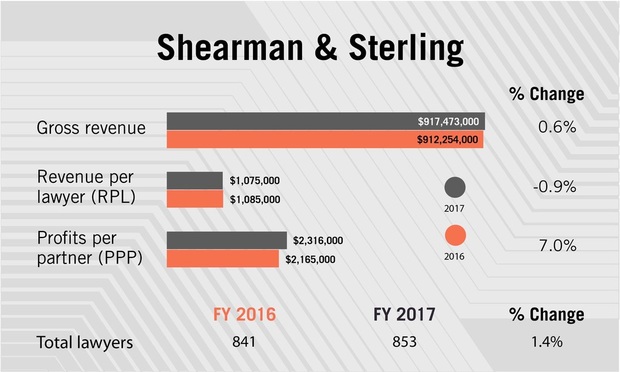

Shearman Sees Profits Rise as Revenue Stays Steady

Shearman & Sterling boosted partner profits by 7 percent while barely eking out revenue gains last year.

March 01, 2018 at 06:11 PM

6 minute read

While its gross revenue barely budged last year, Shearman & Sterling was able to lift its equity partner profits in 2017 about 7 percent.

Shearman leaders said the main drivers in profitability growth were the firm's “business mix,” and that its strategy is aimed toward growing disproportionately in the United States with corporate clients.

In a signal of these efforts, the firm announced on Thursday that it is moving into Texas—a development that has been in the works for several weeks.

In 2017, gross revenue rose 0.6 percent to $917.5 million. Profits per equity partner increased 7 percent to $2.3 million on an 8.6 percent rise in net income.

With a slight increase in the total number of lawyers, to 853 firmwide, revenue per lawyer decreased less than 1 percent to $1.075 million.

When asked about the modest uptick in revenue, incoming senior partner David Beveridge said as the firm changed its focus, it lost some revenue, “but the revenue we gained has been more profitable.”

“We're looking at this in the long term,” he added. “We saw improvements in our profitability that we were looking for.”

The firm has embraced a focus on high-profit areas, such as finance, U.S. mergers and acquisitions, disputes and investigations, said outgoing senior partner Creighton Condon.

“As we improved our business mix, we've seen a rise in profitability,” Beveridge said.

For instance, in its mergers and acquisitions practice the firm “had a greater mix” of large corporate transactions, Beveridge said.

In one of the largest deals in 2017, Shearman represented CVS on its $69 billion acquisition of Aetna Inc., a deal expected to transform the health care industry. It advised Liberty Global on the completed split-off of Liberty Latin America Ltd. and advised Novartis on its proposed $3.9 billion acquisition of a radiopharmaceutical company.

In finance, Shearman advised on Altice USA's $2.15 billion initial public offering of common stock, one of the largest IPOs in 2017. Other work included advising Credit Suisse as sole book-running manager on the $690 million initial public offering of Social Capital Hedosophia Holdings and advising BNP Paribas, as an administrative agent, for a $15 billion refinancing for Toyota Motor Credit Corp. and some of its affiliates.

In other work for large corporations, Shearman's litigation lawyers secured an appellate victory for Daimler and Daimler CEO Dieter Zetsche, after plaintiffs alleged that Daimler and other defendants were liable for their retirement benefits. In another appellate victory, the firm represented Nomura in a mortgage-backed securities dispute in which the New York Court of Appeals reversed a decision against the Japanese financial institution.

The firm's energy lawyers represented the U.S. Department of Transportation in the extension of a $416 million secured loan for an infrastructure project in Colorado and the U.S. Department of Transportation's Build America Bureau on financing the construction of New York's Moynihan Train Hall Redevelopment Project.

Business Management

In addition, the firm's “management of the business,” including controlling vendor and real estate expenses throughout its various offices, helped drive profitability, firm leaders said, but they stressed the primary driver was its combination of client matters.

While London revenue rose by 14 percent to $169.7 million in 2016, the firm declined to disclose London office revenue in 2017.

Shearman, in a high-profile move, expanded in its nonequity ranks in 2016, but the firm had 13 fewer nonequity partners in 2017.

Beveridge said some nonequity partners were promoted to equity, while others left, “and that's what we would have expected.”

“It's going to ebb and flow depending on the year, but right now we don't foresee a significant change in either direction in the near team” in nonequity partners numbers, Beveridge said.

Condon said the firm put the nonequity structure in place to have the flexibility to make adjustments based on business and it “has set the foundation for how we operate business in the future.”

Texas Launch

Meanwhile, the firm announced Thursday its move into Texas, first in Austin, where it is bringing on seven partners and a counsel from Andrews Kurth Kenyon. The eight new Shearman hires all focus on advising emerging growth companies in the technology life sciences and media and telecommunications industries.

Shearman & Sterling also plans to open a Houston office that will focus on energy transactions, including oil and gas projects. ALM affiliate Texas Lawyer has reported that a group of oil and gas lawyers is expected to move to Shearman's new Houston office from Baker Botts.

Shearman leaders said the Austin office is expected to have about 25 to 30 attorneys. The Houston office, which will open in a few months, will have eight to 10 partners by the end of the year, the firm projects.

“We are continuing to invest,” Condon said, “and the firm is fully behind that and it's all part of our long-term strategy.”

Shearman is also considering a larger plan for the Austin office. Beveridge said the firm is exploring the possibility that it would become a site for talented nonpartner-track associates and staff attorneys with “quality of life” considerations. Beveridge said the Austin location is attractive because of its proximity to good universities, its venture capital business and the availability of highly skilled talent who may not want to be on the partnership track.

“It's a good spot to explore,” said Beveridge.

The option for a different sort of Austin office is not part of the immediate plan, however. The office will for now focus on the firm's tech and life sciences practices. The firm already has a staff attorney location in Melville, New York.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Sullivan & Cromwell Signals 5-Day RTO Expectation as Law Firms Remain Split on Optimal Attendance

Changes at the Top: How 'Different Leadership Skills' Are Prevailing in Big Law

Trending Stories

- 1People in the News—Jan. 22, 2025—Knox McLaughlin, Saxton & Stump

- 2How I Made Office Managing Partner: 'Be Open to Opportunities, Ready to Seize Them When They Arise,' Says Lara Shortz of Michelman & Robinson

- 3The Intersection of Labor Law and Politics Following the Presidential Election

- 4Critical Mass With Law.com’s Amanda Bronstad: LA Judge Orders Edison to Preserve Wildfire Evidence, Is Kline & Specter Fight With Thomas Bosworth Finally Over?

- 5What Businesses Need to Know About Anticipated FTC Leadership Changes

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250