Here's the 'Extraordinary' Story of Treasury Nominee Bimal Patel, Ex-O'Melveny Partner

“I am so fortunate that the doctors saved my life and that my parents, particularly my mom, always believed in me,” Patel, up for a key Treasury post, told U.S. senators on Thursday at his confirmation hearing.

February 14, 2019 at 12:55 PM

5 minute read

Bimal Patel, formerly of O'Melveny & Myers. Courtesy photo

Bimal Patel, formerly of O'Melveny & Myers. Courtesy photo

Born three months premature, weighing two pounds and two ounces, Bimal Patel entered life facing long odds of growing up to tell the U.S. Senate of his improbable journey to being nominated for a top U.S. Treasury Department post.

As he told members of the Senate Banking Committee on Thursday, he contracted pneumonia at two weeks old. “Doctors,” Patel said, “told my parents that I would never grow past four feet tall, that I would be incapacitated, and that I would die.”

Patel is in line for a top supervisory role at the U.S. Treasury Department—assistant secretary for financial institutions. Since May 2017, Patel has served as deputy assistant secretary for the Financial Stability Oversight Council, a panel created under the Dodd-Frank financial reforms charged with promoting market discipline and responding to emerging risks.

“I am so fortunate that the doctors saved my life and that my parents, particularly my mom, always believed in me,” said Patel, a former top financial regulatory partner at O'Melveny & Myers in Washington.

But his story began years before he was born, when his father left a life as a peanut farmer in rural India to pursue an education in the United States. His father, seated behind him at Thursday's hearing, would go on to receive a Ph.D. from New York University and run a number of small businesses in Georgia while teaching at Spelman College, a historically black all-women's college in Atlanta.

Patel's story struck members of the committee, with Sen. Thom Tillis, R-North Carolina, calling it “extraordinary.” But it did not pave an entirely smooth path for Patel during Thursday's confirmation hearing, in which members of the Senate Banking Committee largely focused on Mark Calabria, the Trump's administration's nominee to lead the Federal Housing Finance Agency.

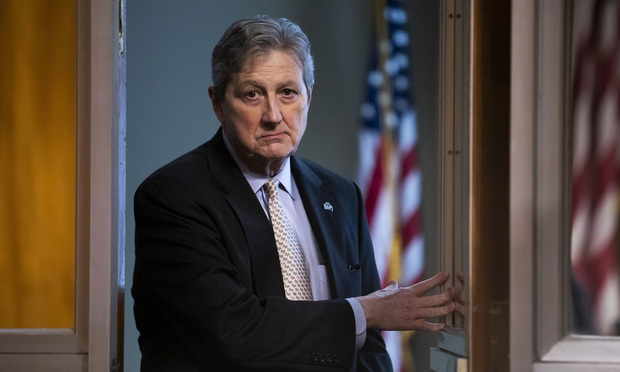

At one point in the hearing, Patel drew raised eyebrows from U.S. Sen. John Kennedy, R-Louisiana, who asked whether there are any banks that are “too big to fail.” Among the Financial Stability Oversight Council's tasks is determining whether institutions are systemically important, or “too-big-to-fail.”

Senator John Kennedy (R-LA). Credit: Diego M. Radzinschi / NLJ

Senator John Kennedy (R-LA). Credit: Diego M. Radzinschi / NLJHere's the exchange between Kennedy and Patel:

Kennedy: Do you believe we still have banks that are too big to fail?

Patel: Senator, I believe comparing to pre-crisis levels that financial institutions on the whole are better—

Kennedy: Do you believe that we have banks that are too big to fail?

Patel: I believe in the aggregate that we have greater visibility and resolvability—

Kennedy: Am I missing something here? I'm not connecting with you. Do we still have banks that are too big to fail? Now, you're going to run financial institutions in this country—that's kind of a basic question.

Patel: It is. I think the circumstances surrounding the failure are very fact-dependent.

Kennedy: Well, you're not going to answer the question are you? OK, let me try another one. We did have a financial meltdown in 2008, right?

Patel: We did, yes.

Kennedy: Oh, thank god.

Kennedy: Do you find it embarrassing that many financial institutions that contributed to that meltdown were not held accountable? Not just the institutions—but the people responsible.

Patel: I strongly believe in protecting taxpayers and I hope that we never have to live through another set of events like—

Kennedy: Mr. Patel, I'm not going to vote for you if you don't answer my questions. I don't mean to be rude. But I need answers. We should get you to do your job.

Patel: We should hold accountable those responsible—

Kennedy: And we didn't—did we?

Patel: In some cases we did not.

Kennedy: Right—see that was easy.

Patel: I apologize.

Kennedy: I'm not against big. I'm against dumb. I'm not a big regulation kind of guy. But I'm against not properly regulating our financial markets. The emphasis is properly—and you've got to do that.

Patel: I commit to you, that if I am fortunate enough to be confirmed I will work with you and try to address your concerns.

Read Patel's opening statement below:

Read more:

Ex-O'Melveny Partner Bimal Patel Picked for Key Treasury Post

Former O'Melveny Chair Culvahouse Reports $1.7M Income in Ambassador Filing

Get to Know Martha Pacold, Treasury Lawyer and Ex-Thomas Clerk Up for Court Seat

Why the Treasury Department's Top Lawyer Sold Off His Bitcoin Holdings

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

SEC Official Hints at More Restraint With Industry Bars, Less With Wells Meetings

4 minute read

CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

Wells Fargo and Bank of America Agree to Pay Combined $60 Million to Settle SEC Probe

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250