DC Judge in Trump Tax Returns Case Agonizes Over a Bunch of What-Ifs

Judge Carl Nichols, a Trump appointee, threw a bunch of hypotheticals at the attorneys as he waded into a fight over the president's New York tax returns.

September 18, 2019 at 03:18 PM

6 minute read

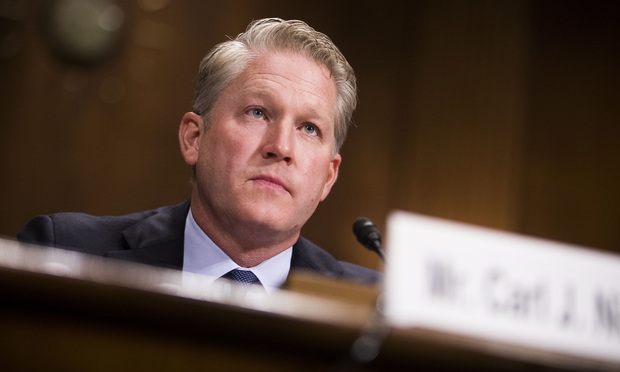

Carl Nichols testifies before the Senate Judiciary Committee during his confirmation hearing to be U.S. district judge for the District of Columbia, on Aug. 22, 2018.

Carl Nichols testifies before the Senate Judiciary Committee during his confirmation hearing to be U.S. district judge for the District of Columbia, on Aug. 22, 2018.

A federal judge weighing where a fight over President Donald Trump's New York state tax returns will unfold got bogged down in legal hypotheticals Wednesday, with lawyers saying some of the make-believe issues brought up in court aren't necessarily relevant or are unlikely to play out.

U.S. District Judge Carl Nichols of the District of Columbia, a recent appointee who is grappling with his first major case in the Trump tax proceedings, didn't signal exactly how he will rule on the jurisdiction fight. But the judge made it clear that he isn't taking anything for chance, repeatedly laying out hypotheticals—including one that he acknowledged might not impact his ruling.

The potential scenarios may be apt for a case that relies on a hypothetical premise: whether the House Ways & Means Committee chooses to take advantage of a recently passed New York state law and request Trump's tax returns.

Trump's attorneys at Consovoy McCarthy have argued in briefings that the injury posed to Trump takes place in D.C. But lawyers for the state authorities said a federal court in New York should handle the matter because it's a New York law relating to New York officials and records.

Nichols at several points in the hearing presented potential ways the situation could play out. He repeatedly asked attorneys for both parties to "assume away" certain factors for the situations he presented to them.

At times, Nichols' questions seemed to exasperate Andrew Amer, the attorney representing New York officials, who told the judge that some scenarios were unlikely to play out because of other legal arguments that would have taken place beforehand.

New York officials are requesting that Nichols dismiss a count in the complaint against them for lack of jurisdiction. That count alleges that the New York law violates the First Amendment because it was created "to retaliate against the president."

However, Consovoy & McCarthy's Patrick Strawbridge, arguing on behalf of Trump, said the president's legal team likely would not seek a legal case in New York. He said they lacked the resources to be able to handle two cases pertaining to the law in two different federal courts, and that they believed the main issue of the case could be resolved in D.C.

Amer sought to shoot down arguments presented by Trump's team that claimed New York Attorney General Letitia James may have coordinated with House Democrats to get the state law passed.

Amer said state tax Commissioner Michael Schmidt is the only official actually implicated in the case, as he would enforce the law, not the attorney general. He said Trump's lawyers can't "mix and match the defendants."

Nichols then presented another hypothetical: If New York officials and members of the House met and decided the state should enact the law as the best way for Congress to get Trump's tax returns, could that count as conspiracy?

"There's no such thing as a conspiracy to pass legislation," Amer replied.

And the New York lawyer hit the Trump legal team's request to conduct some jurisdictional discovery, saying that effort was not made on a "good faith basis," calling it a "fishing expedition."

Nichols posed other hypotheticals to Strawbridge, like how much action the tax commissioner would have to take in D.C. in order for the injury to take place there.

The judge contrasted a pair of scenarios, one in which the commissioner solely reviewed, gathered and shipped the tax documents from New York to D.C., and another where the commissioner traveled to D.C. to produce the documents to lawmakers.

Strawbridge maintained that the disclosure of the president's tax information to Congress alone was enough to show injury. But he said that if Nichols granted them jurisdictional discovery, they may be able to obtain documents from New York authorities showing potential plans of what would happen if lawmakers were to request the state returns.

"This might not even matter," Nichols asked at one point, "but is Mr. Trump still a New York citizen?"

"A New York citizen attempting to sue New York defendants but doing all of that in D.C. is a little different than a D.C. citizen," doing so, the judge said. But he hedged his own hypothetical by nothing that Trump is in D.C. because he's the president, and that the law only applies to Trump because of his office.

Strawbridge said he was "hesitant to answer" about which state Trump is currently a resident. But he said that information was secondary, because the harm to Trump would still happen in D.C.

House general counsel Douglas Letter also told Nichols that the House plans to file its own motion to dismiss, causing Nichols to question whether he should rule on both the New York and House motions at once.

Letter and Amer came out against that suggestion. Letter noted that the deadline for the House to make its filing was in late October, meaning that Nichols wouldn't rule on it for several weeks after Wednesday's hearing.

Amer said the House's arguments and issues are likely substantially different than the ones brought by his state, and that New York officials had agreed to an order temporarily preventing them from providing the House with Trump's state returns if asked, with the understanding that Nichols would rule on the jurisdiction issues promptly.

Nichols ended the hearing by making it clear he will not rule on the case swiftly. He told the parties to not expect an opinion "within 24 hours," and gave both sides a week to file any additional information or supplemental authorities with his court.

"I have no present intention of not deciding it," he said of the motion, clarifying that New York agreeing to not provide Trump's state tax returns to Congress while the jurisdiction debate plays out is not a "de facto" concession to the president's lawyers.

"That's not to say I find this an easy matter," Nichols added.

Read more:

Trump's Lawyers Mount New Effort to Keep DC Judge on Tax Returns Lawsuit

After Speedy Subpoena Cases, Trump Tax Disputes Linger

NY AG Rebukes Trump Claim of Coordination With Congressional Democrats

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

4th Circuit Revives Racial Harassment Lawsuit Against North Carolina School District

3 minute read

Fenwick and Baker & Hostetler Add DC Partners, as Venable and Brownstein Hire Policy Advisers

2 minute read

DOJ, 10 State AGs File Amended Antitrust Complaint Against RealPage and Big Landlords

4 minute read

Special Counsel Jack Smith Prepares Final Report as Trump Opposes Its Release

4 minute readTrending Stories

- 1SDNY US Attorney Damian Williams Lands at Paul Weiss

- 2Litigators of the Week: A Knockout Blow to Latest FCC Net Neutrality Rules After ‘Loper Bright’

- 3Litigator of the Week Runners-Up and Shout-Outs

- 4Norton Rose Sues South Africa Government Over Ethnicity Score System

- 5KMPG Wants to Provide Legal Services in the US. Now All Eyes Are on Their Big Four Peers

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250