HSBC Agrees to $101M Penalty to Settle FX 'Front Running' Investigation

Documents released Thursday show the bank's foreign exchange traders made "front running" trades ahead of transactions for clients who hired the bank to handle currency conversions.

January 18, 2018 at 05:30 PM

3 minute read

HSBC entered into a nonprosecution agreement with the Justice Department and agreed to a $101 million penalty to settle an investigation into whether it used confidential information to manipulate currencies ahead of transactions on behalf of the bank's clients, according to documents made public Thursday.

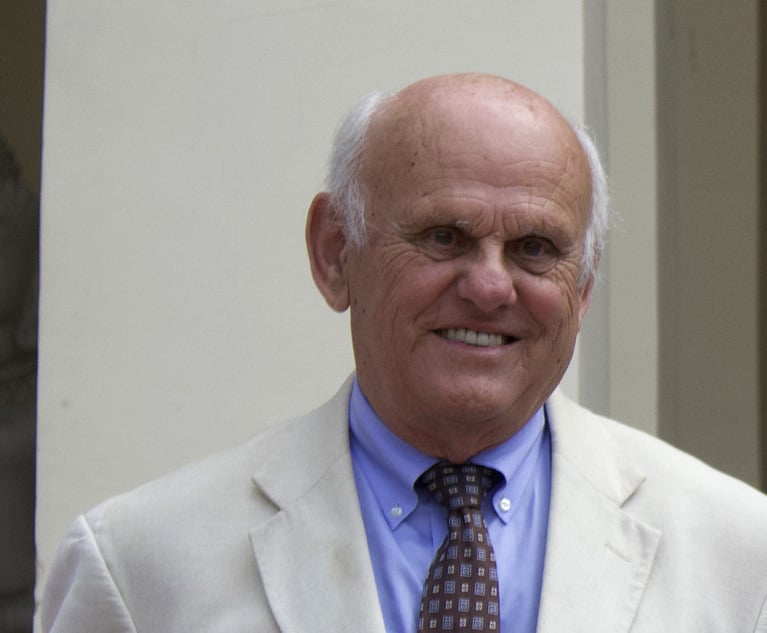

The agreement, posted to the docket of the U.S. District Court for the Eastern District of New York late Thursday, shows the deal is related to previous actions against the former head of the bank's global foreign exchange cash trading, Mark Johnson. Johnson was convicted in October of numerous wire fraud counts in the Eastern District.

Thursday's revelations show Johnson's actions connected directly to HSBC itself, while detailing another scheme that prosecutors said showed the bank profited handsomely from the front-running trading practice.

In the documents released Thursday, prosecutors detailed the scheme Johnson was convicted of. At the center of it was HSBC's handling of a currency exchange transaction for Cairn Energy from the $3.5 billion sale of an Indian subsidiary. In October 2011, HSBC won the contract to handle the transaction, promising not to take any actions based on the confidential information about the transaction to convert dollars to pounds.

Ahead of the actual transaction, HSBC employees, including Johnson, openly discussed “ramping up” the currency market in a way that wouldn't make Cairn suspicious. Traders at the bank began buying up British pounds in anticipation of the transaction. When the actual transaction occurred in December, Johnson and others orchestrated front-running purchases of the currency ahead of the announcement.

All told, HSBC generated some $8 million in profits from the front-running scheme. Before and after the transaction, Johnson and others at HSBC continually provided Cairn with misleading information in an attempt to hide their fraudulent actions.

HSBC was represented by Davis Polk & Wardwell.

In a separate scheme detailed in the court documents, an unnamed company was likewise the victim of front-running. In February 2010, HSBC traders again used confidential information to make $34.8 million for the bank.

Prosecutors charged the bank with two counts of wire fraud. HSBC entered into a three-year deferred prosecution agreement and accepted responsibility for its actions. The bank agreed to pay a $101.5 million penalty, including a $63.1 million fine and $38.4 million in restitution. The payment reflected a 15 percent reduction in recognition of HSBC's cooperation and remediation, according to the bank.

“HSBC is committed to ensuring fair outcomes for our customers and protecting the orderly and transparent operation of the markets,” a spokesman for the bank said in a statement. “Since the historical conduct described in the agreement, we have strengthened our controls in the global markets business, and we will continue to make further improvements.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Bankruptcy Judge Clears Path for Recovery in High-Profile Crypto Failure

3 minute read

US Judge Dismisses Lawsuit Brought Under NYC Gender Violence Law, Ruling Claims Barred Under State Measure

In Resolved Lawsuit, Jim Walden Alleged 'Retaliatory' Silencing by X of His Personal Social Media Account

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute readTrending Stories

- 1No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 2Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 3Meet the New President of NY's Association of Trial Court Jurists

- 4Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

- 5Freshfields Hires Ex-SEC Corporate Finance Director in Silicon Valley

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250