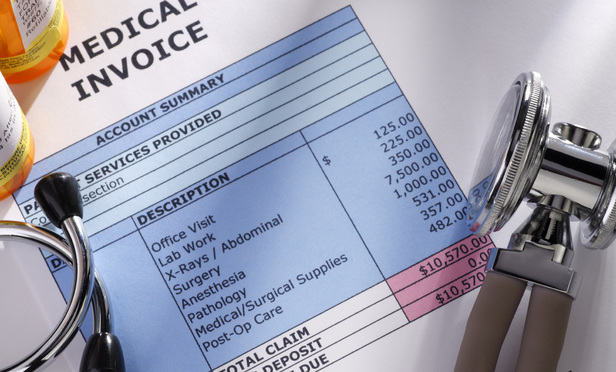

The Affordable Care Act provides defendants in personal injury cases and their counsel with creative arguments to limit exposure to future medical expenses. This article explores several of those arguments and proposes strategies for incorporating them, based on the limitations of the particular jurisdiction.

Defendants’ primary argument under the ACA is that a plaintiff’s future cost of care cannot exceed the cost of purchasing an ACA health plan for those portions of their damages that would be covered by such a plan. Because a plaintiff is legally required to maintain a certain minimum coverage, and because no plaintiff can be denied coverage for any pre-existing condition, the true cost of future medical care cannot exceed the sum of premiums, co-payments, out-of-pocket expenses and any expenses not covered by insurance. Evidence of an ACA insurance policy will therefore likely substantially reduce a plaintiff’s true cost of care.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]