There's Been a Rise in Securities Lawsuits Over Cryptocurrencies, and SEC Cases Are Behind It

A Lex Machina report found that securities lawsuits filed over cryptocurrencies or bitcoin have tripled so far this year as SEC chairman Jay Clayton announced a crackdown on that industry.

September 11, 2018 at 07:36 PM

5 minute read

Photo by Lex Machina

Photo by Lex Machina

Securities lawsuits filed over either cryptocurrencies or bitcoin have tripled so far this year as U.S. Securities and Exchange Commission chairman Jay Clayton announced a crackdown on that industry, according to a new report by legal analytics firm Lex Machina.

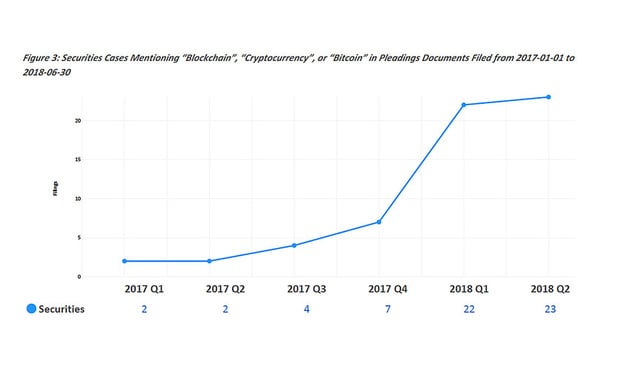

Released on Tuesday, the report found there were 45 cases filed so far this year that mentioned “blockchain,” “cryptocurrency” or “bitcoin” in the filings, up from 15 in 2017. And the SEC, which has vowed to scrutinize cryptocurrencies and initial coin offerings (ICOs), was responsible for 30 percent of the cases filed in 2018, according to Laura Hopkins, legal data expert at Lex Machina, a unit of LexisNexis. That's the second-most popular filer of such cases, topped only by the law firm Levi & Korsinsky, she said.

The report also found that, during that same period, New York's Skadden, Arps, Slate, Meagher & Flom topped the list of defense firms handling securities cases, as well as a separate ranking of those with the most defense wins. Sidley Austin, Latham & Watkins and Gibson, Dunn & Crutcher also made the top 10 of both lists.

“The depth of our experience across a wide range of industries, coupled with our seamless coordination across offices—both nationally and internationally—is key to our success,” said Jay Kasner, head of Skadden's securities litigation group. “We are extremely hard-working, strategic and collaborative, and truly operate as one team with the common goal of delivering the best service to our clients around the world.”

Lex Machina's Securities Litigation Report of 2018 compared securities cases filed from July 1, 2015, to Dec. 31, 2016—just before President Donald Trump nominated Clayton on Jan. 4, 2017—to those brought from Jan. 1, 2017, to June 30, 2018. Clayton became the SEC's chairman on May 4, 2017. The report identified securities cases in federal district courts and included regulatory lawsuits, like those brought by the SEC.

Hopkins said the report compared cases based on Clayton's tenure because the data showed a clear shift that centered around the Trump administration: There were 1,097 securities cases filed in 2016 and 1,676 in 2017, a 50 percent increase.

“At a very high level, we think it's an interesting trend because the popular narrative might be that securities enforcement under the new administration, given its deregulatory and other policy positions, might have fallen,” said Owen Byrd, chief evangelist and general counsel at Lex Machina. “We thought it was noteworthy and newsworthy to uncover that filings had increased at the very time when you might think from other signals in the sphere of news that the trend might have gone another way.”

Of course, the filings also include cases brought by plaintiffs firms, some of which have sued over the market decline in cryptocurrencies. Shareholder surveys released this year by Cornerstone Research and Stanford Law School's Securities Class Action Clearinghouse and NERA Economic Consulting found that shareholder filings were on the rise, with Pomerantz and The Rosen Law Firm among the top plaintiffs firms. Lex Machina ranked Levi & Korsinsky at No. 2, just below the SEC, with 266 cases in the past 18 months.

“They are aggressively expanding their practice in plaintiffs-side securities work,” Byrd said of Levi & Korsinsky.

Eduard Korsinsky and Joseph Levi, name partners of New York's Levi & Korsinsky, did not respond to a request for comment.

As in the other shareholder surveys, Lex Machina found a decrease in the amount of damages in settlements and other dispositions of securities cases. According to Lex Machina's report, penalties obtained by the SEC and the Commodity Futures Trading Commission dropped from $570 million to $412 million. Other securities damages, which include CFTC cases, dropped from $676 million to $364 million.

One factor might be the U.S. Supreme Court's Kokesh v. United States decision, which limited the SEC's ability to get disgorgement of profits beyond five years. Clayton has raised concern about the practical effect of that 2017 ruling. Disgorgement, which includes cases by the SEC and plaintiffs firms, fell from $3.5 billion to $1.9 billion. “It does look like there's a decline,” Hopkins said, but it might be too early to tell.

Here's some other trends from Lex Machina's report:

- The federal district court in Delaware jumped to No. 3 from No. 14 in number of securities cases filed, with 198, or 8 percent, of the total number during the past 18 months. Only 36 cases were filed in that district in 2015 and 2016 combined. Several recent court decisions, such as the Delaware Court of Chancery's 2016 decision in In re Trulia Stockholder Litigation, which rejected disclosure-only settlements, are driving the increase of cases in federal court.

- Defendants are winning more cases through judgments on the pleadings and voluntarily dismissals by plaintiffs. In the 18 months prior to Clayton's nomination, judgments on the pleadings contributed to 3 percent of all defense wins, and plaintiffs voluntarily dismissed 12 percent of cases. After Clayton's nomination, those numbers jumped to 8 percent and 28 percent, respectively. “Yes, there are more cases, but a lot of them are being tossed out before being heard by the court,” Hopkins said.

- Cases took less than half as long to end. The median “time to termination” for cases prior to Clayton's nomination was 419 days, while it took just 138 days in the 18 months after that date.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trump Administration Faces Legal Challenge Over EO Impacting Federal Workers

3 minute read

Skadden and Steptoe, Defending Amex GBT, Blasts Biden DOJ's Antitrust Lawsuit Over Merger Proposal

4 minute read

Does the Treasury Hack Underscore a Big Problem for the Private Sector?

6 minute readTrending Stories

- 1Data Disposition—Conquering the Seemingly Unscalable Mountain

- 2Who Are the Judges Assigned to Challenges to Trump’s Birthright Citizenship Order?

- 3Litigators of the Week: A Directed Verdict Win for Cisco in a West Texas Patent Case

- 4Litigator of the Week Runners-Up and Shout-Outs

- 5Womble Bond Becomes First Firm in UK to Roll Out AI Tool Firmwide

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250