'Troll King' Intellectual Ventures Wins Antitrust War With Capital One

U.S. District Judge Paul Grimm of Maryland seemed sympathetic to Capitol One but didn't endorse Capital One's novel antitrust argument.

December 04, 2017 at 07:30 PM

23 minute read

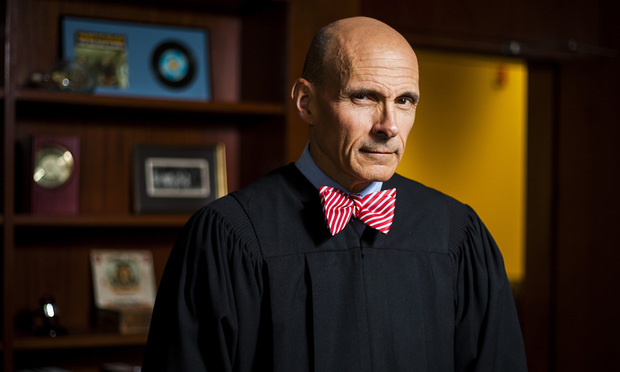

U.S. District Judge Paul Grimm. Photo: Diego M. Radzinschi/ALM

U.S. District Judge Paul Grimm. Photo: Diego M. Radzinschi/ALM Intellectual Ventures has shaken antitrust claims waged by Capital One Financial Corp. after four years of hard-fought litigation.

U.S. District Judge Paul Grimm of the District of Maryland turned back Capital One's argument that IV is violating antitrust laws by aggregating thousands of patents that read on financial industry technology and threatening to assert them seriatim until Capital One submits to an over-priced license. IV has asked Capital One for $131 million to license its entire portfolio for five years, though it maintains that was just an opening offer.

Attorneys for Capital One and other IV targets had hoped the novel antitrust argument might give them another tool for fighting the massive patent holding company that Grimm compared to Henrik Ibsen's “troll king” Dovregubben. Grimm seemed sympathetic at times in his 52-page order, issued Dec. 1. “It is hard to deny that there is something concerning from an antitrust perspective about the way in which IV engages in its licensing business,” the judge wrote at one point.

➤➤ Get IP news and commentary straight to your in-box with Scott Graham's email briefing, Skilled in the Art. Learn more and sign up here.

But under the Federal Circuit's interpretation of the relevant Supreme Court case law, IV is immune from Capital One's suit under the Noerr-Pennington doctrine, Grimm held. Noerr-Pennington shields lawsuits from antitrust claims so long as they're not “sham litigation.” Although IV hasn't prevailed in a patent case against Capital One or any other bank, its litigation against Capital One is not “baseless” and therefore doesn't meet the stringent Supreme Court standard for proving a sham, Grimm concluded.

Grimm added that a previous decision from U.S. District Judge Anthony Trenga of the Eastern District of Virginia rejecting nearly identical claims between the parties precluded Capital One from relitigating them in Grimm's court.

The Dec. 1 ruling is a huge win for IV and its team of attorneys at Feinberg Day Alberti & Thompson, led by Ian Feinberg; and Freitas Angell & Weinberg, led by Robert Freitas. Capital One is represented by a Latham & Watkins team headed by Matthew Moore, plus Troutman Sanders and Kirkland & Ellis.

A spokesman for Intellectual Ventures said the company would have no comment on the decision. A Latham spokeswoman referred a query to Capital One, which did not respond to a request for comment.

University of California, Hastings law professor Robin Feldman, whose scholarly critique of IV is quoted liberally in Grimm's opinion, said the decision “is not the end of the story. In fact, the decision foreshadows the battleground ahead.”

That battleground will feature the Federal Circuit, which she said has set the hurdle too high for antitrust cases against a patent holder. “The judge's clear and vibrant language, describing patent trolling, sets the stage for future litigants” to press their case at the Federal Circuit or the Supreme Court, Feldman said.

Grimm began his opinion by explaining the conundrum of the case. “A patent, by its very nature, vests its owner with a type of legal monopoly,” he wrote. “Enforcing a patent through litigation protects this monopoly, even though in other circumstances we view monopolies as harmful.” But while it's one thing to assert a handful of patents, “it is another matter to acquire a vast portfolio of patents that are essential to technology employed by an entire industry and then to compel its licensing at take-it-or-leave-it prices,” Grimm wrote.

Capital One actually succeeded on the merits of a primary argument, with Grimm finding the bank had raised a triable issue of fact as to whether IV's portfolio of financial industry patents constitutes a relevant market for antitrust purposes. “While fact-finders ultimately might reject [Capital One's expert's] reliance on cluster markets to justify her antitrust market analysis, I cannot conclude that as a matter of law it is unreasonable,” Grimm wrote.

But the case foundered on Noerr-Pennington. Capital One had urged Grimm to look beyond IV's litigation conduct and consider its entire alleged “scheme” of aggregating patents, concealing them in shell companies, and bringing repetitive suits to extract supra-competitive license prices.

But Grimm pointed to Professional Real Estate Investors v. Columbia Pictures, in which the Supreme Court ruled that if an antitrust defendant has probable cause to file suit, the sham litigation exception does not apply. Grimm noted that Justice John Paul Stevens had written separately in that case to say that “repetitive filings, some of which are successful and some unsuccessful, may support an inference that the process is being misused.” But the Supreme Court majority did not adopt that caveat, Grimm pointed out.

