Judge Carl Nichols Is Assigned to Trump's Bid to Keep NY Tax Returns Secret

The former WilmerHale partner and clerk to Justice Clarence Thomas was assigned Friday to Trump's new lawsuit. Nichols was confirmed to the bench in May.

July 26, 2019 at 09:22 AM

5 minute read

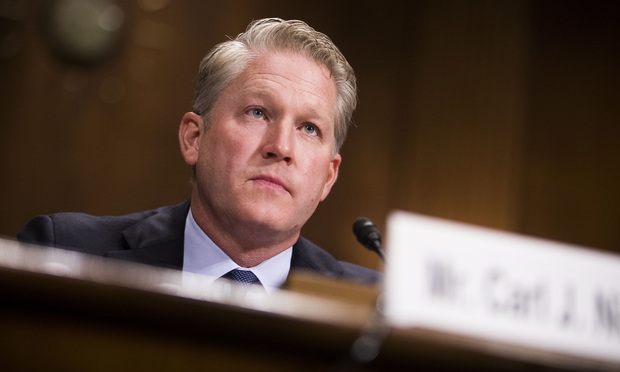

Carl Nichols testifies before the Senate Judiciary Committee during his confirmation hearing to be U.S. district judge for the District of Columbia in August 2018. (Photo: Diego M. Radzinschi/ALM)

Carl Nichols testifies before the Senate Judiciary Committee during his confirmation hearing to be U.S. district judge for the District of Columbia in August 2018. (Photo: Diego M. Radzinschi/ALM)

U.S. District Judge Carl Nichols in Washington, the most recent trial judge confirmed to the bench, was assigned Friday to preside over President Donald Trump's bid to prevent a U.S. House committee from obtaining his New York state tax returns.

The assignment came less than 24 hours after U.S. District Judge Trevor McFadden spurned the president's attempt to put the case in his court. McFadden is presiding over a case the House filed against the Treasury Department and IRS, and Trump's lawyers had designated the new lawsuit as “related” to the pending one.

Nichols, like McFadden, was appointed by Trump to the federal trial court. A former Wilmer Cutler Pickering Hale and Dorr regulatory partner, Nichols was confirmed in May. The former clerk to Justice Clarence Thomas, during the 1997-1998 term, was earlier a leading U.S. Justice Department appellate lawyer before joining WilmerHale.

This week, Trump's lawyers at Consovoy McCarthy had urged McFadden to quickly block the House Ways and Means Committee from obtaining copies of the president's New York state tax returns under a new law that permits state authorities to share the tax filings of top government officials on a request from a U.S. congressional committee.

At a hearing Thursday, McFadden said the two tax-returns suits were not “related” and Trump's new case would be reassigned randomly to another judge. McFadden, quoting language from an unrelated 2000 case, said he was mindful of trying “to avoid the appearance of judge-shopping or favoritism in assignments and to assure that cases were assigned on an impartial and neutral basis.”

New York state lawmakers said at the time the law was passed, just a few weeks ago, that the move would allow greater cooperation between state and federal officials. Trump, despite vowing for months on the campaign trial that he would release his tax returns, has refused to do so. Trump was the first presidential candidate in modern times not to release tax returns.

Trump's lawyer William Consovoy argued that the House Ways and Means Committee, acting under the New York state law, called the Trust Act, could request Trump's tax returns “at any time, with no notice to the president. And New York could respond to the request nearly instantaneously, mooting the president's ability to object before his tax records are disclosed.”

Consovoy claimed Congress has no legitimate legislative interest in the president's tax records. He also challenged the constitutionality of the Trust Act, arguing it was enacted this month to “discriminate and retaliate against President Trump for his speech and politics,” in violation of the First Amendment.

House lawyers contend that the committee's consideration of seeking Trump's state tax returns is “immune from challenge through the court system.” The House Democrats have not yet formally requested the state tax returns from New York.

“Mr. Trump's complaint and his emergency application brazenly request that this Court violate the separation of powers and enjoin the Ways and Means Committee from even embarking on legislative activity squarely within its Article I powers,” Douglas Letter, the House general counsel, said in a court filing.

Trump's lawsuit initially landed in McFadden's court because he is presiding over a separate case in which the House has sued the Treasury Department and IRS for copies of the president's federal tax returns. In that case, the IRS has refused to comply with a House Ways and Means subpoena seeking federal returns between 2013 and 2018. Federal law requires the IRS to furnish—on request by the Ways and Means Committee—the tax returns of any private citizen.

The lawsuits related to Trump's tax returns are among several in Washington and New York courts that seek financial records tied to the president. Trump's attorneys lost two bids recently to block House committee subpoenas seeking records from Mazars USA, the president's longtime accounting firm, and from his primary lender, Deutsche Bank.

Read more:

How WilmerHale's Carl Nichols Got Trump's Nod for DC Federal Trial Bench

Who Is Trevor McFadden? Meet the Judge Assigned the Trump Tax Returns Case

Justice Dept., Silent on Trump's Subpoena Fights, Is Invited to Express Views

Trump's Lawyer Faced Skeptical DC Circuit Panel in Subpoena Fight

Trump Sues to Strike Down NY Law Over Tax Returns

READ: US House Asks Judge to Force Disclosure of Trump's Taxes

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

Wells Fargo and Bank of America Agree to Pay Combined $60 Million to Settle SEC Probe

Supreme Court May Limit Federal Prosecutions Over 'Misleading' but True Statements

CFPB Alleges Berkshire Hathaway Subsidiary Originated Unaffordable Housing Loans

Trending Stories

- 1Goodwin Procter Relocates to Renewable-Powered Office in San Francisco’s Financial District

- 2'Didn't Notice Patient Wasn't Breathing': $13.7M Verdict Against Anesthesiologists

- 3'Astronomical' Interest Rates: $1B Settlement to Resolve Allegations of 'Predatory' Lending Cancels $534M in Small-Business Debts

- 4Senator Plans to Reintroduce Bill to Split 9th Circuit

- 5Law Firms Converge to Defend HIPAA Regulation

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.