Cool Charitable Giving Moves in the New Tax Climate

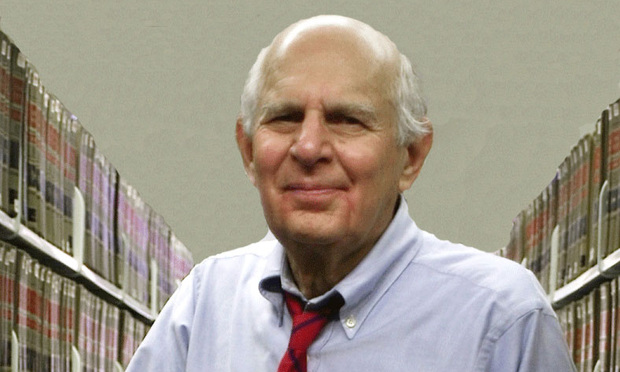

In his Estate Planning and Philanthropy column, Conrad Teitell writes: Now that many more clients will be taking the standard deduction, making direct transfers from IRAs to charities is a smart tax strategy for additional donors. And, direct IRA transfers from IRAs can also be advantageous for taxpayers who itemize.

February 23, 2018 at 02:50 PM

9 minute read

Starting this year, the doubling of the standard deduction reduces the percentage of taxpayers who itemize their deductions from 30 percent to between five and 10 percent.

Now that many more clients will be taking the standard deduction, making direct transfers from IRAs to charities is a smart tax strategy for additional donors. And, direct IRA transfers from IRAs can also be advantageous for taxpayers who itemize. I'd alert clients about this taxwise way of supporting charities now rather than waiting until later in the year. It'll be too late if they've already made withdrawals from their IRAs.

Tax Free Direct Charitable/IRA Distributions

Maltum in parvo (in a nutshell). An individual age 70½ or older can make direct charitable gifts annually of up to $100,000 from an IRA, to public charities (other than donor advised funds and supporting organizations) and not have to report the IRA distributions as taxable income on his federal income tax return. Most private foundations are ineligible donees, but private-operating and passthrough (conduit) foundations are. There is no charitable deduction for the IRA distributions. However, not paying tax on otherwise taxable income is the equivalent of a charitable deduction. Tax-free distributions are for outright (direct) gifts only—not life-income gifts. Qualified Charitable Distributions (QCDs) from IRAs, in effect, make Required Minimum Distributions (RMDs) tax free.

Traditional and Roth IRAs only. Distributions from traditional and Roth IRAs are the only ones that are tax free. Distributions from employer-sponsored retirement plans, including SIMPLE IRAs and simplified employee pensions (SEPs), aren't qualified charitable distributions; nor are distributions from Keoghs, 403(b) plans, 401(k) plans, profit sharing and other plans.

Doing a two step to qualify: (1) Roll over a non-qualified pension plan into a qualified IRA. That's generally tax free (make sure that's so). (2) The qualified IRA then makes the distributions directly to the charity.

Pointer on donor-advised funds of community foundations. As noted, IRA distributions to those funds don't qualify. But IRA distributions to a community foundation's endowment and field-of-interest funds do qualify—as long as the donor has no advisory rights.

Distributions from a qualified IRA must be made directly by the IRA's administrator or trustee to a qualified charity. A payment to the donor who one honko-second later gives it to the charity doesn't qualify (a honko-second is the shortest measure of time—the time that elapses between a traffic signal turning green and the driver of the car behind honking his horn).

The entire distribution must be paid to the charity with no quid pro quo. The exclusion applies only if a charitable deduction for the entire distribution would have been allowable (determined without regard to the generally applicable percentage limitations). Thus if the donor receives (or is entitled to receive) a chicken dinner in connection with the transfer to the charity from the IRA, the exclusion isn't available for any part of the IRA distribution.

Example. $100,000 from a donor's IRA is distributed to the charity. He receives (or is entitled to receive) a benefit worth $25. The entire $100,000 will be taxable to the donor.

Substantiation required. The exclusion won't be available if the IRA distribution to the charity isn't properly substantiated. The charity must give the donor a timely written acknowledgment that it has received the IRA distribution and that no goods or services were given in connection with the IRA distribution. See specimen receipt at the end of this article.

You turn 70½ for purposes of qualifying for the IRA/charitable distribution when you are actually 70½. Play it safe and tell clients not to have any distributions made to charity until at least one or two days after they reach age 70½.

Caveat on year-end charitable distributions. A donor who by U.S. mail sends checks and securities to a charity this year that are received by the charity next year has made a charitable gift this year. Will a distribution mailed by the IRA trustee/custodian to the charity this year, but received by it next year, qualify for tax-free treatment? Unless clarified by the IRS, make sure that the charity actually receives the distribution this year.