Instead, Grimm had to focus on the case before him, which began as a patent suit by IV. Although Grimm ultimately had ruled the handful of patents IV was asserting were non-infringed, invalid or ineligible, he said it was clear IV had had probable cause to file the suit for several reasons. An experienced special master had originally recommended that two patents be found eligible, for one. “This fact alone is sufficient to show that a reasonable litigant could realistically expect to succeed on the merits,” Grimm wrote. Plus, patents are presumed valid, the suit was filed before the Supreme Court tightened eligibility requirements in Alice v. CLS Bank, and IV incurred substantial costs in litigating the case, including the hiring of nine expert witnesses.

“This is an opinion that relies on the facts of the case such as a pre-Alice filing, special master report, nine experts, and a similar case in another jurisdiction,” said Rutgers antitrust and IP professor Michael Carrier. “There could be a successful suit in the future against an entity like IV but the facts would need to be different.”

U.S. District Judge Paul Grimm. Photo: Diego M. Radzinschi/ALM

U.S. District Judge Paul Grimm. Photo: Diego M. Radzinschi/ALM Intellectual Ventures has shaken antitrust claims waged by

U.S. District Judge Paul Grimm of the District of Maryland turned back

Attorneys for

➤➤ Get IP news and commentary straight to your in-box with Scott Graham's email briefing, Skilled in the Art. Learn more and sign up here.

But under the Federal Circuit's interpretation of the relevant Supreme Court case law, IV is immune from

Grimm added that a previous decision from U.S. District Judge Anthony Trenga of the Eastern District of

The Dec. 1 ruling is a huge win for IV and its team of attorneys at Feinberg Day Alberti & Thompson, led by Ian Feinberg; and Freitas Angell & Weinberg, led by Robert Freitas.

A spokesman for Intellectual Ventures said the company would have no comment on the decision. A Latham spokeswoman referred a query to

University of California, Hastings law professor Robin Feldman, whose scholarly critique of IV is quoted liberally in Grimm's opinion, said the decision “is not the end of the story. In fact, the decision foreshadows the battleground ahead.”

That battleground will feature the Federal Circuit, which she said has set the hurdle too high for antitrust cases against a patent holder. “The judge's clear and vibrant language, describing patent trolling, sets the stage for future litigants” to press their case at the Federal Circuit or the Supreme Court, Feldman said.

Grimm began his opinion by explaining the conundrum of the case. “A patent, by its very nature, vests its owner with a type of legal monopoly,” he wrote. “Enforcing a patent through litigation protects this monopoly, even though in other circumstances we view monopolies as harmful.” But while it's one thing to assert a handful of patents, “it is another matter to acquire a vast portfolio of patents that are essential to technology employed by an entire industry and then to compel its licensing at take-it-or-leave-it prices,” Grimm wrote.

But the case foundered on Noerr-Pennington.

But Grimm pointed to Professional Real Estate Investors v. Columbia Pictures, in which the Supreme Court ruled that if an antitrust defendant has probable cause to file suit, the sham litigation exception does not apply. Grimm noted that Justice John Paul Stevens had written separately in that case to say that “repetitive filings, some of which are successful and some unsuccessful, may support an inference that the process is being misused.” But the Supreme Court majority did not adopt that caveat, Grimm pointed out.

Instead, Grimm had to focus on the case before him, which began as a patent suit by IV. Although Grimm ultimately had ruled the handful of patents IV was asserting were non-infringed, invalid or ineligible, he said it was clear IV had had probable cause to file the suit for several reasons. An experienced special master had originally recommended that two patents be found eligible, for one. “This fact alone is sufficient to show that a reasonable litigant could realistically expect to succeed on the merits,” Grimm wrote. Plus, patents are presumed valid, the suit was filed before the Supreme Court tightened eligibility requirements in Alice v. CLS Bank, and IV incurred substantial costs in litigating the case, including the hiring of nine expert witnesses.

“This is an opinion that relies on the facts of the case such as a pre-Alice filing, special master report, nine experts, and a similar case in another jurisdiction,” said Rutgers antitrust and IP professor Michael Carrier. “There could be a successful suit in the future against an entity like IV but the facts would need to be different.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Khan Defends FTC Tenure, Does Not Address Post-Inauguration Plans

DOJ, 10 State AGs File Amended Antitrust Complaint Against RealPage and Big Landlords

4 minute read

Just Ahead of Oral Argument, Fubo Settles Antitrust Case with Disney, Fox, Warner Bros.

Who Got the Work: Gibson Dunn and Wilmer to Defend BlackRock in ESG Antitrust Lawsuit

2 minute readTrending Stories

- 1Fulton DA Seeks to Overturn Her Disqualification From Trump Georgia Election Case

- 2The FTC’s Noncompete Rule Is Likely Dead

- 3COVID-19 Vaccine Suit Against United Airlines Hangs on Right-to-Sue Letter Date

- 4People in the News—Jan. 10, 2025—Lamb McErlane, Saxton & Stump

- 5How I Made Partner: 'Be Open With Partners About Your Strengths,' Says Ha Jin Lee of Sullivan & Cromwell

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250