A new bill in Congress seeks to curb securities regulators’ purported in-house advantage over defendants who are brought before the agency’s administrative law judges. But law scholars who have crunched the numbers say the legislation is inspired by incomplete data.

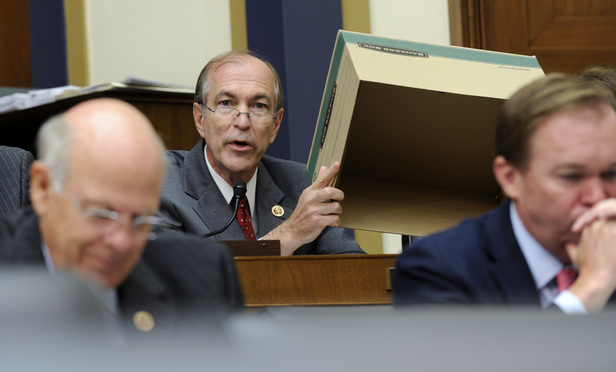

Rep. Scott Garrett, R-New Jersey, last month introduced the Due Process Restoration Act of 2015, which gives targets of the U.S. Securities and Exchange Commission the right to terminate any proceeding the agency brings in front of an administrative law judge rather than in a U.S. district court. The bill would also boost the government’s standard of proof for any defendant who keeps a case in the administrative venue.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]