Arnold & Porter Resists Pay Cuts as COVID-19 Crisis Follows Revenue Dip

Grappling with the pandemic in the wake of flat or declining 2019 finances, the firm has held off from announcing furloughs, layoffs or compensation cuts.

April 17, 2020 at 06:00 PM

6 minute read

Arnold & Porter Kaye Scholer offices in Washington, D.C. Courtesy photo.

Arnold & Porter Kaye Scholer offices in Washington, D.C. Courtesy photo.

Responding to the coronavirus crisis, Arnold & Porter Kaye Scholer said it will transform its summer associate program into a five-week remote program and is takings steps to aggressively manage expenses—without making pay cuts.

No large cost-cutting measures at Arnold & Porter have been publicly reported. The Am Law 50 firm's chairman, Richard Alexander, said in a statement it has "not announced any changes to our staffing levels or compensation." A spokeswoman confirmed late in the week that no furloughs, layoffs or compensation cuts had been made among staff and attorneys, and there had been no reductions in partner draws or distributions.

However, Alexander said the firm is "continuing to watch the market very closely and taking appropriate steps in response, including aggressively managing the expenses of the firm." When asked what expenses the firm was managing, the spokeswoman cited costs related to travel, in-person training, "and other operational expenditures."

"Our focus remains on the health and well-being of our colleagues while continuing to serve our clients" to help them weather the crisis, said Alexander in his statement.

In holding a remote summer associate program, Arnold & Porter joins others in the approach, including Orrick, Herrington & Sutcliffe, which has announced a five-week virtual arrangement. DLA Piper has also been weighing whether to hold a five-week program remotely. Arnold & Porter said it expects all 2Ls will receive offers to join the firm as first-year associates in 2021.

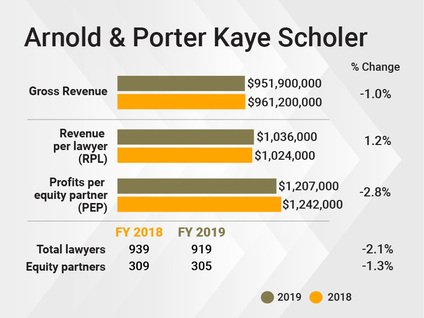

Revenue, Partner Profits Inch Down

Last year, Arnold & Porter's revenue contracted about 1% to $951.9 million. With a 2% drop in attorney head count, the firm's revenue per lawyer rose just over 1% to $1.036 million.

The total net income dropped 4% to $368.16 million, even with four fewer equity partners. Profits per partner dipped 2.8% to $1.2 million. But its profit margin, while seeing a small dip last year, remained relatively high in 2019 at 39%.

Alexander, in a late March interview about the firm's financial performance, said the partnership in 2019 continued to "successfully leverage" the integration of the Arnold & Porter and Kaye Scholer firms, which merged in 2017, leading to expanding work for clients and combined strengths that brought in new clients.

Alexander, in a late March interview about the firm's financial performance, said the partnership in 2019 continued to "successfully leverage" the integration of the Arnold & Porter and Kaye Scholer firms, which merged in 2017, leading to expanding work for clients and combined strengths that brought in new clients.

But he pointed to several factors that impaired the firm's revenue growth last year, including a lax regulatory environment, a collections shortfall and pricing pressures.

Arnold & Porter has a substantial regulatory practice, which he called a "market differentiator."

"There is no question that the current administration's focus on deregulation has had an impact on those practices," he said. "When you have wholesale government agencies who are no longer enforcing certain parts of the federal regulatory apparatus that we have strong practices in, that's going to have an impact."

Also, he said the firm saw a "slight shortfall" on its collections at the end of 2019, which he said was a matter of timing.

He added the firm was also not immune to pricing pressures. The firm's clients include Fortune 50 and 100 corporations. "They give us their most important work and they also are very, very demanding from a pricing standpoint," Alexander said.

Meanwhile, when looking at year-over-year changes, he said Arnold & Porter had a "very significant" non-litigation matter that ended in late 2018, declining to specify the matter. "It takes some time to ramp that work back up," he said.

On 2020, he said, while the firm was trying to conduct business as usual, "we are also doing a lot of contingency planning." But he pointed to 2008, when many law firms were laying off lawyers during the Great Recession. Arnold & Porter "did none of that and we managed through that quite successfully. That's my focus. My focus is on our clients and our people and all the other important constituent relationships we have," he said.

He said it was incumbent on law firm leadership to conduct stress testing, to be transparent with lenders, partners and associates, to recognize when demand changes in pockets of the firm and to be nimble in utilizing resources

The last few weeks had been "among the busiest" at the firm, he said in the late March interview, citing the need for counseling on the stimulus legislation and demand for restructuring, finance and in life sciences and health care practices.

"The work in 2020 is going to shift," he said. "All law firms are going to experience this, and I think some firms will be resilient because of the diversification of their practice."

The firm's lawyers are now in their fourth year after the merger of New York-based Kaye Scholer and Washington, D.C.-based Arnold Porter. Alexander said the merger brought "expanded product offerings to our clients," which had been "a home run" and the firm had been able to hire talent that it otherwise wouldn't have been able to bring in.

Looking Ahead

While the combined firm has had flat revenue growth in its first few years, Alexander said it has done a "done a good job these three years of setting the building blocks."

Now, he said, "what we need to do is take what we have and to leverage it and to continue to grow our practice, and I feel like we've done the hard blocking and tackling necessary to put us in a good position."

He also acknowledged that there's still more to be done to maximize the benefits of the firm's merger. Three years later, Arnold & Porter's leadership wants to make sure there's "depth of practice" throughout all offices and wants to build its transactional group. "We have been spending a lot of time focusing on the growth of our offices outside New York and Washington, and we've been actively involved in lateral discussions," he said.

Arnold & Porter's equity partnership has grown smaller since the merger, from 322 partners in 2017 to 305 last year. Alexander cited a number of factors, including retirements. "It's a combination of continuing to deal with the life cycle of people and continuing to hold our partners to a high standard and then investing in the next generation," he said, adding the firm has promoted 36 new partners since the combination.

Arnold & Porter scored high profile courtroom wins last year, while working on noteworthy deals, especially in the health care industry. For instance, the firm represented Alcon Laboratories, a division of longtime client Novartis, in its $285 million acquisition of PowerVision Inc., a medical device development company.

Meanwhile, the firm won attention for helping overturn Pennsylvania's gerrymandered legislative map and convincing the U.S. Supreme Court to halt the Trump administration's attempt to add a citizenship question to the 2020 census.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Am Law 100 Lateral Partner Hiring Rose in 2024: Report

Sidley Adds Ex-DOJ Criminal Division Deputy Leader, Paul Hastings Adds REIT Partner, in Latest DC Hiring

3 minute read

‘High Demand’: Former Trump Admin Lawyers Leverage Connections for Big Law Work, Jobs

4 minute readLaw Firms Mentioned

Trending Stories

- 1Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 2Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

- 3Jackson Lewis Leaders Discuss Firm's Innovation Efforts, From Prompt-a-Thons to Gen AI Pilots

- 4Trump's DOJ Files Lawsuit Seeking to Block $14B Tech Merger

- 5'No Retributive Actions,' Kash Patel Pledges if Confirmed to FBI

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250