Judge's Pay-Data Ruling, a Trump Rebuke, Puts New Squeeze on Employers

"I imagine there are a lot of questions being posted and everyone is trying to figure out what this means,” one labor and employment lawyer says.

March 06, 2019 at 01:20 PM

6 minute read

The original version of this story was published on Law.com

A Washington judge's order reinstating an Obama-era rule that requires greater disclosure of private workforce pay data has put new pressure on employers and management-side lawyers, as a deadline to comply with the regulation approaches and uncertainty lingers over whether the government will challenge the ruling.

The Trump administration failed to provide sufficient reasoning to block enforcement of the new pay-data reporting rule, U.S. District Judge Tanya Chutkan of the District of Columbia said in her decision this week. The regulation, which requires disclosure of pay information based on gender, race and ethnicity, was adopted by the U.S. Equal Employment Opportunity Commission as one measure to spotlight and combat pay disparities.

Chutkan's order means that employers with more than 100 workers must comply with the new reporting requirement by May 31. The EEOC has not said whether the agency will try to extend the deadline, and the U.S. Justice Department has not indicated whether the government will try to quickly appeal the ruling. The National Women's Law Center was a plaintiff in the case, filed in 2017 after the Trump administration scuttled the pay-data rule.

Labor and employment specialists are now faced with advising corporate clients whether and how to comply with the reinstated rule, which companies had long resisted as burdensome and potentially an open invitation for lawsuits confronting alleged workplace disparities.

“Right now, my advice for employers is to hit pause,” said Guy Brenner, a Proskauer Rose labor and employment partner in Washington. “No one thought they would have to submit this report and this is not an insignificant burden. I imagine there are a lot of questions being posted and everyone is trying to figure out what this means.”

U.S. government lawyers who defended the block on the new rule had cautioned Chutkan against any reinstatement, saying such a move “could upset the current expectation of filers, who may not be aware of this litigation nor its potential impact on their obligation.”

U.S. District Judge Tanya S. Chutkan. Credit: Diego M. Radzinschi / ALM

U.S. District Judge Tanya S. Chutkan. Credit: Diego M. Radzinschi / ALMChutkan said the government's “speculation is unsupported by the record.” The judge said the revised pay data collection “had been in place for almost a year by the time it was stayed.” Companies, the judge said, “were on notice that the stay could be withdrawn at any time.”

Jenny Yang, a former EEOC chair during the Obama administration, said the revised form was crafted with the aim of encouraging employers to set compensation practices in a job-specific way and to help the agency fight a culture of secrecy about how much employees are paid.

“Pay data collection is long overdue,” Yang said. “We would have had the second year of data by the end of March if there hadn't been a delay in the process.”

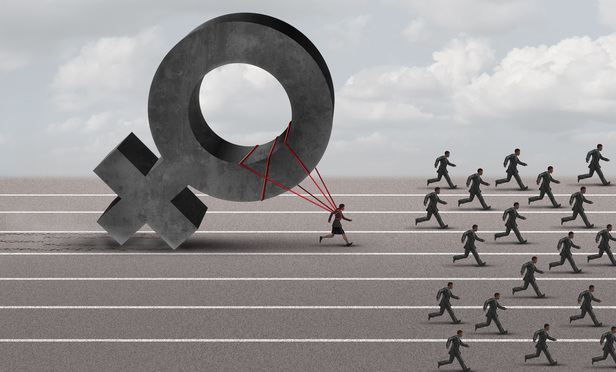

In the backdrop of the case is an increasing spotlight on equitable pay in the United States, where reports show women make 80 cents on the dollar to men in comparable positions. There have been calls for increased transparency from federal, state and local lawmakers in recent years to address wage gaps.

The business community pushed back against the new pay-data reporting requirements, arguing they were onerous and would not properly address why there were gaps. Companies in recent years, in part sparked by the #MeToo movement, have begun to take on pay equity analyses and other efforts.

Klair Fitzpatrick, a Morgan, Lewis & Bockius employment partner in Philadelphia, said clients were preparing to comply with the changes, even though they believe they impose “burdensome requirements and have the potential to be misused.”

Fitzpatrick said the firm has been pushing companies to conduct pay equity studies and take into account how the government will look at their pay, as well as other factors such as what influences the pay.

“It's really in an employer's best interest to be proactive before the government asks for data,” Fitzpatrick said. “We're looking at the bigger picture: What does my employment population look like and where do we have issues? The #MeToo movement and other efforts have propelled employers to focus on these issues.” She added: “I'm not saying it's going to be easy.”

Jay Patton, a shareholder at Ogletree, Deakins, Nash, Smoak & Stewart, said employers need clarity and that the May 31 reporting deadline would create compliance headaches for companies.

“To have employers do it now would be a major change and cause serious restructuring in how data is kept and collected for the filing process,” he said.

➤➤ Get employment law news and commentary straight to your in-box with Labor of Law, a new Law.com briefing. Learn more and sign up here.

Meanwhile, there are imminent changes at the EEOC itself, as the Trump administration's nominee to lead the agency recently cleared a committee vote and is awaiting confirmation. The nominee, Janet Dhillon, has indicated support for pay-data collection, but perhaps not in the revised form that was just reinstated.

Littler Mendelson shareholder James Paretti Jr. in Washington, a former senior counsel at the EEOC, said the agency is scrambling. The revised reporting requirements included expanded data points that mean more information for both companies—and the agency—to process.

“Employers have relied on OMB's stay and have not put resources into tracking the information,” he said. “EEOC similarly has not prepared their infrastructure.”

Erin Connell, an employment partner at Orrick, Herrington & Sutcliffe in San Francisco and co-chair of the firm's pay equity task force, suggested it would be “reasonable to push back the deadline and address the moving pieces.”

Regardless of whether or not the new pay data rules are implemented now, or later this year, management attorneys said the spotlight on compensation equality won't be soon to fade. State and local governments have ramped up their own rules in recent years, and numerous class actions will keep attention on complaints of disparities. Companies are also feeling greater pressure from shareholders and boards of directors.

“We will see this issue surface in some form or another,” said Fisher & Phillips partner Cheryl Behymer.

Read more:

Federal Judge Hits Trump Agency for 'Illegal' Move to Stop New Pay-Data Rule

Why the US Labor Dept. Is Dropping Its Google Pay-Data Appeal

Suspending Obama-Era Pay Data Rule Was Lawful, DOJ Tells Court

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Hours After Trump Takes Office, Democratic AGs Target Birthright Citizenship Order

4 minute read

Private Equity Giant KKR Refiles SDNY Countersuit in DOJ Premerger Filing Row

3 minute read

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250