Death-time distributions to charity from IRAs—reminder. Current and continuing laws allow tax-free distributions to charities at death for both outright and charitable remainder gifts. Income in respect of a decedent (IRD) isn't taxable to charities and CRTs. When a CRT beneficiary receives payments, he or she will be taxable on the IRD. Less than one-tenth of 1 percent of estates are subject to the estate tax. If those estates have income in respect of a decedent, the IRA beneficiaries are entitled to itemized deductions on their income tax returns spread over their life expectancies for estate taxes attributable to their bequests. This should be considered when deciding whether to create a testamentary charitable remainder trust funded with an IRA. But this isn't an issue for over 99.9 percent of estates. Also, outright bequests of IRAs to charity avoid tax on the IRD. So give appreciated stock outright to family members who will get a stepped-up basis, and give the IRA and other IRD “items” to charity. The charity being tax exempt doesn't pay tax on the IRD. Other IRD items include: salary and wages earned before death but paid after death; accounts receivable; unpaid royalties; commissions and partnership income earned before death but paid after death; unpaid royalties; payments under installment obligations paid after death; and interest or dividends earned before death but paid after death.

For death-time transfers from IRAs, there isn't a ceiling or limitation on the types of charitable donees. Thus distributions to all private foundations and public charities (including supporting organizations and donor advised funds) qualify. To avoid IRD concerns, the gift must be properly structured.

Advantages of IRA/Charitable Distributions:

• A gigantic additional pool of funds is available for charitable gifts.

• The over nine-tenths of taxpayers who take the standard deduction—and thus can't deduct their charitable gifts—can get the equivalent of a deduction by making gifts directly from their IRAs to qualified charities. Not being taxed on income is the equivalent of a deduction.

• Itemizers who bump into the adjusted gross income ceilings on charitable-gift deductibility can use distributions from IRAs to make additional gifts. Because they won't be taxed on the distributions, they have the equivalent of additional charitable deductions.

• The carryover can be saved. Deductible gifts made in a current year are taken into account before deducting a carryover from earlier years. Making a gift from an IRA (as opposed to making a gift with other funds or assets) means that a carryover can be used in the current year.

• As adjusted gross income increases, the following benefits can be reduced or eliminated: social security; contributions to Roth IRAs; and passive activity losses and credits,

• If a donor's state income tax law doesn't allow charitable deductions (e.g., Connecticut): Making the gift from the donor's IRA to the charity can be the equivalent of a state income tax charitable deduction.

Caution. State laws differ, so check out all the ramifications in your state. For example, in some states IRA distributions directly to the IRA owners aren't subject to state income tax. A distribution from the IRA to charity thus won't save state income taxes and the donor could lose a state income tax charitable deduction that might—depending on state law—be available for a gift from the donor to the charity. Of course, consider both the federal and state tax rules. You may have heard this before: Do the arithmetic under various scenarios.

Reminder. It won't be a Qualified Charitable Distribution (QCD) if the IRA donor gets a chicken dinner or any other benefit. So don't fowl up an IRA distribution with a quid pro crow.

For donors not to be taxed on the IRA transfers, the donee-charity must properly acknowledge the gift from the donor's IRA. And this is NOT the usual receipt for gifts of other contributions to charities.

Specimen Receipt for Gift Received From Donor's IRA

Charity's Name

Address

Date sent to donor

Name and address of donor

Dear [donor's name]:

Thank you very much for your $ gift to [name of charity] from your Individual Retirement Account (IRA), received on [date]. This acknowledges that we received your gift directly from [Name of IRA Administrator] and that it is your intention for all or a portion of your gift to qualify as a qualified charitable distribution from your IRA under the Internal Revenue Code. Note, that you may exclude the qualified gift amount from your gross income, but if you do so, you may not also claim the gift amount as a charitable deduction on your 2018 tax return.

This confirms that [name of charity] is qualified under IRC §170(b)(1)(A) and that your gift was not transferred to either a donor advised fund or a supporting organization.

No goods or services were provided in consideration of this gift.

Thank you again for your gift.

Sincerely,

s/

Title Date

Retain this letter for your tax records for 2018.

As always, consult your own advisers.

And to you my dear readers, consult your own advisers.

Conrad Teitell is a principal at Cummings & Lockwood in Stamford, Conn.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Big Law Sidelined as Asian IPOs in New York Are Dominated by Small Cap Listings

The Benefits of E-Filing for Affordable, Effortless and Equal Access to Justice

7 minute read

A Primer on Using Third-Party Depositions To Prove Your Case at Trial

13 minute read

Shifting Sands: May a Court Properly Order the Sale of the Marital Residence During a Divorce’s Pendency?

9 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250