In Trump Tax Returns Case, Lawyers at Odds Over Next Steps

"Notwithstanding their best efforts, the parties are unable to reach agreement," Trump's attorneys and lawyers for the U.S. House tell a Washington federal trial judge.

July 30, 2019 at 06:55 PM

6 minute read

Carl Nichols, appearing at Senate Judiciary for his confirmation hearing last year. Photo: Diego M. Radzinschi / ALM

Carl Nichols, appearing at Senate Judiciary for his confirmation hearing last year. Photo: Diego M. Radzinschi / ALM

President Donald Trump's personal attorney and U.S. House lawyers said Tuesday they were unable to reach an agreement over how to proceed in the president's bid to prevent federal lawmakers from seeking copies of his New York state tax returns.

The impasse threw further uncertainty into Trump's push to bar House Democrats from seizing on a New York law, passed only weeks ago, that opened a path for lawmakers to request the tax returns from state finance officials. Trump, defying norms, has refused to release his state and federal tax returns, despite promises that he would do so.

The two sides, along with the New York state attorney general's office, were directed to the negotiation table by U.S. District Judge Carl Nichols of the District of Columbia, a Trump court appointee who joined the bench just a few weeks ago.

At a court hearing Monday, Nichols said the case presented him with a procedural “conundrum,” as the Democrat-controlled House Ways and Means Committee has not yet made any request for Trump's New York tax returns. But Nichols also noted that New York officials could provide Trump's tax returns to House Democrats without notifying the president, rendering the case moot before it could be fully heard.

Nichols ordered the two sides to try to negotiate a process that would preserve the president's ability to challenge any production of his state tax returns to House Democrats. About a half hour before their 6 p.m. deadline, the lawyers said they could not reach such a compromise.

House general counsel Douglas Letter, in a joint court filing with Trump's lawyer and the New York state attorney general's office, stressed that Congress enjoys broad legislative immunity that should shield it from the president's push for an injunction. Any such order issued against the committee, Letter argued, would mark the first time—”as far as counsel for the House is aware”—that a court has overridden that immunity and stopped a body of Congress from taking legislative steps.

“This is of particular concern where the injunction against a body of Congress would be issued at the behest of the President, raising glaring separation of powers concerns; this is precisely what the Framers of the Constitution wished to guard against,” Letter said.

Trump's lawyer, William Consovoy of the Washington firm Consovoy McCarthy, proposed that the House Ways and Means Committee be required to provide 14 days' notice of any request for the president's state tax returns. Consovoy also offered an alternative: New York should notify Nichols of any request it receives from the House and wait 14 days before providing Trump's tax returns.

William Consovoy of Consovoy McCarthy at a meeting of the Federalist Society. Washington, D.C. April 17, 2018. Photo: Diego M. Radzinschi/ALM

William Consovoy of Consovoy McCarthy at a meeting of the Federalist Society. Washington, D.C. April 17, 2018. Photo: Diego M. Radzinschi/ALMAndrew Amer, a special litigation counsel for the New York attorney general's office, argued that the state's offices fell outside Nichols's jurisdiction as a trial judge in Washington. Trump's claims against New York, he argued, should be dismissed or at the very least be transferred to Manhattan federal district court.

Still, if Nichols set an expedited schedule for hearing arguments on the jurisdiction question, Amer said the commissioner of the New York finance department would temporarily hold off on responding to any request for Trump's state tax returns.

That respite would end a week after Nichols's ruling on the jurisdiction issue, Amer said, giving Trump a “reasonable opportunity to take whatever steps he deems necessary to protect his interests” if the judge rules for New York. If Nichols rules against New York, Amer said, the state's proposal would give the parties time to meet and consider next steps.

Trump's lawsuit takes aim at the Trust Act, a New York law enacted earlier this month that allows state finance officials to turn the president's tax returns over to Congress. The law, according to the president's lawyers, was “enacted it to discriminate and retaliate against President Trump for his speech and politics,” in violation of his First Amendment rights. Consovoy has argued that House Democrats lack a valid legislative purpose for seeking the president's tax returns.

A co-sponsor of the New York bill said the measure was one step to give the U.S. Congress another oversight tool as a co-equal federal branch of government. “This is an important juncture in our history where we have a White House stonewalling Congress and preventing it from undertaking its oversight responsibility,” State Sen. Brad Hoylman, a Manhattan Democrat, said in May.

The case is one of several in Washington and New York courts that confront the secrecy of Trump's financial records.

Two federal appeals courts are weighing trial judges' orders that said congressional committees are permitted to obtain records from Trump's longtime lender Deutsche Bank and his accounting firm Mazars USA. Separately, the House has sued the Trump administration to obtain six years' worth of the president's federal tax returns.

A lawyer for Trump on Tuesday threatened to sue California over a new state law, signed by the governor, that requires presidential candidates to submit their tax returns in order to appear on the ballot.

Trump has maintained that he is being audited but otherwise would release his tax returns. “I don't mind releasing. I'm under a routine audit, and it will be released. As soon as the audit's finished, it will be released,” Trump said shortly before the 2016 election.

Read more:

New DC Judge Urges 24-Hour Detente in Trump Tax Returns Case

Judge Carl Nichols Is Assigned to Trump's Bid to Keep NY Tax Returns Secret

Who Is Trevor McFadden? Meet the Judge Assigned the Trump Tax Returns Case

Justice Dept., Silent on Trump's Subpoena Fights, Is Invited to Express Views

Trump's Lawyer Faced Skeptical DC Circuit Panel in Subpoena Fight

READ: US House Asks Judge to Force Disclosure of Trump's Taxes

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

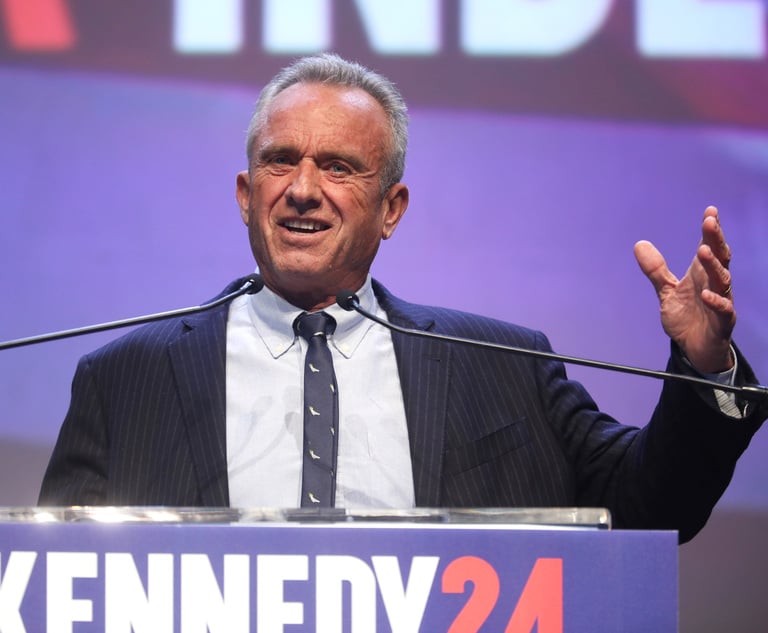

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute read

Am Law 200 Firms Announce Wave of D.C. Hires in White-Collar, Antitrust, Litigation Practices

3 minute read

Trump Administration Faces Legal Challenge Over EO Impacting Federal Workers

3 minute readTrending Stories

- 1No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 2Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 3Meet the New President of NY's Association of Trial Court Jurists

- 4Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

- 5Freshfields Hires Ex-SEC Corporate Finance Director in Silicon Valley

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250