstone Research and Stanford Law School's Securities Class Action Clearinghouse, found 204 filings so far this year. That's on pace to match last year's record total of 412—the highest number of cases filed since 2008.

But, unlike in 2017, the potential dollar value of the cases grew significantly, driven by several mega-filings, which are those seeking at least $5 billion.

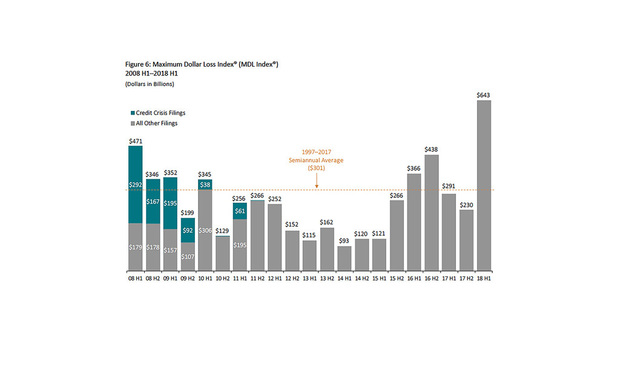

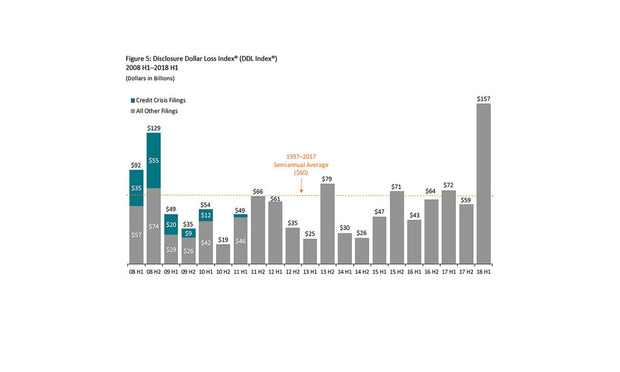

Credit: Cornerstone Research and Stanford Law School's Securities Class Action Clearinghouse

Credit: Cornerstone Research and Stanford Law School's Securities Class Action Clearinghouse“We still have very high volume of traditional cases, and these traditional cases are now getting larger in terms of dollars,” said Sasha Aganin, vice president of Cornerstone Research. “We have some mega-filings, which were relatively rare in the previous couple of cycles, so we're now back to the situation where large cases, or giant cases, reflect a large portion of dollar losses that we are measuring.”

According to the report, the maximum dollar loss, which calculates the total market capitalization decrease during the entire class period, totaled $643 billion in the first half of 2018—the highest semiannual level since the second half of 2002. And the disclosure dollar loss—the value of the market capitalization decrease at the time the alleged misstatements were disclosed—was 162 percent higher than the historical aggregate average of $157 billion.

The report didn't cite specific cases, but one of the biggest shareholder lawsuits filed this year, for example, was against Facebook Inc. following the Cambridge Analytica scandal.

The jump in dollar value is anticipated to continue, Aganin said, particularly as some experts predict a market correction in the second half of 2018. The filings also could lead to larger settlement values, which reached historic lows in 2017, he said.

Filings over mergers and acquisitions continued to play a lead role in the increase, although their numbers dipped slightly this year. Core filings, which include cases brought when a stock price drops, jumped 28 percent from the second half of 2017, the report said.

The report didn't mention the plaintiffs firms filing the cases so far this year. But Aganin said that the same three law firms that drove last year's growth—The Rosen Law Firm and Pomerantz, both in New York, and Los Angeles-based Glancy Prongay & Murray—are “very active” in this year's filings.

Credit: Cornerstone Research and Stanford Law School's Securities Class Action Clearinghouse

Credit: Cornerstone Research and Stanford Law School's Securities Class Action ClearinghouseThe data shows that companies are more likely to face a shareholder class action than ever before. The report anticipated that, as in 2017, shareholders could end up suing 8.5 percent of companies listed on the Nasdaq or New York Stock Exchange this year. That's well above the historic average of 2.9 percent.

“The costs of shareholder litigation are rising,” Aganin said. “There is a high chance a typical company would be sued in a shareholder case, either over an M&A transaction or because of a stock price drop.”

What remains unclear is the impact of the U.S. Supreme Court's March 20 ruling in Cyan v. Beaver County Employees Retirement Fund, which allowed plaintiffs to bring claims in state courts under Section 11 of the Securities Act of 1933. Filings had dropped prior to the ruling, but Aganin predicted that cases in state courts would be “more likely” during the second half of this year.

Also unclear is the prevalence of shareholder class actions brought over initial coin offerings or other cryptocurrencies. In 2017, there were five such cases; so far this year, there were seven. But the U.S. Securities and Exchange Commission is considering potential regulation.

“The attractiveness of bringing a lawsuit related to underlying cryptocurrencies in federal court will depend to a large degree on what the SEC develops as its framework,” Aganin said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Bankruptcy Filings Surged in First Half of 2024 Amid Uptick in Big Chapter 11 Cases

3 minute read

Trump Financial Statements From 2011 to 2020 'Should No Longer Be Relied Upon,' Accountant's GC Says

Bonuses and Beyond: Law Firms Wrap Up Lucrative Year With Record-High Rewards

Trending Stories

- 1Antitrust Partner Plans Move to Davis Polk From Fried Frank

- 2How This Dark Horse Firm Became a Major Player in China

- 3Bar Commission Drops Case Against Paxton—But He Wants More

- 4Pardons and Acceptance: Take It or Leave It?

- 5Gibbons Reps Asylum Seekers in $6M Suit Over 2018 ‘Inhumane’ Immigration Policy

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250