, Consumer Financial Protection Bureau headquarters in Washington D.C. (Photo: C. Ryan Barber/ALM)

, Consumer Financial Protection Bureau headquarters in Washington D.C. (Photo: C. Ryan Barber/ALM)Ex-CFPB Official Resists 'Fishing Expedition' Deposition in Student Loan Suit

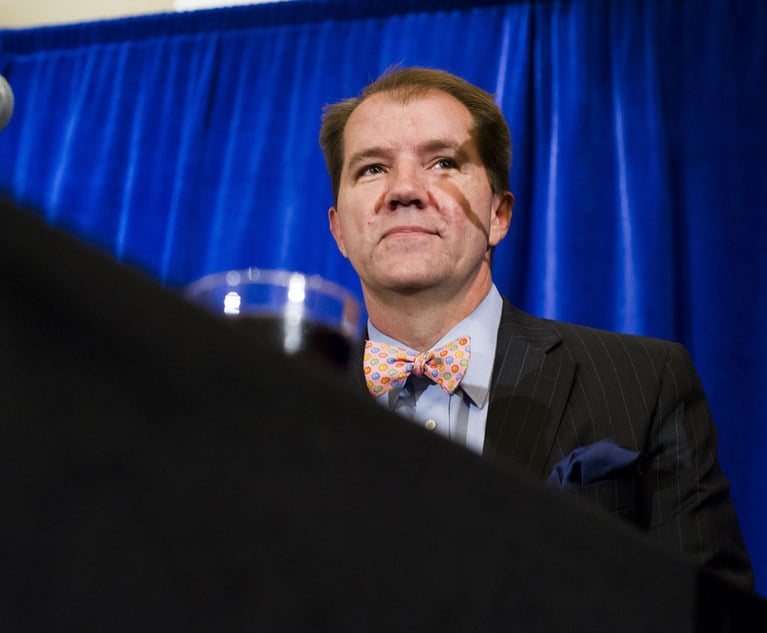

Seth Frotman, the CFPB's former student loan ombudsman, said the deposition would set a “bad precedent” that would deter people from taking government posts.

December 05, 2018 at 08:01 AM

5 minute read

A prominent former Consumer Financial Protection Bureau official is resisting a deposition by Navient Corp. in a student loan lawsuit, arguing that the questioning would require him to discuss confidential information and amount to an “open-ended fishing expedition.”

Seth Frotman, the CFPB's former student loan ombudsman, filed papers in Pennsylvania federal court late Tuesday to block a subpoena issued by Delaware-based Navient, one of the country's largest student loan servicing companies. Frotman resigned from the bureau in August in protest of its Trump-appointed leadership.

Frotman's lawyer, former CFPB attorney Deepak Gupta of Washington's Gupta Wessler, said Navient is pressing to question Frotman “on a breathtakingly broad array of topics,” including privileged communications about the investigation and the “plainly irrelevant” circumstances of his resignation.

The subpoena challenge comes amid a bitter, yearlong discovery dispute between the CFPB and Navient, which has accused the agency of withholding thousands of documents. The agency sued Navient in January 2017, alleging the company misled borrowers and made mistakes that added billions of dollars to repayment bills.

The CFPB has pressed its case against Navient while otherwise pulling back on enforcement under the tenure of acting director Mick Mulvaney, who last year declared an end to the days of the agency “pushing the envelope.” Since taking control of the agency in November 2017, Mulvaney and his top aides have dropped pending cases, dramatically slowed new enforcement actions and weakened the office of fair lending.

Lawyers for Navient, represented by Wilmer Cutler Pickering Hale and Dorr, did not immediately comment.

Frotman ascended to the student loan ombudsman role in 2015, succeeding Rohit Chopra, who has since become a Democratic member of the Federal Trade Commission. Last week, Frotman launched his next step: the Student Borrower Protection Center, a Washington-based nonprofit that will focus on working with state and local officials to help borrowers.

Gupta argued that questioning a former high-ranking official about their government service is allowed only under “extraordinary circumstances” and that the questioning would address information Frotman is prohibited from discussing—either because of attorney-client privilege or other doctrines disallowing the disclosure of certain work at the agency.

“Absent intervention by this court, Navient's subpoena puts Mr. Frotman in an untenable situation: a choice between two incompatible legal commands,” Gupta wrote in Tuesday's filing. “On the one hand, the subpoena commands Mr. Frotman to appear for Navient's open-ended fishing expedition. On the other hand, even if he wanted to spill the beans about privileged and confidential matters arising from his government service, as things stand Mr. Frotman is legally barred from testifying.”

In 2017, the CFPB resisted an Ohio law firm's attempt to depose the agency's former director, Richard Cordray. In early December 2017, just weeks after Cordray stepped down as the agency's director, a federal judge denied the agency's request for a protective order preventing his deposition. Cordray would be deposed later that month in the Columbus, Ohio, office of Jones Day. The law firm Weltman, Weinberg & Reis Co. went on to prevail against the CFPB, beating claims that it misled debtors about the role lawyers played in collecting consumer debts.

Mulvaney had taken steps to weaken Frotman's former office, pushing it out of the agency's enforcement division into the section devoted to consumer education. In his resignation letter, Frotman accused Mulvaney of using the CFPB “to serve the wishes of the most powerful financial companies in America.”

In a declaration included among Tuesday's filings, Frotman said the deposition would set a “bad precedent” that would deter people from taking government posts.

“I fear that it would be a green light to litigants nationwide that they can drag me and other former high-level officials into the very large number of court cases over student-loan-servicing and other consumer-finance practices, which would be very burdensome,” Frotman wrote. “In addition to inappropriately pulling back the curtain on high-level policymaking, and chilling the frank exchange necessary to a good deliberative process, I also worry that this would discourage people from future public service.”

Read more:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'New Circumstances': Winston & Strawn Seek Expedited Relief in NASCAR Antitrust Lawsuit

3 minute read

5th Circuit Rules Open-Source Code Is Not Property in Tornado Cash Appeal

5 minute read

DOJ Asks 5th Circuit to Publish Opinion Upholding Gun Ban for Felon

Trending Stories

- 1Judge Denies Sean Combs Third Bail Bid, Citing Community Safety

- 2Republican FTC Commissioner: 'The Time for Rulemaking by the Biden-Harris FTC Is Over'

- 3NY Appellate Panel Cites Student's Disciplinary History While Sending Negligence Claim Against School District to Trial

- 4A Meta DIG and Its Nvidia Implications

- 5Deception or Coercion? California Supreme Court Grants Review in Jailhouse Confession Case

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250