Foreign-Owned Company Warns Justices of Potential 'Havoc' in Subpoena Feud

"With its decision below, the D.C. Circuit became the first appellate court in American history to exercise criminal jurisdiction over a foreign state," lawyers for the mystery company wrote in their redacted filing at the Supreme Court.

January 22, 2019 at 05:10 PM

6 minute read

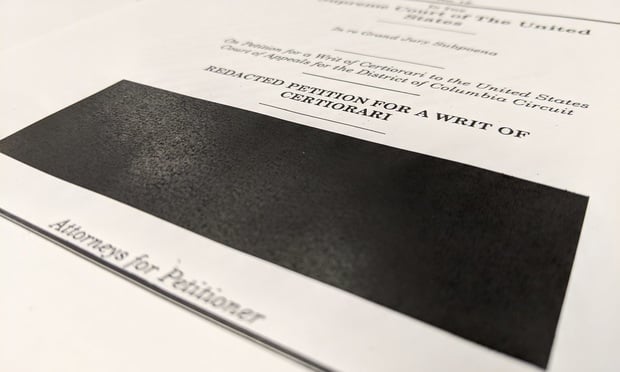

A mystery company's redacted cert petition was unsealed Tuesday.

A mystery company's redacted cert petition was unsealed Tuesday.

The foreign-owned company fighting a grand jury subpoena apparently tied to the special counsel's Russia investigation is warning the U.S. Supreme Court that a decision subjecting the enterprise to the U.S. criminal process would create a “foreign policy nightmare” and invite reciprocal treatment from other countries.

On Tuesday, the Supreme Court unsealed a partially redacted petition from the company's defense lawyers that shed light on a few new details but otherwise maintained the secrecy that has surrounded the case for months. The foreign-owned company is pushing to overturn a decision from a three-judge panel of the U.S. Court of Appeals for the D.C. Circuit, which ruled in December that the company could not invoke sovereign immunity to dodge a grand jury subpoena.

The company's petition cautioned that the D.C. Circuit panel's ruling, if left intact, could have a global ripple effect. The government has until Feb. 21 to respond to the petition.

“If left to stand, the ruling would wreak havoc on American foreign policy—possibly alienating U.S. allies, undermining diplomatic efforts, and inviting reciprocal treatment abroad for American agencies and instrumentalities,” the company's lawyers argued. The lawyers' names were shielded from the public. The D.C. Circuit decision was the “first appellate court in American history to exercise criminal jurisdiction over a foreign state,” the lawyers said in their petition.

Indeed, the decision provided fresh precedent on the subject of immunity for state-owned companies, an area of the law that has long been considered murky. The D.C. Circuit ruling caught some attention from the white-collar bar, as lawyers who are not involved in the fight parsed any potential wider impact of the ruling.

“I think prior to this opinion, many lawyers probably assumed that the evidence held outside the U.S. by the [state-owned] entity would be largely—not entirely, but largely—immune from the reach of a U.S. grand jury. This opinion is a road map for ways of getting around that and making them accessible,” said Debevoise & Plimpton partner Bruce Yannett, a former federal prosecutor who leads the firm's white-collar and regulatory defense practice.

The D.C. Circuit took remarkable measures to conceal the identity of the state-owned company, closing an entire courthouse floor during arguments. Several media reports have presented circumstantial clues suggesting the case is tied to Special Counsel Robert Mueller's ongoing Russia investigation, but the office has declined to comment.

In a redacted opinion that referred to the company's owner only as “Country A,” the D.C. Circuit rejected arguments that the corporation could not be forced to comply with a subpoena under the Foreign Sovereign Immunities Act, a law that shields foreign governments and state-owned companies from lawsuits under certain circumstances.

The appeals panel, upholding a ruling by U.S. District Judge Beryl Howell in Washington, found that even if the immunities law applies to criminal proceedings, a point the government disputed, the corporation would still be required to comply with the subpoena because it falls under an exception for commercial activities.

The D.C. Circuit described the issue of criminal immunities for state-owned corporations as “unsettled,” noting the “paucity” of cases on the subject. “From that paucity,” the D.C. Circuit panel said, “the corporation would have us infer that such corporations are universally understood to possess absolute immunity, but that notion strikes us as highly speculative. An equally likely explanation for the absence of cases is that most companies served with subpoenas simply comply without objection.”

U.S. District Judge Beryl Howell. Credit: Diego M. Radzinschi/NLJ

U.S. District Judge Beryl Howell. Credit: Diego M. Radzinschi/NLJThe company is being fined $50,000 daily for noncompliance with the subpoena. Prosecutors had asked Howell to impose a $10,000 daily fine. The U.S. Supreme Court last month restored the compliance order, rejecting a push from the company's lawyers to keep a freeze on the subpoena.

The D.C. Circuit's decision could come into play particularly in investigations into money laundering and sanctions violations. In the area of sanctions enforcement, Dechert counsel Sean Kane said there have long been questions about whether foreign entities can be forced to comply even with administrative subpoenas issued by the Treasury Department's Office of Foreign Assets Control, or OFAC.

Kane, a former assistant director for policy at OFAC, said the D.C. Circuit ruling “removes one argument from the quiver if you're a state-owned enterprise.”

Joon Kim, a Cleary Gottlieb Steen & Hamilton partner and former acting U.S. attorney for the Southern District of New York, said the decision could give prosecutors more leverage when they subpoena state-owned foreign corporations.

“There are regions in the world with many partially or fully state-owned companies engaged in commercial business,” Kim said. “To the extent these state-owned enterprises in these countries thought there was a question or uncertainty about whether or not they could be subject to the criminal process in the U.S., this decision, at least, says they are.”

Kim said prosecutors in the past might not have been inclined to litigate a foreign, state-owned company's claims to immunity to a grand jury subpoena. “Now, prosecutors would be more likely to press since they have a circuit court decision that they can point at to compel compliance or use in any litigation over the issue,” he said.

The redacted Supreme Court petition is posted below:

Read more:

Gibson Dunn Team Fights Secrecy in Apparent Mueller Subpoena Fight

Justices Restore Contempt Order Against Corporation Defying Apparent Mueller Subpoena

Appeals Court Just Delivered Blow to Company Fighting Apparent Mueller Subpoena

DC Circuit Secrecy Keeps Apparent Mueller Grand Jury Fight Under Wraps

Justice Department Fights Claims Mueller's Probe Is Out of Control

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

SEC Official Hints at More Restraint With Industry Bars, Less With Wells Meetings

4 minute read

CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250