Some of the major work the firm did last year regarded litigation for E.I. du Pont de Nemours and Co. DuPont, for example, settled with the South Korean conglomerate Kolon Group in a long-running trade secrets dispute regarding Kevlar last April.

In the antitrust practice, the firm served as counsel for AT&T Inc. alongside Arnold & Porter in the $67 billion acquisition of DirecTV. The end of that case was among one of the dropoffs in work that hurt Arnold & Porter’s revenue results in 2015. Also last year, Crowell & Moring worked on $46 billion more in deals, for Humana regarding its merger with Aetna and United Technologies Corp.’s sale of Sikorsky Aircraft to Lockheed Martin Corp.

New chair, new plan

The numbers come at a time of crossroads for the Washington-based firm, as it jostles for identify and business in a crowded, somewhat stagnant market. The partnership elected Styles as chairwoman in March, when antitrust litigator Kent Gardiner stepped down after nine years in the job.

Styles is looking to hire a chief operating officer, she said. “I spend a lot of time focusing on how we run as a business and how we run efficiently and well,” she said, admitting that she doesn’t have a business degree and seeks assistance.

Crowell’s long-time chief marketing and business development officer, Jose Cunningham, also left the firm last year, for Nixon Peabody. He had been with Crowell & Moring for more than 10 years. With Cunningham’s departure, Styles said the firm will shift its focus from spending on marketing and branding to business development.

“I think the answer we’re coming at is being very agile and looking outside the doors of your own law firm,” she said. “We are going to have to be more forward thinking with our talent.

“The clients don’t really care if you’re a partner or an associate or you work out of a basement in Denver. They want us to be able to moderate our approach to the practice of law.”

Styles said she’s now working on a five-year plan for the firm. She spoke about finding a “lane” for the firm to compete in among the Am Law 100, and the need to maintain the stability of the partnership and finances. Crowell & Moring has no long-term debt and has not used its line of credit in the past three years, she said, an unusual and auspicious circumstance for any large law firm.

Shrinking payroll

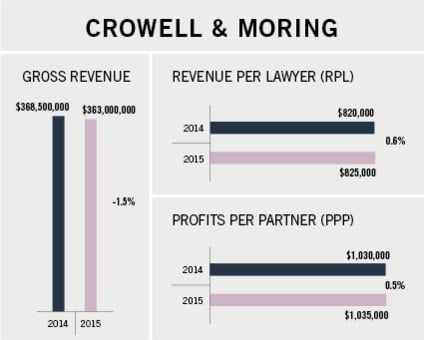

Crowell & Moring’s total lawyer head count decreased last year, from 450 in 2014 to an average of 441. The equity partnership lost one full-time position, for a total of 96 lawyers.

The firm appears to have saved the most by shrinking its nonequity partnership. The total nonequity partners declined from 89 to 82, and the total amount paid in nonequity partners’ compensation declined by almost 17 percent. On average, that’s a savings of more than $900,000 per former full-time nonequity lawyer.

Styles said some of the reduction in the nonequity pay amount occurred because high-earning lawyers were promoted to the equity partnership. Other head count decreases added up because of “normal attrition” and departures, she said, including the retirement of a few of the firm’s founding partners.