Charitable Deductions for Clients Who Are Volunteers

In his Estate Planning and Philanthropy column, Conrad Teitell writes: Volunteers who contribute their time certainly aren't motivated by tax breaks. Many probably don't even know they're entitled to deduct the unreimbursed expenses they incur in helping charitable organizations. Clients who are itemizers may deduct unreimbursed expenses that they incur incidental to their volunteer work.

December 22, 2017 at 02:41 PM

5 minute read

Volunteers who contribute their time certainly aren't motivated by tax breaks. Many probably don't even know they're entitled to deduct the unreimbursed expenses they incur in helping charitable organizations.

Clients who are itemizers may deduct unreimbursed expenses that they incur incidental to their volunteer work. Reg. §1.170A-1(g). So costs incurred in going from home to the charity's office (or other places where they render services), phone calls, postage stamps, stationery, and similar out-of-pocket costs are deductible as charitable donations.

Volunteers may deduct 14 cents per mile when using their vehicle to do volunteer work. IRC §170(I). They may also deduct unreimbursed parking and toll costs. If they prefer, they can deduct their actual allowable expenses for gas and oil (tolls and parking too) provided they keep proper records (e.g., credit card receipts, canceled checks, travel diary). However, insurance and depreciation on their cars aren't deductible. Reg. §1.170A-1(g).

If your client travels as a volunteer and must be away from home overnight (see IRC §162), reasonable payments for meals and lodging as well as transportation costs are deductible. Out-of-pocket costs at a convention connected with volunteer work are deductible only if the volunteer is chosen to represent his church, group, alumni body, etc.

To deduct unreimbursed expenses of $250 or more while providing volunteer services to a charity, the volunteers must substantiate the deduction with written receipts and have the receipts in hand before they file their income tax returns. IRC §170(f)(8); Prop. Reg. §1.170A-16. If the volunteer files the return after the due date (or after an extended due date), the receipt must nevertheless have been in the volunteer's hand by the due date (plus any extensions).

For cash gifts, regardless of the amount, recordkeeping requirements are satisfied only if the volunteer maintains as a record of the contribution, a bank record or a written communication from the donee showing the name of the donee and the date and amount of the contribution. A bank record includes canceled checks, bank or credit union statements and credit card statements. Bank or credit union statements should show the name of the charity and the date and amount paid. Credit card statements should show the name of the charity and the transaction posting date. The recordkeeping requirements will not be satisfied by maintaining other written records. Donations of money include those made in cash, by check, electronic funds transfer, credit card, text message, and payroll deduction. Prop. Reg. §1.170A-15.

A volunteer who has unreimbursed expenditures of $250 or more while providing volunteer services to a charity is treated as having obtained a receipt from the charity (and thus may deduct those expenses) if the volunteer has adequate records for the volunteer's expenses (those generally required to substantiate deductions) and obtains an abbreviated receipt from the charity. The receipt must contain: (1) a description of the volunteer's services; (2) a statement whether the charity provided any goods or services in exchange for the unreimbursed expenses; (3) a description and good faith estimate of the value of any goods or services provided (if the goods or services provided consist of any intangible religious benefits, the receipt must so state); and (4) if no goods or services were provided, the receipt must so state. Reg. §1.170A-13(f)(10).

The IRS says that if a donor makes a single contribution of $250 or more in the form of unreimbursed expenses, e.g., out-of-pocket transportation expenses incurred in order to perform donated services for an organization, then the donor must obtain the written acknowledgment described above from the organization. Separate contributions of less than $250 are not subject to the “$250 or more” substantiation requirements even if the sum of the contributions to the charitable organization during a taxable year equals more than $250. Reg. §1.170A-13(f)(1).

A volunteer may not deduct travel expenses as charitable gifts if there's a significant element of personal pleasure, recreation or vacation in the travel. But enjoying volunteer work doesn't rule out a deduction. For example, an on-duty troop leader for a tax-exempt youth group who takes children belonging to the group on a camping trip may deduct qualifying travel expenses even if he or she enjoys the trip or likes supervising children. IRC §170(j).

A volunteer may also deduct unreimbursed expenses incurred in using personal property while performing volunteer work (e.g., the cost of printing pictures from his or her camera). However, volunteers may not deduct insurance and depreciation or the cost of the equipment. Reg. §1.170A-1(g).

And volunteers may not deduct the value of their services. For example, suppose the prevailing rate for the services rendered is $50 per hour. If the volunteer devotes 100 hours during the year rendering those services for the charity, he or she may not deduct the $5,000 value of the services. Although deductions are allowed for property gifts, the IRS doesn't consider services to be “property.” Also, the use of the volunteer's home for meetings is not a “property contribution.” Reg. §1.170A-1(g).

Finally, it's up to your clients to substantiate their deductions if the IRS questions them. Volunteers should be prepared to prove their costs with canceled checks, receipted bills, diary entries, etc. Also they should be ready to show the connection between the costs and the volunteer work. See Welch v. Helvering, 290 U.S. 111 (1933); Mandeville, T.C. Memo 2007-332.

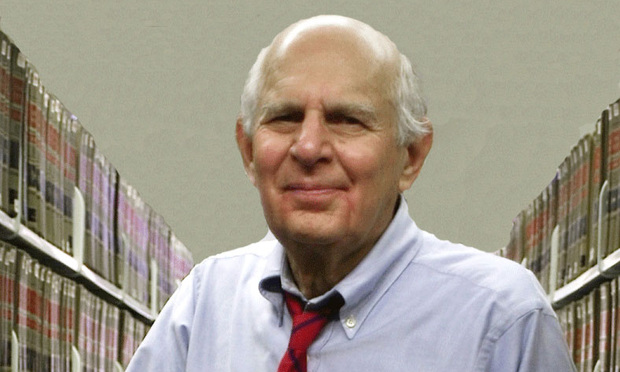

Conrad Teitell is a principal at Cummings & Lockwood in Stamford, Conn.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Judgment of Partition and Sale Vacated for Failure To Comply With Heirs Act: This Week in Scott Mollen’s Realty Law Digest

Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

9 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250